India and the European Free Trade Association (EFTA) finally signed a Trade and Economic Partnership Agreement (TEPA) on March 10, 2024, granting India duty-free market access for 99.6 per cent of its total exports to the region. Additionally, the agreement has secured a $100 billion investment in India over the next fifteen years, which will greatly benefit the country with its diverse and extensive labour force. However, the specific benefits of the TEPA and the investment for India's various sectors, employment, and particularly the textile industry, remain to be seen.

What's in the deal?

The TEPA, resulting from 16 years of diligent efforts by both parties, provides Indian products duty-free access to HS lines 25-97, excluding agricultural and dairy products. From a trade perspective, the benefits for India may be limited, especially considering that Switzerland, its largest trading partner within the EFTA, already allows duty-free access for manufacturing products from all countries. Consequently, the trade benefits might be modest. Nonetheless, the agreement includes several firsts for India, demonstrating the country's commitment to enhancing governance, sustainable development, inclusive growth, social progress, and environmental protection. The agreement includes comprehensive chapters on trade remedies, legal provisions, and visas for working professionals, among other aspects.

However, one of the most standout commitments by the EFTA is the $100 billion investment in different Indian sectors across the years which can benefit the Indian employment scenario. An estimated 1 million jobs will be created via the FDI route. Although this will be a purely private sector FDI investment and not through the government, this presents itself as an interesting juncture that becomes a mix of many variables together—enhanced trade, increased employment, technology knowledge exchange, and the growth of the Indian economy.

However, questions about the impact of tariff reductions and the overall benefits of the TEPA for India remain. Particularly, how the agreement will influence India's textile exports is a point of interest, given India's significant trade relations with EFTA countries such as Switzerland and Norway.

A silver lining for textile trade

The TEPA ensures that 99.2 per cent of tariff lines will be duty-free, representing a major portion—99.6 per cent—of India's total exports to the EFTA. Although this offers a cause for optimism, some uncertainties linger, especially since Switzerland has already eliminated duties on all manufacturing product imports as of January. Consequently, India's textile industry may not see significant benefits from the agreement with regard to Switzerland.

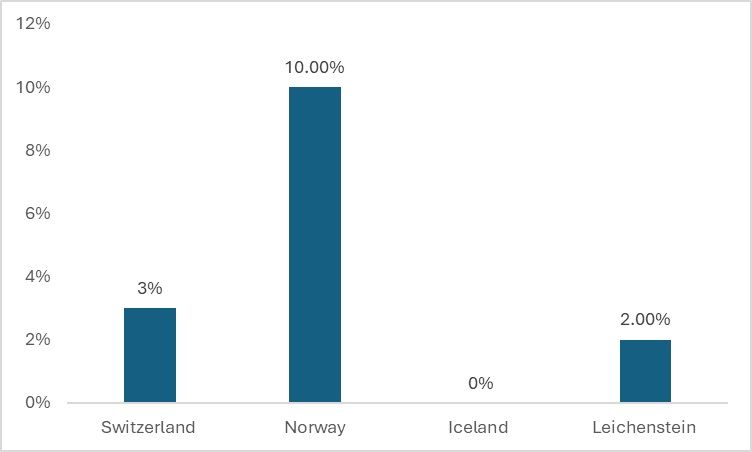

As far as the textile exports to the EFTA are concerned, apparel accounts for a significant share in the total exports. A detailed tariff comparison in this category reveals that Indian apparel exports face the highest tariffs in Norway, followed by Switzerland and Liechtenstein, while Iceland applies zero tariffs.

Figure 1: Tariff on Indian apparel imports in EFTA countries (in %)

Source: ITC trade map market access tool

From a trade perspective, the tariff rates imposed by Norway, ranging from approximately 10 to 14 per cent on certain products, are the highest among the EFTA countries, followed by Switzerland. In contrast, Liechtenstein and Iceland apply negligible tariffs, which suggests that India's trade benefits with these countries might be limited. Given the economic sizes of these nations, the potential for significant trade benefits with Iceland and Liechtenstein is lower compared to Switzerland and Norway.

Considering the economic scale of the EFTA countries as of 2023, the potential gains for India from trade relations will largely depend on the economic size of its partners. Despite the higher per capita income in EFTA countries due to their smaller populations, their total economic sizes are relatively small when compared to India's. Specifically, Switzerland's economy stands at $640 billion, Norway's at approximately $597.42 billion, Iceland's at $28.06 billion, and Liechtenstein's at about $8.06 billion. Therefore, from an economic standpoint, India stands to gain more in both value and volume by enhancing trade with Norway, given its relatively larger economy compared to the other EFTA members.

