Sri Lanka, a prominent producer of textiles and apparel in South Asia, is currently in a fragile economic position. The country has defaulted on debt servicing and is in discussions with the International Monetary Fund (IMF) for debt restructuring. Despite these challenges, Sri Lanka’s exports are showing decent growth as the manufacturing sector recovers from the economic downturn.

Since 2022, Sri Lanka has been grappling with a severe debt crisis, accompanied by a rising cost of living. The apparel and textile industry experienced a decline in earnings compared to other sectors, such as tea and rubber, which saw significant growth. Although textile exports increased in early 2024, the growth was followed by a notable reduction in export figures.

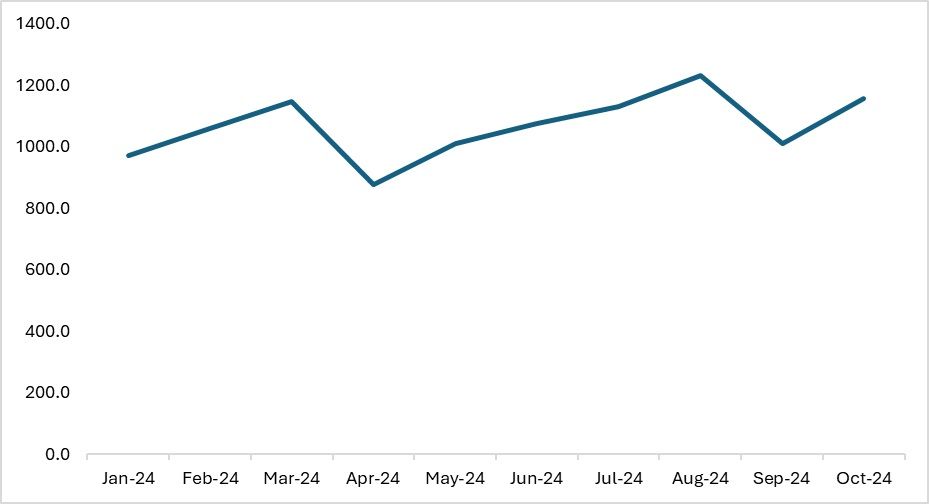

Exhibit 1: The total exports of Sri Lanka (in $Mn)

Source: Sri Lanka Central Bank

Trade data shows that Sri Lanka's total exports increased by 14 per cent in October. Factors such as the recovering US economy, Sri Lanka’s gradual economic recovery, and the strengthening Sri Lankan Rupee have helped ease debt repayment challenges. Although the Sri Lankan Rupee has been one of the worst-performing currencies since 2022, when the country declared bankruptcy, current government efforts are gradually aiding recovery from the economic crisis.

The country has seen increased earnings from exports of tea, rubber, and coconut-based products, followed by textiles and apparel. Total exports have grown at a CAGR of 2 per cent during January-October 2024, with apparel and petroleum exports driving October’s growth. Notably, textile and garment exports account for over 40 per cent of industrial exports, highlighting their importance to the manufacturing sector. In October, the textile and garment sector contributed 48 per cent of industrial exports, underlining its critical role.

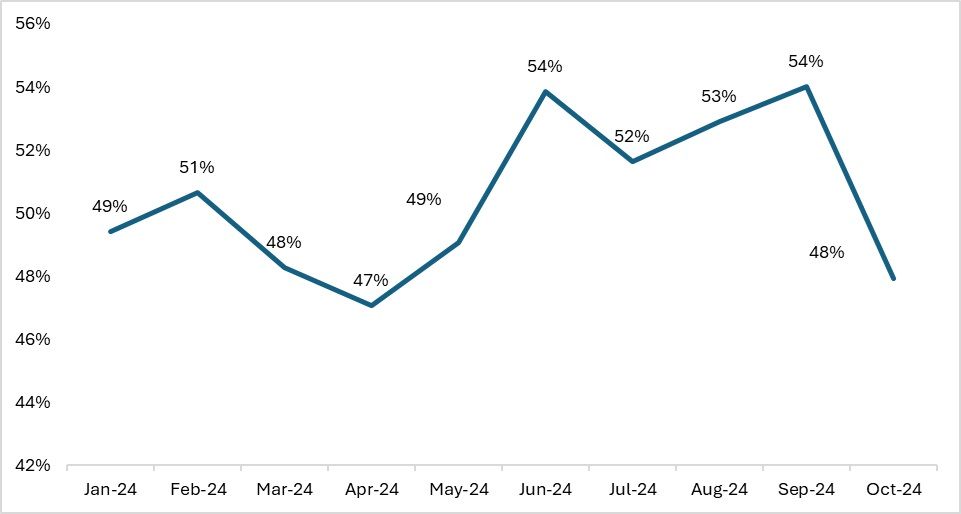

Exhibit 2: Textile exports as a % of total industrial exports

Source: Central Bank of Sri Lanka

The share of textiles in Sri Lanka’s total exports fell to around 48 per cent in October from 54 per cent a month earlier. As of 2024, the textile (including garments) sector’s share typically ranges between 47 and 50 per cent. However, this decline is not a major concern, as textile exports still contribute significantly to the country’s overall export earnings.

In many Asian countries, including India, Bangladesh, Sri Lanka, and China, the textile industry is one of the largest employers. Consequently, textile exports play a crucial role in these nations’ economic ecosystems, underscoring their significance to economic growth and stability.

