India and Peru have entered the eighth round of negotiations for inking a Free Trade Agreement (FTA). This deal represents another step towards increasing market prospects in the Latin American region. India primarily exports cotton yarn to Peru. If realised, the FTA could significantly impact India's market access to Latin American nations. The India-Peru FTA has significant implications for both countries, especially for India.

Bilateral trade between India and Peru

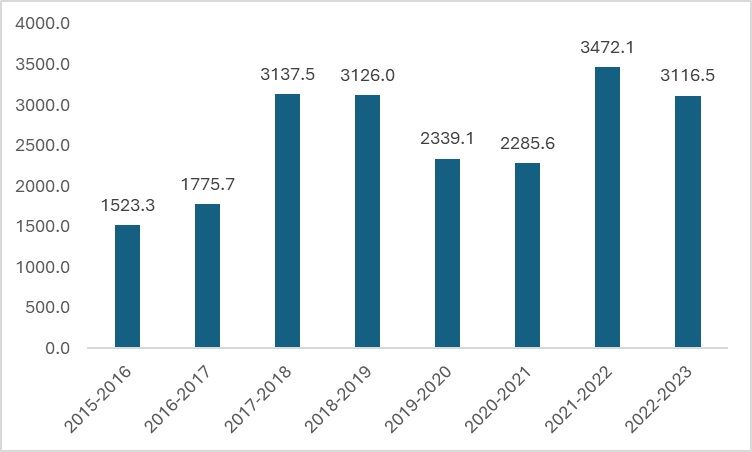

The bilateral trade between India and Peru is increasing, as indicated by the graph. With exceptions during the pandemic and the year 2022-2023, when the world faced economic uncertainty and overall trade took a hit, the bilateral trade has generally been positive. In terms of trade, India has a substantial deficit, with exports significantly lower than imports from Peru. Between 2018 and 2022, trade between the countries increased by 5 per cent. If negotiated wisely, India could take constructive steps to reduce the wide trade deficit.

Figure 1: Trade between India and Peru from FY16-FY23 (in $ mn)

Source: Ministry of External Affairs (MEA)

Peru is India's third-largest trading partner in Latin America, and the current steps towards inking an FTA would boost the country’s expansion potential in Latin America, along with greater access to countries like Mexico and other Caribbean nations. Therefore, the agreement could have widespread benefits, especially for the Indian textile industry. In terms of exports to Peru, Indian cotton yarn ranks among the top 10 commodities. Given that goods imported from these countries receive free or preferential market access to the host country, India stands to benefit from the FTA.

Textile trade between India and Peru

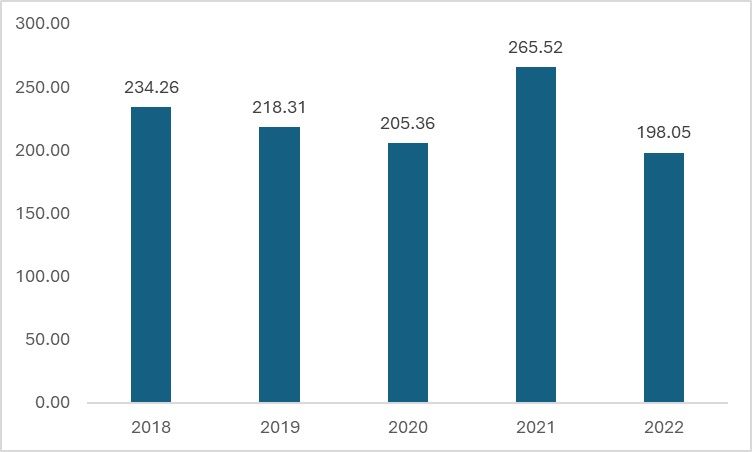

India's overall textile exports to Peru have experienced muted growth and a decline in the year 2022. India's overall textile exports are also experiencing a downturn amid the cost-of-living crisis affecting key market nations such as the US and the EU. However, as the top 10 commodities of the country are textile commodities, India can push for more textile exports to the nation.

Figure 2: India’s textile exports to Peru (in $ mn)

Source: ITC Trade map

India primarily exports cotton yarn and a significant amount of apparel to Peru. With the country's exports falling by approximately 4 per cent in the financial year 2022-2023, the FTA presents an opportunity for India to increase its exports. The following figures may provide a clearer picture of the situation.

