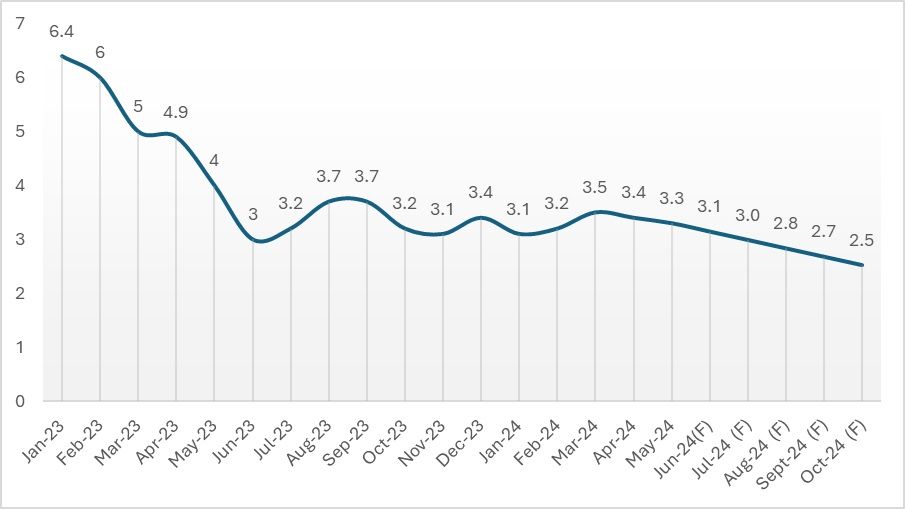

Is inflation finally declining steadily?

As the US economy suffered from increasing inflation and a period of sticky inflation, it has finally shown signs of recovery in May. However, inflation is not reducing at the rate expected by the US Fed. This was reflected by the US central bank, which once again kept the interest rates unchanged at a historic 23-year high Federal target range of 5.25 to 5.50 per cent.

Figure 1: CPI in the US (in %)

Source: US Bureau of Labor Statistics

Even though the Consumer Price Index (CPI) is projected to fall to 2.5 per cent by October 2024, it is still not within the target range of 2 per cent as set by the US Fed. This has led to higher interest rates, lower consumer confidence, and shrinking consumption. Although savings should have increased in the economy, consumer spending has risen robustly. This is indicated by the sales figures of clothing and accessories stores in the country, which increased by around 1 per cent in April, even as inflation is reducing.

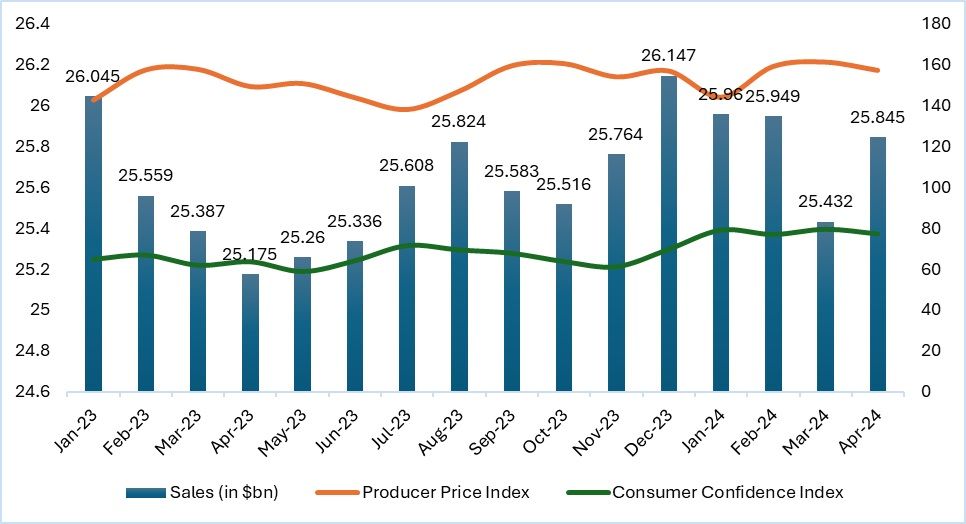

Figure 2: Producer Price Index, Sales and Consumer Confidence Index in the US

Source: University of Michigan, FRED, US Bureau of Labor Statistics

Impact on the producer economy

The Producer Price Index (PPI), an indicator of inflation from the producer's perspective, has shown signs of cooling marginally in the last two months. This indicates that the prices received by sellers or producers have reduced compared to a few months ago, which could signal an easing of inflation on the producer’s side. This may potentially remove the pressure of increasing costs and thereby increase the margins for retailers.

Figure 3: Producer Price Index and Consumer Sentiment Index in the US

Source: US Bureau of Labor Statistics, University of Michigan

The Consumer Confidence Index (CCI) reduced marginally again in May. According to the University of Michigan, consumers' expectations of inflation in the US economy remained more or less constant, reflecting that spending will remain tepid unless consumers' inflation expectations decrease. Although sales in apparel stores have increased by 1 per cent, rising credit costs and higher inflation may take a toll on household spending, as clothing is considered discretionary. During times of inflation, a major portion of spending goes towards necessary items, reducing the spending share on other items in the basket.

Along with inflation, inclement weather has also impacted total sales of apparel and accessories in the US. This can affect the profitability of US retailers in the short term. However, consumer spending increased by around 5 per cent in the past year, which could be due to the discounts offered by retail stores that drove the 1 per cent increase in sales.

Outlook

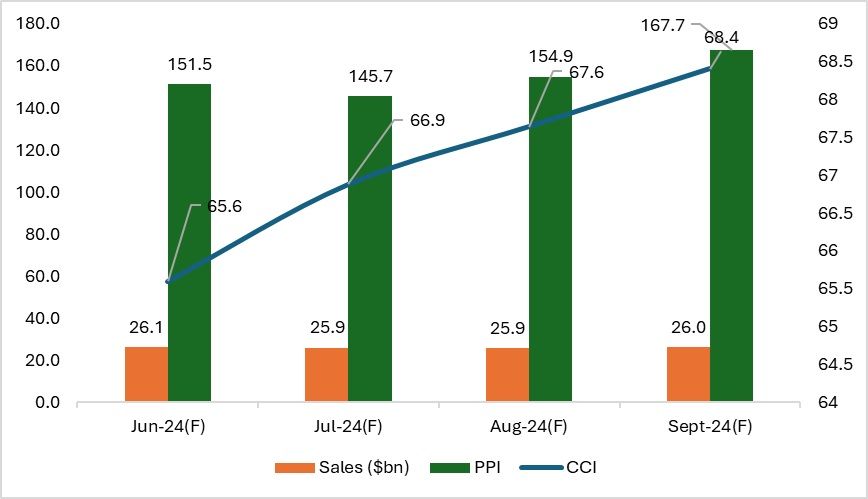

As inflation is forecast to remain above the targeted 2 per cent, and consumers' expectations about inflation stay more or less constant, this is reflected in the sales figures. Sales of apparel are expected to grow at a very slow pace and may take more than a year to recover from the shock caused by consistently higher interest rates, according to an analysis done by Fibre2Fashion.

Figure 4: Outlook for sales, PPI and CCI from June-September

Source: F2F Analysis

The present situation reflects a policy impact lag. With higher interest rates implemented to battle inflation, it takes a significant amount of time for all economic factors to adjust. While expenditure on apparel and other variables was expected to fall, discounts offered by retailers and a robust job market have kept consumer spending stable or increased. As interest rates begin to show effects and apparel inflation eases, prices may also reduce, thereby increasing the profitability of retailers.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!