The India-United Kingdom (UK) FTA has been the most awaited deal since the last two years. With the FTA proceedings stalled due to the UK’s political turmoil, there are now some hopes for the deal to materialise. With the new government led by Keir Starmer hoping for the FTA to be materialised, this article analyses approximately how much can India benefit from the FTA and where it can improve.

India’s recent statistics for apparel exports to the UK

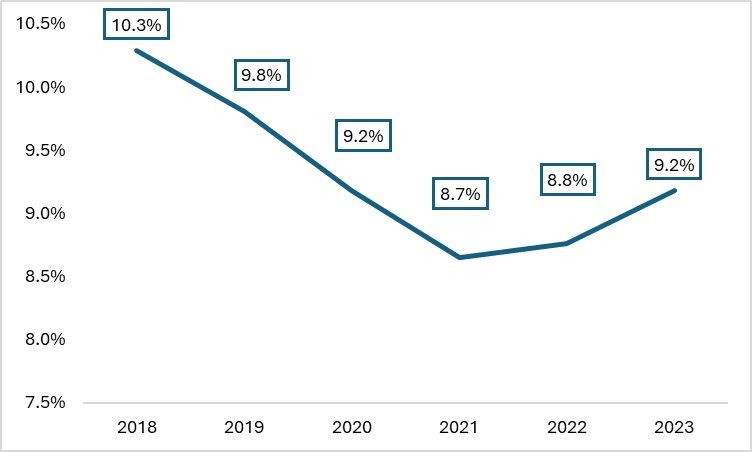

India’s apparel export trends align closely with the overall textile export patterns of the country. In 2023, India’s apparel exports to the UK declined by approximately 8.9 per cent. However, the share of the UK in India’s total apparel exports rose to 9.2 per cent in 2023, up from a low of 8.7 per cent in 2021, when the UK’s apparel imports were heavily impacted by the COVID-19 pandemic.

Exhibit 1: Apparel exports of India to the UK as a % of total apparel exports (in %)

Source: ITC Trade Map, F2F analysis

Pursuing and finalising a Free Trade Agreement (FTA) with the UK is crucial, as it would help India leverage its considerable bargaining power, thanks to UK’s large market and growing population. Apparel ranks among India’s top ten exports to the UK, highlighting significant potential for expanding value-added exports in this sector. With zero tariffs on entry, India’s knitted and woven apparel could gain a substantial foothold in the UK market. Additionally, as India seeks to diversify its textile exports beyond the US and the EU, agreements like the India-UK and India-Australia FTAs could play a vital role in strengthening its export base globally.

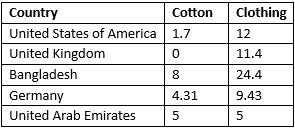

The US, Bangladesh, UAE, UK, and Germany are India’s top five export markets. However, these countries impose substantial tariffs on Indian textile imports, underscoring the need for India to pursue FTAs to enhance its competitive edge. The table below outlines the tariffs applied by each nation on textile imports from India.

Table 1: Tariffs charged by countries on textile imports (in %)

Source: WTO statistics

The tariff that the Indian apparel imports and textiles must pay is 9 per cent due to the DCTS system in the UK which gives the country concessions in the tariff due to its developing nation status. However, with the potential FTA in focus, there are chances that the nation will experience higher exports due to reduction in the import tariff.

In 2023, India’s exports to the UK declined due to the cost-of-living crisis in the UK, and an increase in inflation. However, once the FTA is signed, India’s clothing sector can increase its exports to the UK, if there is nil or less tariff.

The deal waiting to be celebrated

There have been 14 rounds of negotiations between the UK and India since FTA negotiations started in January 2022. However, they have reached a roadblock over carbon tax and the security payments to the migrant Indians in the UK. UK’s version of the CBAM will likely affect India’s steel, iron, and cement exports.

Even though both sides have completed most of the chapters focused on goods, services, and investments, the main issues remain in the liberalisation of import duties on commodities like scotch and electrical vehicles and liberalisation of the financial services. There are some hopes for the issues to be solved in the next round with the new administration; thus, leading to some positive developments in the same. As far as goods are concerned, majority enter the UK at a preferential rate; due to which the number of goods to be negotiated in the FTA are less.

Who will benefit from the FTA

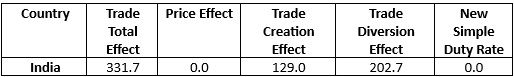

With the FTA in focus, there is a higher possibility that India’s textile exports can benefit. If we assume a scenario where the tariff rate is reduced to zero per cent from the current 9 per cent, India can benefit substantially. There can be an increase of almost $331 million in export revenue, i.e. an increase of 23 per cent – if the condition in the country post the FTA is signed, is normalised and the economy is robust. This analysis is done using the SMART tool by World Integrated Trade Solutions (WITS).