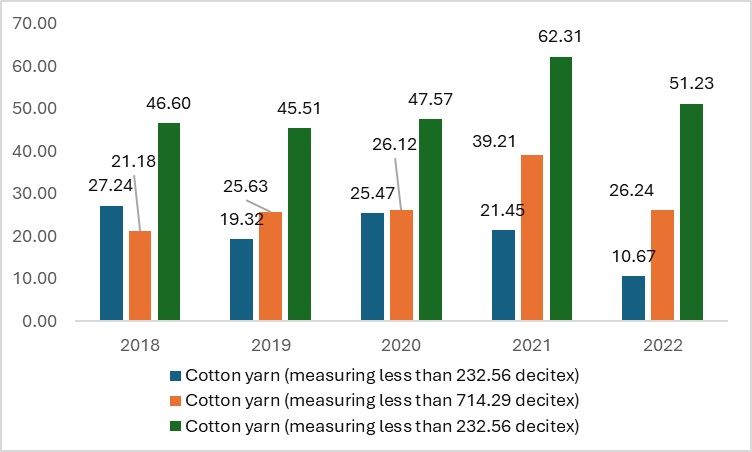

Figure 3: India’s cotton yarn exports to Peru (in $ mn)

Source: ITC Trade map

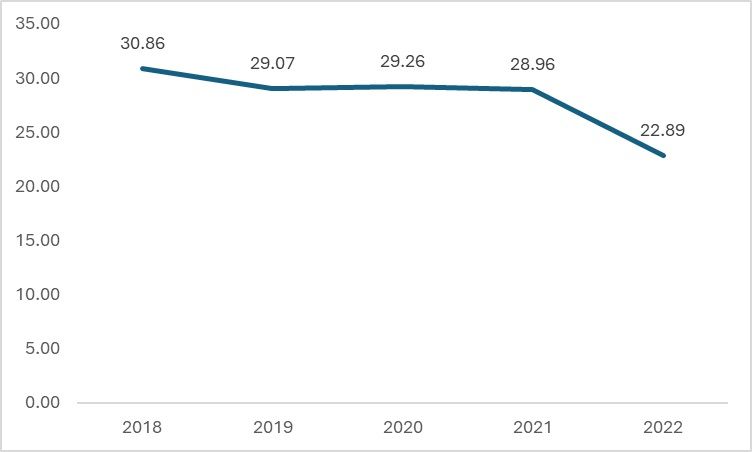

India majorly exports three varieties of cotton yarn to the Latin American nation, in addition to predominantly woven apparel. Although the current details of the FTA have not been disclosed, there could be potential benefits for textile exports. Along with the reduction in overall trade, there has also been a decline in the share of textile exports in total exports to Peru. Thus, if the negotiations result in textile goods being included in the duty-free segment, it will represent one of the most significant economic benefits to the industry. This change could increase the overall profitability of the industry as the market expands, further diversifying the market and shielding it from any negative external impacts that might affect the industry's potential.

Figure 4: Share of textile in India’s total exports to Peru (in %)

Source: ITC Trade map, F2F analysis

How beneficial will the FTA be?

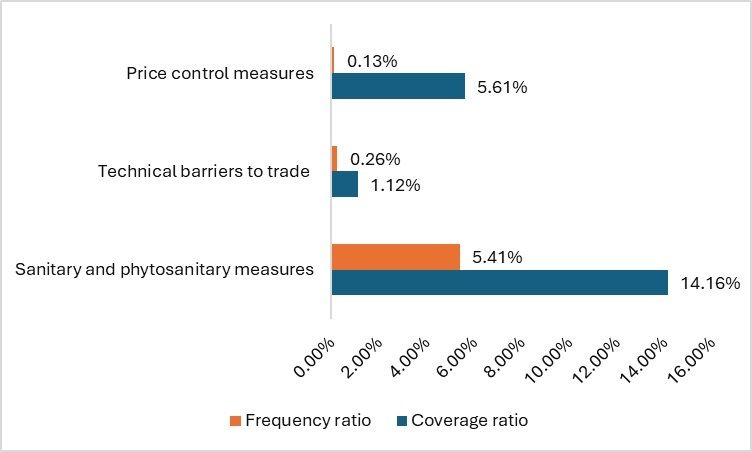

If viewed from the perspective of both countries, the FTA may benefit India—only if it succeeds in easing the non-tariff measures that apply to imports in Peru. Peru imposes a significant number of non-tariff barriers, such as sanitary and phytosanitary measures and technical trade barriers. These measures are generally used to reduce the competitiveness of imported goods compared to domestic ones. Therefore, it will be crucial to negotiate either a total nullification or a relaxation of these non-tariff measures (NTMs). Indian imports in Peru face a 6 per cent tariff. Thus, the benefit would be limited if only the tariffs were reduced.

Figure 5: Non-tariff measures applied by Peru on textile imports (in %)

Source: World Integrated Trade Solution (WITS)

For example, textile imports into Peru specifically need to go through sanitary and phytosanitary measures and technical trade barriers. Among the different non-tariff measures (NTMs), the majority of imported products are affected by sanitary and price control measures, followed by technical barriers to trade. Therefore, if India is successful in removing these barriers, it will be able to reduce the widening trade deficit it has with Peru.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!