The latest policy report from the Bank of England offers an insightful analysis of the current economic conditions, focusing particularly on the implications of increasing interest rates on consumer spending and various sectors of the economy. It delved into the ways in which these heightened rates are influencing household expenditure, with a special emphasis on the potential repercussions for the retail sector, especially in the context of clothing purchases.

Current scenario

The Bank of England’s report stated that the economy of England is being affected by external factors such as the real estate sector crisis in China, followed by global economic uncertainty and a higher level of public debt, which is impacting the financial stability of the country. The UK's real estate sector consists predominantly of Chinese investors, and their selling spree is affecting the UK's economy.

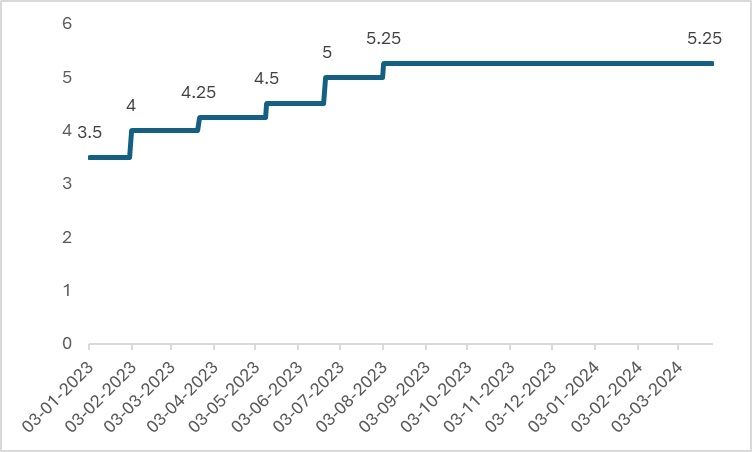

The Bank of England has maintained the interest rates at 5.25 per cent as the Consumer Price Index is above the Bank's target. The interest rate has influenced the retail spending of UK households and the operation of the retail sector. The interest rates will affect household spending, and the retail sector will face challenges as the higher interest rate impacts their debt servicing capacity.

As seen in Figure 1, the interest rate has climbed slowly in a staircase pattern, thereby providing some predictability to the rates to avoid uncertainty in the economy. However, changes in the interest rate, coupled with overall external economic conditions, have affected the UK economy.

Budget cuts, soaring profits

With interest rates at record highs, household spending is likely to be impacted. This is a basic economic principle: regardless of consumer trends and habits, interest rates influence household spending, leading to a likely reduction in expenditure on apparel. According to the Bank of England's report, elevated interest rates will cause households to allocate a larger portion of their income to essential expenses and debt servicing. The report suggests that this trend may persist until 2025.

Figure 1: Interest rates set by Bank of England (in %)

Source: Office for National Statistics

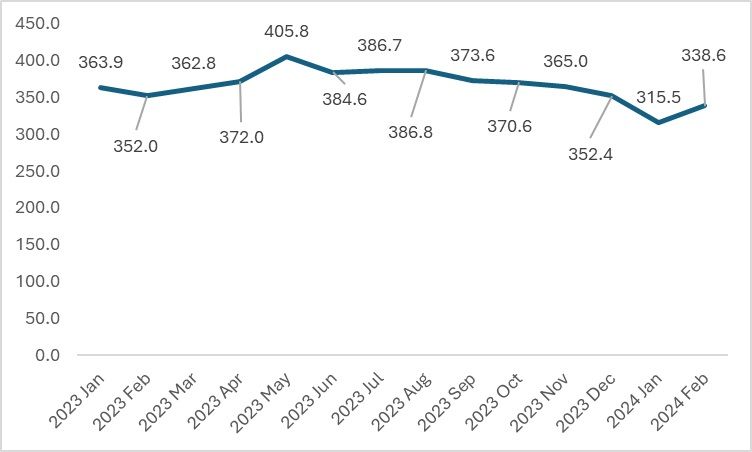

Retailers are facing a similar challenge, as they may struggle to service their debts due to decreased demand, lower profits, and increased operating costs. Expenditure on clothing by the public has been declining since June 2023, when spending stood at $386.7 million. Although there was an increase in February 2024, the expenditure, at $338.6 million, remains 12 per cent lower than the previous year's figures.

Figure 2: Month-wise average weekly spending of UK consumers on clothing (in $ mn)

Source: Office for National Statistics

With higher interest rates, the escalating cost of living crisis, the looming risk of recession, and strained wages, consumers are reallocating their income towards essential commodities and debt servicing.