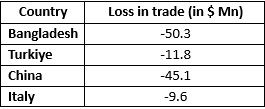

Table 2: Potential losers in exports of apparel post the FTA (in $ Mn)

Source: WITS Smart analysis

Among the competing countries, the loss in the export revenue will be nearly $50 million for Bangladesh, $11 million for Türkiye, and $45 million for China. This reflects that there might be very minor effects of the FTA on apparel exporting nations like Bangladesh, which already faces a zero tariff for entry into the UK under the GSP system. However, there will be higher de-risking of the countries from China due to the Xinjiang cotton issue.

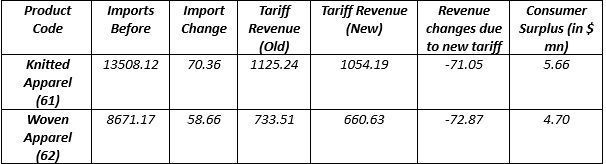

Table 3: Changes in the tariff revenue for the UK (in $Mn)

Source: WITS SMART analysis

The tariff revenue for the UK will reduce by 6 per cent given that the import duty from the apparel is completely relaxed. This might be because of the price effect in play where the price of the commodity will play a huge role in the tariff collected. This is considering that apparels are the top export commodities for India, and India is the fourth largest source of apparel imports for the UK. Therefore, the loss in revenue is significant. However, there is also an increase in the consumer surplus in the UK due to the reduction in the cost of the apparels imported. Apart from India gaining competitiveness in the UK, the consumers will also gain from the reduction in the import tariff.

Diversion, welfare, and the true outcome of the FTA

Table 4: Effect on the country's export of apparel to the UK if India UK-FTA is finalised (in $Mn)

Source: WITS SMART, Author’s analysis

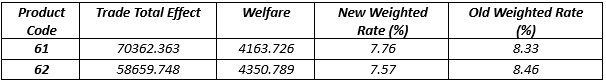

The main impact of the FTA will be on the amount of trade created and diverted. If the FTA is materialised, India will experience major benefits in the total trade created. However, the news does not seem to be as good as predicted. More importance is given to the trade developed because of the new FTA in any trade deal. However, India’s trade diversion is at a maximum, which can be construed bad news for the country. As per the WITS SMART analysis, India is likely to get maximum trade of $202 million via FTA through trade diversion, and only $129 million via trade creation. The analysis shows that India may benefit majorly from the trade diverted from Bangladesh (about $50 million) and Türkiye (around $8.3 million).

The trade diversion can benefit the Indian apparel production firms that have the UK as their major export market; thus, resulting in more revenue for the companies in India. However, there is a small catch in the trade diversion. There can be an impact on both the importing as well as the exporting countries when there is more of a trade diversion in the FTA. It can affect the welfare benefits as well (Table 5).

Table 5: Welfare benefits for the UK through the potential FTA (in $Mn)

Source: WITS SMART

The welfare of the consumers here will be larger as compared to the revenue that the government will get. Given that apparels will be available at a lower cost there, the sentiment will be positive, and as a result there will be a higher demand for Indian apparels in the country. With the reduction in the tariff, the total benefits accrued to the consumers will increase to around ~$83 million, as the prices may reduce post the FTA and there will be a reduction in the revenue of the government. Thus, the benefit is passed directly to the consumers. Therefore, from the perspective of pricing, UK consumers may benefit; looking at the position of India in the import scenario of the UK: the latter may benefit; thus, boosting consumer sentiment and increasing potential retail spending in the country.

Key takeaway

The India-UK FTA brings in benefits for both sides—a reduction in the prices of apparel for the UK citizens, additional revenue for Indian exporters and increased welfare for the consumers. However, there is a small issue to be looked upon. The FTA if finalised, India will benefit from the trade diversion. There is no new trade creation in apparels. India as a country needs to improve on its textile processing prowess, and the FTA can present the country with a good opportunity to capitalise on the situation and invest more in the textile industry. So far, the PLI schemes and the NTTM are the mediums through which the government has been investing in the sector to increase productivity. With the trade diversion, although India may benefit, the UK may face some losses because it will be importing from a country that has a lesser comparative advantage vis-à-vis Bangladesh or Vietnam. Although India boasts the entire value chain in textile, it is not integrated enough to make it efficient. The Government of India is investing in the sector to increase productivity and employment. The Indian textile sector was estimated to be around $165 billion in 2022 and is set to increase further as the demand for the Indian textiles increase worldwide. Going by this narrative, India needs to increase the efficiency of the textile sector to gain a comparative advantage and aim more towards trade creation rather than trade diversion as the former will help in generating additional employment and incentivise investments in the sector.

Since the Indian textile sector has been struggling to modernise itself, it is unable to take the benefits of a lot of market access deals signed by the government. India-Australia FTA, India-Japan CEPA, India-South Korea CEPA, India- ASEAN FTA etc are the areas where the country can capitalise on its textile expertise and increase its exports.

In conclusion, the India-UK FTA will result in benefits to both nations from the pricing effect perspective. From the Indian perspective, this will mean good news for the apparel producers who can receive more orders, thus encouraging capital investment. From the perspective of the UK, the country’s consumers will benefit from the potential reduction in the prices of apparel; thus giving a bright aspect for the retail sector of the country to focus on. However, India needs to focus more on the FTAs which can create trade rather than divert the trade to the country.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!