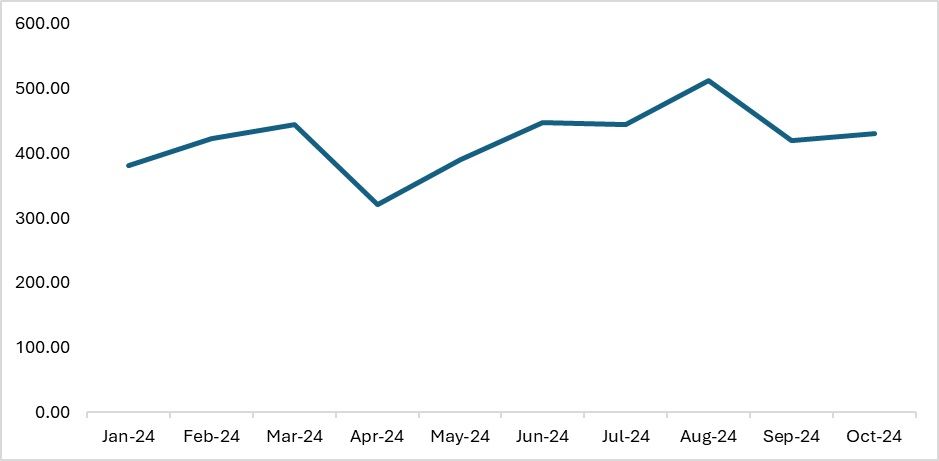

Exhibit 3: Textile exports of Sri Lanka (in $Mn):

Source: Central Bank of Sri Lanka

Sri Lanka’s textile exports are regaining momentum, indicating a recovery in an industry that previously faced restrictions on sourcing inputs for apparel production. The country primarily exports to the US, followed by the UK and EU nations. As a member of the EU’s GSP+ consortium, Sri Lanka benefits from preferential tariff rates, with a utilisation rate of 66 per cent for this agreement. The EU imports most of Sri Lanka’s textile goods at concessional rates. However, Sri Lanka needs to explore additional avenues to increase exports to the EU, as over 85 per cent of its goods are eligible for GSP+ benefits. It has utilised only 51 per cent of its GSP+ benefits for apparel exports.

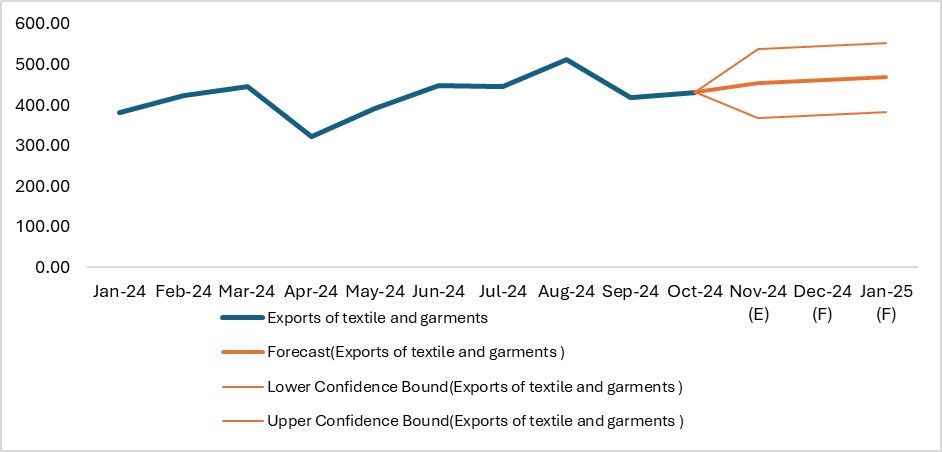

Exhibit 4: Forecasts of Sri Lanka’s textile and apparel exports (in $Mn):

Source: ITC Trade map, F2F analysis

A comparison of Sri Lanka’s monthly textile exports for 2023 and 2024 shows impressive growth, with exports increasing by 16 per cent and 22 per cent year-on-year in September and October 2024 respectively. This recovery is attributed to a reversal of lower growth trends and higher demand from major markets such as the US and the EU. Additionally, the country is aligning with global trends, including green garment manufacturing.

Through the adoption of lean manufacturing techniques, Sri Lanka is reducing water consumption while ratifying all 27 ILO conventions, enhancing its chances of securing more orders from markets like the EU and the US. With the EU’s CBAM policy emphasising sustainability and environmentally friendly apparel production, Sri Lankan garments may have an advantage in entering these markets compared to other Asian producers.

Table 1: Year on Year growth of the Sri Lankan Apparel (in $Mn, %)

Source: Central Bank of Sri Lanka, ITC trade map, F2F analysis

Way ahead

Sri Lanka’s exports have grown compared to last year, signalling a recovery. Textile exports were among the top contributors to this growth, followed by the tea and agricultural industries, indicating a sectoral recovery amid ongoing economic challenges. The country is currently negotiating a bailout package with the IMF, while its manufacturing sector shows slight signs of recovery.

Sri Lanka’s textile sector is unique in Asia, having legally ratified all ILO agreements and achieved LEED certification. These factors position the nation as a prospective beneficiary in the future, as consumer countries seek to de-risk their supply chains to avoid sanctions. With economic recovery underway in the US and the EU, the forecasted growth in Sri Lanka’s textile and apparel exports appears well-founded. The country exports a significant portion of its textiles and apparel to the EU under GSP+, and further benefits could be gained by negotiating for more products to qualify under this scheme.

Like many developing Asian economies, Sri Lanka’s textile sector is a major contributor to export earnings, accounting for 52 per cent of the country’s total and employing approximately 700,000 people directly and indirectly. The country is showing signs of recovery and is on the right path to overcoming past economic setbacks. The forecasted increase in textile exports underscores a positive long-term outlook, driven by robust demand from consumer countries and a recovering domestic and global economy.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!