With major countries preparing for the next four years of Donald Trump’s presidency, the Chinese economy is gearing up to face the challenges ahead. With the threat of trade war looming, the Chinese Central Bank is considering devaluing its currency, which could significantly impact the nation’s economy and trade. Currency devaluation is a policy action where a country deliberately depreciates its currency against the dollar. The main observations post the election of Donald Trump as the 47th President of the US are:

Currency Challenges and Trade Woes

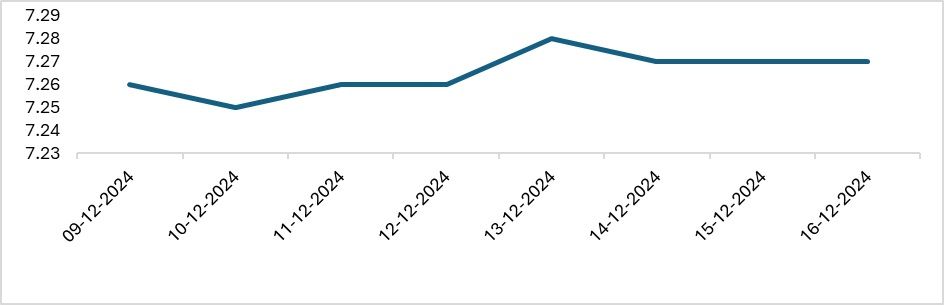

The Chinese renminbi has fluctuated since Donald Trump won the US presidential election. If the movement of the renminbi against the dollar is observed, the renminbi has been depreciating against the dollar at a slower pace. The country’s central bank, i.e. the People’s Bank of China (PBOC), highly controls the currency. The bank has pegged the currency to the US dollar and the value of the currency is not determined by the market actions of demand and supply. Instead, the Chinese Central Bank performs interventions to ensure that the exports of the country stay cheaper, thus keeping the competitiveness of the exports constant.

Exhibit 1: Renminbi against the dollar

Source: Xe.com

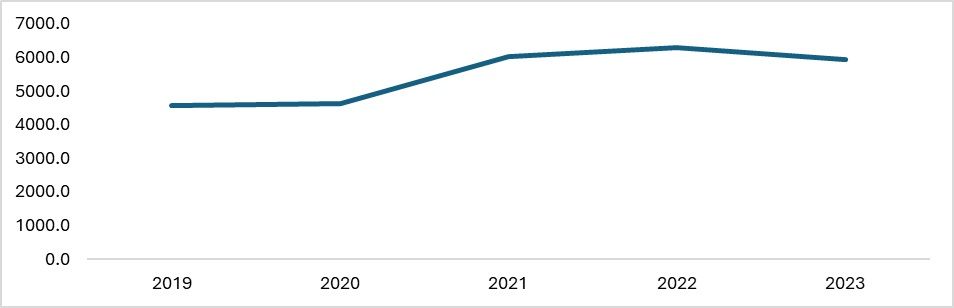

The decoupling stance and the plan for devaluation raise questions about China’s short-term plans and its preparation for a trade war with the US. The country’s total trade has skyrocketed as many manufacturing countries have experienced a significant boost in production. This surge comes as consumer countries like the EU and the US are de-risking from Chinese manufacturing and exports. In response, Chinese manufacturing companies are adopting a decoupling strategy. This strategy aims to make China’s manufacturing less dependent on inputs from other countries. With globalisation acting as a double-edged sword—it both integrates economies and can be weaponised—countries’ strategic security significantly influences global policy-making.

Exhibit 2: Total trade of China (in $bn)

Source: ITC Trade map, F2F analysis

When it comes to China and the US, these countries are more overdependent on each other than one can imagine. In terms of trade, the US is the largest market for China, and for the US, China is the second largest source of inputs. In 2023, the share of China was 14 per cent in the US’s total imports and the share is unchanged even in the month of October.

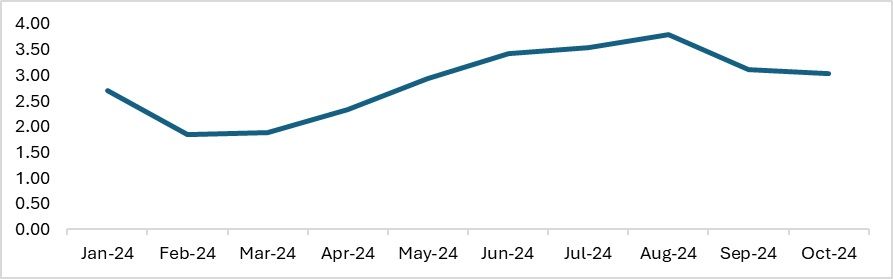

Exhibit 3: Apparel exports of China to the US (in $bn)

Source: ITC Trade map, F2F analysis

The apparel exports of China to the US have reduced over time. As of October 2024, the apparel exports fell by almost 3 per cent. However, the country’s overall exports have reduced marginally by one per cent in October 2024. With Donald Trump in power, the higher tariffs will reduce the value of Chinese exports to the US, if there is no policy in place from the Chinese side to reduce the impact of the same on its huge array of exports.

