The Free Trade Agreement comes at a time when the US is looking to impose tariffs on several nations, including India. China, in particular, has been focusing on exploring the UK and EU markets due to the heightened tariffs it is expected to face under the Trump administration. Despite these challenges, China still reigns supreme and ranks first overall in textile exports. With renewed efforts to not only maintain its position but also to supply the UK with a higher volume of products, China is poised to capture a significant share of India’s textile exports. A majority of UK-based apparel companies also source from predominantly Chinese suppliers. India’s FTA, therefore, arrives at a crucial moment and could be the right move amidst trade uncertainty and China’s increasing focus on the European market.

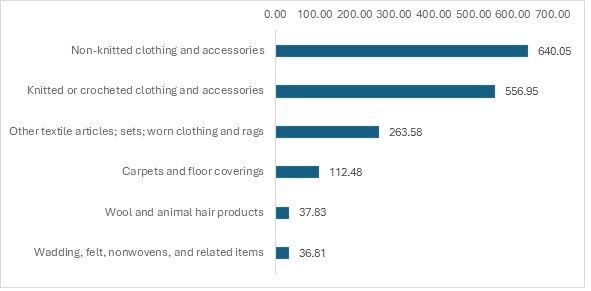

Exhibit 1: Top Indian textile exports to the UK (in $ mn)

Source: ITC TradeMap

India’s textile trade with the UK has long been a crucial component of the trade relationship between the two nations. India accounts for approximately 6 per cent of total apparel imports to the UK, positioning the UK as one of the top five markets for India’s textile exports.

The year 2022 marked a significant turning point for the textile industry, with a surge in demand following the post-pandemic recovery. India has managed to sustain much of this growth, with only a few sectors experiencing a decline. Notably, exports of carpets, wool and animal hair products, and non-woven items have increased compared to the peak year of 2022.

India benefits from the Developing Countries Trading Scheme (DCTS), which provides preferential tariff rates, making Indian textile products more accessible and cost-effective for UK consumers. Additionally, Indian ethnic wear has gained prominence in the UK, driven in part by the large Indian diaspora, further strengthening India's position in the UK market.

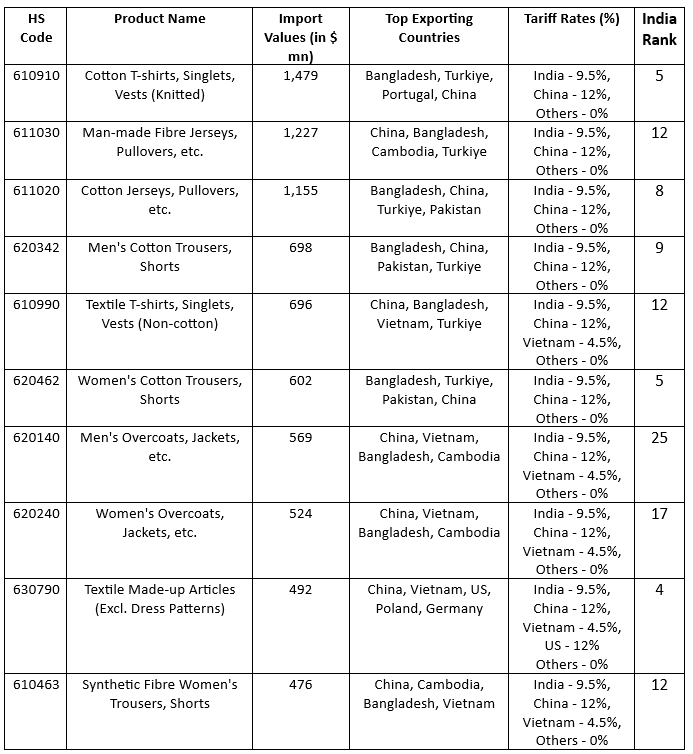

Table 1: India’s competitors and their tariff rates for top 10 most imported textile products in the UK

Source: F2F Analysis

India’s pain points

India primarily faces increased tariffs on its top exported products to the UK. Despite benefitting from DCTS, India lags behind comparatively ‘lesser’ developing countries such as Bangladesh, Vietnam, Cambodia, and Myanmar. Other nations, such as Turkiye, Poland, and Portugal, have preferential trade agreements that grant them a 0 per cent tariff on their products.

