The Indian government has announced an increase in drawback rates—customs and central excise duties charged on imports that are subsequently used as inputs in items for export. The new rates, effective from October 30, 2023, have been lauded as a boon for the textile sector, which has been facing stiff competition from Asian rivals including Bangladesh, Vietnam, and China.

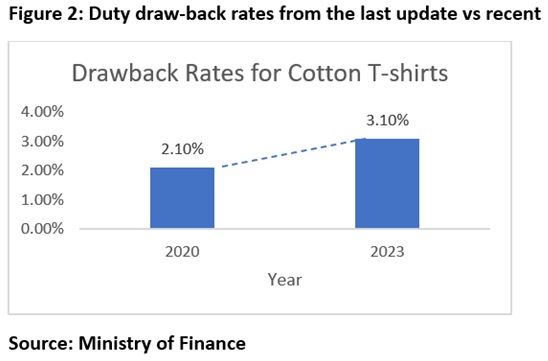

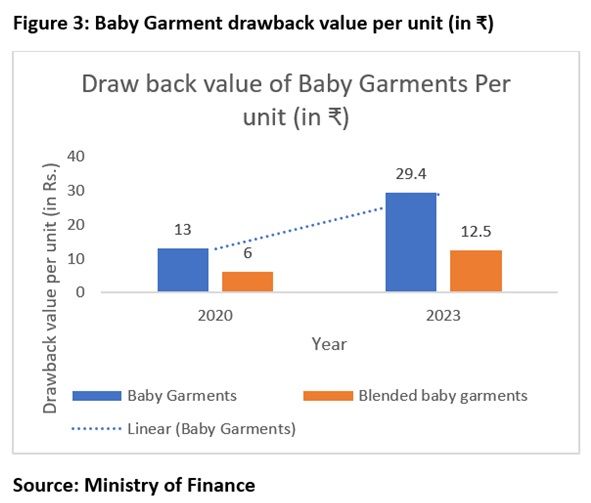

The most notable change has been in the cotton T-shirts category, where the drawback rates have been elevated from 2.1 per cent in 2020 to 3.1 per cent in 2023. Additionally, the value per unit cap for baby garments and blended baby garments has seen a significant increase. For the former category, the value change has been 55 per cent, and for the latter, it is 52 per cent.

Since 2018, the Indian textile industry has been battling a series of setbacks. Initially, the implementation of GST had a negative impact on the sector, followed by a competitive disadvantage in export pricing against countries like Bangladesh and Sri Lanka.

Raising the drawback rates will undoubtedly contribute to boosting textile exports of India, thereby restoring its long-lost potential as a leading exporter of textiles and apparel in the long term. The export rankings for 2022-2023 indicate that India still has the potential to climb the scale in apparel exports.

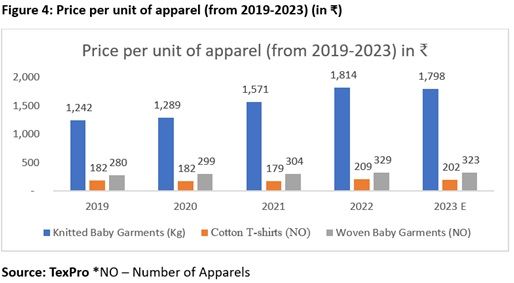

Statistics from TexPro show an increase in the value of products for which the Indian government has raised duty drawbacks. This move could steer the country towards greater competitiveness against nations like Vietnam, which is revising its tax schemes for foreign textile industries. Bangladeshi and Sri Lankan exports benefit from the Everything but Arms (EBA) policy and Generalised Schemes of Preferences (GSP) offered by European countries. These policies allow products from these nations to face no tariffs due to their developmental status. Given that Europe is one of India's largest textile export destinations, and that India does not benefit from any of the aforementioned policies, the steps taken by the Indian government represent a positive move to enhance textile and apparel exports.

The increase in the drawback rates will bring about a reduction in the price of apparel-cotton T-shirts and baby garments in the upcoming years starting as early as Q4 2023. The export prices according to F2F analysis driven by data on TexPro illustrate that the export prices will witness a decline from 2023 onwards, thus increasing India’s competitive advantage, which can aid in increasing the apparel exports and helping India to regain its lost ranking status.

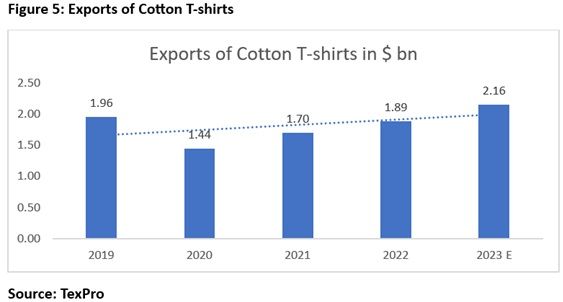

The exports of cotton T-shirts are projected to see a 12.5 per cent rise from the 2022 levels, amounting to $1.89 billion. In 2022, cotton T-shirts accounted for approximately 11.3 per cent of India's total apparel exports and roughly 5 per cent of the overall T&A exports. This uptick in exports may be an indirect consequence of increased duty drawbacks, which lower the export price.

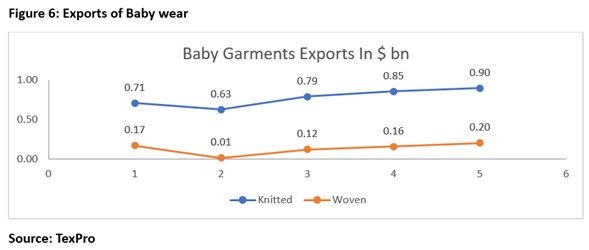

Similarly, knitted babywear exports are anticipated to grow by 5 per cent compared to last year. The contribution of knitted babywear stood at 5.3 per cent of India's total apparel exports and 2.3 per cent of the overall T&A exports. The woven babywear segment is also expected to see a 20 per cent spike. In 2022, babywear exports were valued at $0.16 billion, making up about 1 per cent of India's total apparel exports and approximately 0.4 per cent of the overall T&A exports.

The current drawbacks will only help to increase the competitiveness of Indian textile exports. Although this is a first step towards enhancing India's competitiveness in the textile industry, further government policies are needed to encourage the sector to improve its productivity. Having struggled for the past three years, India's textile sector requires more than just an increase in duty drawbacks. However, the current modifications may serve as a catalyst for long-term improvement in the country's textile industry, provided there are no abrupt changes to the existing structure.

ALCHEMPro News Desk (MI WE)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!