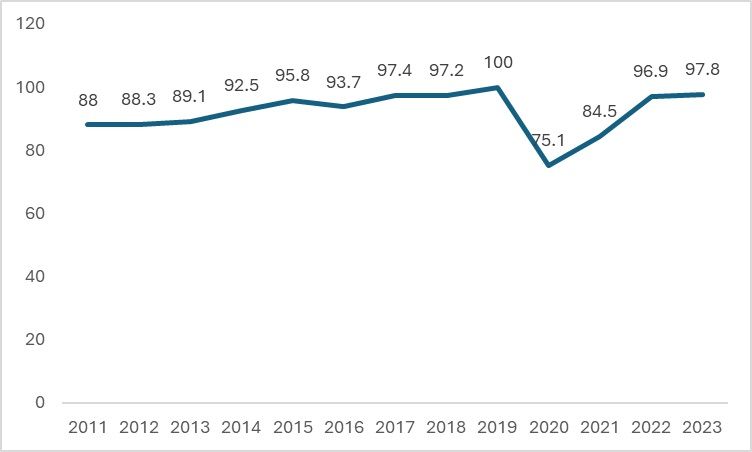

Figure 3: Retail Index of UK's economy (2011-2023)

Source: Office for National Statistics

The retail sector in the UK is currently facing a unique set of challenges. Since 2000, the sector has seen significant growth, fuelled by increased availability of debt. However, it is now at considerable risk due to the rise of the online retail sector within the UK. The retail index for clothing and apparel remains low compared to the peak of 181.4 in May. In 2023, the UK's retail index declined as the country entered a recession, as confirmed by official data. This decrease in the retail index reflects reduced consumer spending and lower consumer confidence, making it difficult for retailers to generate profits, boost sales, and service debt.

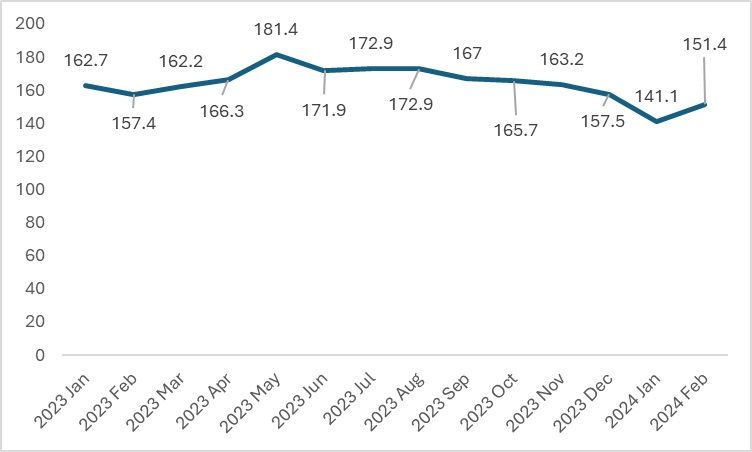

Figure 4: Retail Sales Index for clothing and footwear in UK (in units)

Source: Office for National Statistics

The overall retail sales index experienced a contraction until January 2023, but an increase was observed in February, attributed to an improvement in the overall economic situation and optimism that the country may recover alongside wage increases. The retail sales index, a crucial indicator of consumer spending on various goods over a given period, offers valuable insights into the spending patterns of UK consumers on specific items.

The retail index for clothing and footwear indicates that spending in these categories is gradually recovering as the economy begins to rebound from recessionary pressures, as supported by official data.

A prospect for enhancing exports

As interest rates rise, imports might decline due to diminished demand, presenting a unique opportunity for the country. The UK's textile industry, a vital employment provider, significantly contributes to the nation's GDP.

In light of the current situation, the UK could develop strategies to bolster long-term export growth. This period offers a prime opportunity for the UK to capitalise on. Although demand is waning in some regions, a robust market for textiles and apparel persists in others, allowing the UK to maximise this potential.

Oxford Economics released a report indicating that the UK's textile sector employs approximately 197,000 individuals and has the capacity to generate an additional 160,000 jobs throughout the industry. To enhance exports, the UK must effectively leverage Free Trade Agreements (FTAs).

Road ahead

Although the UK economy is on the mend, the situation remains quite complex. The country has endured challenging times, grappling with the repercussions of Brexit, the impact of conflicts exacerbating the cost-of-living crisis, and the journey towards post-recession recovery. Despite the complexity, the situation may not significantly impact supplier countries, although there could be some disruptions if demand from the UK remains subdued. While the UK has its own textile industry, it imports apparel from countries like Bangladesh and China. Therefore, if the recovery progresses more slowly than anticipated, supplier nations, such as Bangladesh, might experience a decline in revenue.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!