Trade with EFTA countries and textile exports

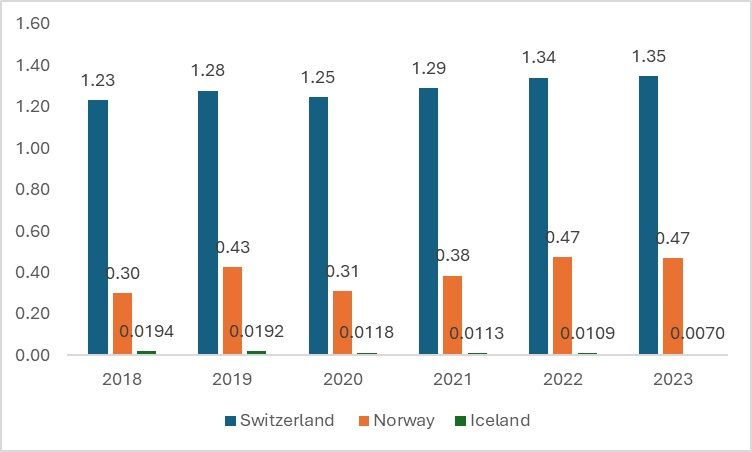

When analysing trade with the EFTA countries, it becomes evident that Switzerland receives the maximum share of overall exports, followed by Norway. Iceland has a minimal share, reflecting the size of its economy. India experiences the largest trade deficit with Switzerland, primarily due to gold imports. Considering the volume of exports, Norway could be a potential market for India after Switzerland, given the increasing trend in exports to the country.

Figure 2: India's exports to EFTA countries (in $ bn)

Source: ITC Trade map

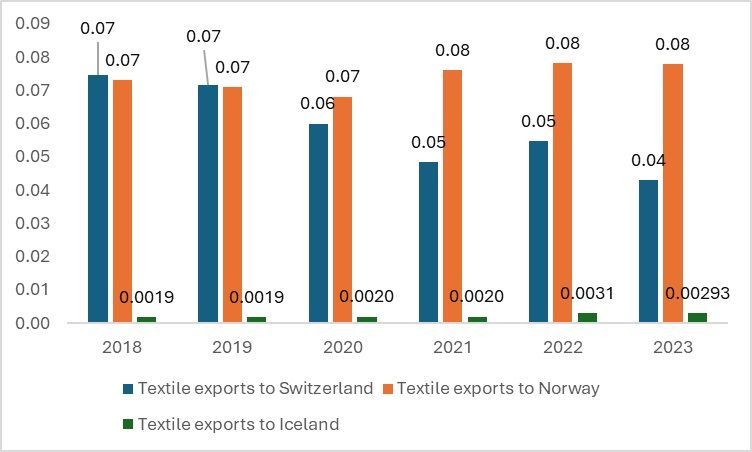

The trend diverges in the case of textile exports. Post-COVID-19, there has been a reduction in exports to Switzerland, and this decline continues. Currently, the highest textile exports are to Norway, reaching $0.08 billion. Despite the overall trade with Norway remaining constant in 2023, considering the tariff example mentioned earlier, there is a high likelihood that India will significantly benefit from the TEPA provisions for textiles in Norway, followed by Switzerland.

Figure 3: India's textile exports to EFTA countries (in $ bn)

Source: ITC Trade map

The total textile exports to EFTA were $0.14 billion in 2022 and $0.12 billion in 2023. Additionally, with the TEPA, India has the potential to realise the unrealised export potential, which can be an added benefit to the Indian textile industry, along with the recent committed investment by the EFTA countries of $100 billion.

If we consider the total exports to the EFTA, they form approximately 0.28 per cent of the total exports. With the current TEPA, there are higher chances that the exports may increase to become 2 per cent or close to the same, as the increase in the overall exports is beneficial for India.

Unlocking India's textile export potential in European markets

India still has a lot of potential to export textile and apparel products to Norway and Switzerland. According to the ITC export potential tool, India has an unutilised potential of around 34 per cent in the export of cotton T-shirts to Norway, and the same is the case for Switzerland. The country can export numerous textile and apparel products to Switzerland. As the country has recently removed all tariffs on the imports of manufacturing products, India can take maximum advantage of the same. On the other hand, even for Iceland, where the country exports a variety of different products in apparel at a duty-free rate, much potential can be exploited.

However, there is a lot on the cards for the textile sector of the country. India's textile sector can highly benefit from the investments made by the bloc in the country. Technology transfer, value addition in textile products, and, most importantly, market access to the EU can happen through Switzerland. Switzerland possesses some world-class technologies when it comes to textile machinery and engineering. Apart from this, there will also be a scope to export intermediate products of textiles to Switzerland, perform some value addition, and then further export them to the EU. How the entire situation will unfold will be clear in the coming years.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!