Under these circumstances, India’s FTA has become increasingly urgent, as the country is losing cost-effectiveness compared to manufacturing giant China. It is essential to structure the FTA in a way that underscores the need to support the textile sector, which plays a significant role in human development through employment.

India also ranks particularly low in non-cotton-based products, highlighting the stark contrast between the value of India’s textile exports and those of leading countries. Cambodia, a comparatively smaller market with Least Developed Country (LDC) status, has successfully developed its MMF-based garment sector.

Some European countries have raised concerns about the quality of Indian products; however, major textile exports face no regulatory requirements, nor have any trade remedies been applied to them. This suggests that Indian apparel products can enter the UK market freely, without the need for specific certifications or licenses. However, countries such as China, Bangladesh, and Cambodia have leveraged this opportunity more effectively.

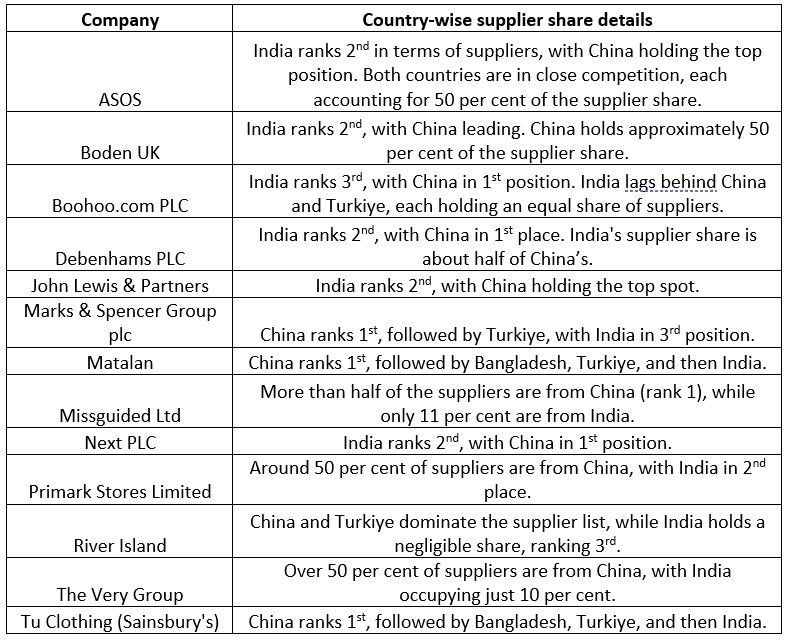

Table 2: UK-origin top apparel companies and their supplier details

Source: TexPro, F2F Analysis

The India-UK FTA will provide significant advantages for Indian suppliers to UK apparel companies. Reduced tariffs and streamlined trade processes will make Indian apparel more cost-effective, enhancing suppliers’ competitiveness in the UK market. As a result, Indian suppliers could see growth in their market share, particularly as UK companies seek to diversify their supply chains away from over-reliance on China and other suppliers like Bangladesh and Turkiye.

With fewer trade barriers, Indian suppliers may also gain easier access to UK market segments that prioritise sustainability, quality, and affordable production. As seen in supplier rankings, India ranks 2nd for most UK apparel companies, with China generally holding the top position. This FTA can help Indian suppliers expand their market share, particularly as UK companies look beyond China, potentially strengthening their role in the supply chains of brands like ASOS, Boden UK, and Primark.

The FTA is also expected to drive increased investment in India’s apparel manufacturing sector, leading to advancements in production technology and efficiency. UK companies may invest more in Indian operations, improving the overall quality and timeliness of Indian apparel exports. This will not only solidify India’s position in existing supplier lists but could also enable Indian suppliers to secure a larger share of UK brands' sourcing strategies. As India becomes more competitive and efficient, UK apparel companies will find Indian suppliers increasingly attractive, fostering long-term, mutually beneficial business relationships.

Conclusion

India should focus on including textiles and apparel in the zero-tariff textile product list while also attracting investment opportunities into the country. The India-UK FTA holds significant potential to transform apparel trade between the two nations. By reducing tariffs and easing trade processes, the FTA will enhance the competitiveness of Indian suppliers, enabling them to expand their market share in the UK—especially as UK companies seek to diversify their supply chains beyond China.

This trade agreement is also expected to drive increased investment in India’s apparel manufacturing sector, improving production efficiency and quality. As a result, Indian suppliers will become more attractive to UK companies, fostering long-term business growth and strengthening bilateral trade relations.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!