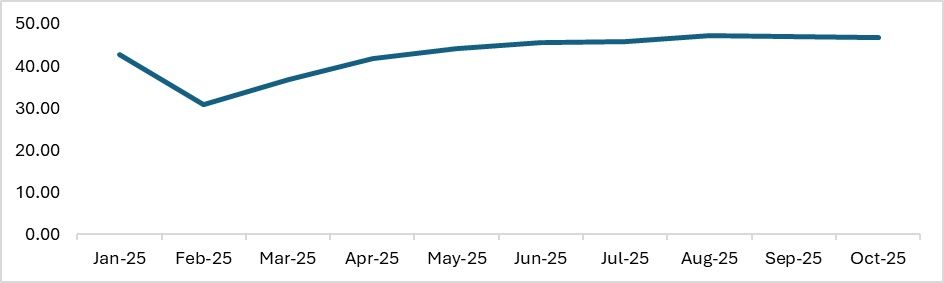

Exhibit 4: The total exports of China to the US in 2024 (in $bn)

Source: ITC Trade map

If Chinese authorities decide to devalue the currency, it will provide a significant boost to the country’s exports. However, this move would also lead to higher input costs and increased inflation within the country. Currently, inflation in China stands at a modest 0.2 per cent, but currency devaluation could drive it higher, potentially dampening domestic consumption.

During the last trade war, China’s exports were heavily impacted as there was no perfect substitute for the US as an export market. This made domestic consumption a critical pillar of the Chinese economy. According to the Stanford Centre for Chinese Economy and Institutions, Chinese firms suffered losses of nearly four per cent during the trade war, primarily due to their inability to lower prices amid declining profit margins. This resulted in a drastic reduction in both sales and profitability for many firms.

Having learned from past challenges, China has now better prepared itself for a renewed trade war or any potential tariff hikes by the US administration. By focusing on domestic market strength, enhanced supply chain flexibility, and diversified trade partnerships, the country is striving to mitigate the economic fallout from external trade tensions.

China’s Push for Diversification: Navigating Investment Challenges

With uncertainty looming over the US market, China is already looking to diversify and expand the reach of its exports to different countries. Till now China has aggressively invested in South Asian countries like Sri Lanka and Bangladesh, and in African countries like South Africa, and Kenya. However, China’s investments are the highest in the US in varied sectors like healthcare, technology, and transport. Therefore, with the renminbi devaluation, the country also has to look after the investment outflows from the country. There are chances that overseas investment of China will reduce in value and therefore the country’s overall FDI outflow will reduce along with an increase in investor reluctance.

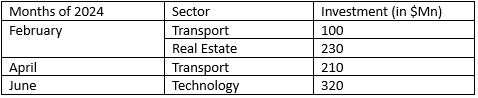

Table 1: Chinese investments in the US (in $Mn)

Source: AEI China Investment Tracker

Excluding investments, China has witnessed an increase in the share of other countries in its export basket. Notably, the share of developing countries in China’s exports has been growing, offering some protection against the tariff threats posed by the US. The EU, US, developing countries and ASEAN remain China’s primary trading partners.

However, China’s inability to identify a complete substitute to offset the decline in trade caused by US-imposed tariffs continues to challenge exporters, especially given their already thin profit margins. Since 2018, the country has increasingly relied on domestic sales and in-house sourcing, enabling firms to maintain greater flexibility in adapting to shifts in global trade policies. This focus on domestic markets has become a key strategy for mitigating the impact of external trade disruptions.

Easing Economic Pressures: Can Devaluation Revive China's Economy?

China’s central bank plays a critical role in stabilising the currency to prevent any free fall. The PBOC actively intervenes in the market and is currently focusing on maintaining the renminbi’s peg against the US dollar, rather than pegging it to a broader basket of currencies.

Beyond the tariff threats, China is also reducing its holdings in US Treasury bonds. This move stems from concerns over potential US sanctions, such as the freezing of Chinese assets. Notably, 50 per cent of China’s foreign assets are denominated in dollars, creating a delicate balancing act. While devaluing the renminbi might temporarily boost the value of these dollar-denominated investments, it could harm the country’s long-term investment prospects if the currency weakens further.

On the export front, devaluation would enhance the competitiveness of Chinese goods globally. According to the Stanford Centre for Chinese Economy and Investment, exports would likely see a boost, as higher import costs—following the trade war—were largely passed on to American consumers. Currency devaluation could provide some relief to Chinese manufacturers. However, this strategy comes with significant risks for the domestic economy.

Devaluation would push up domestic inflation, raising input costs and potentially eroding the profitability of manufacturers within China. This would create a dual challenge for the economy, with manufacturers facing lower profits both in domestic and international markets. Moreover, inflationary pressures could hurt domestic consumers, further dampening consumption and economic growth.

At a time when the world is increasingly seeking to de-risk supply chains from China, the decision to devalue the currency presents a double-edged sword. The government faces a critical dilemma: whether the burden of economic uncertainty should fall on domestic consumers or the manufacturing sector. Either choice could have far-reaching consequences for the Chinese economy.

Meanwhile, the potential impact of Donald Trump’s policies on Chinese exports, manufacturing profitability, and inflation remains uncertain. If on assuming office, President Trump implements tariff hikes on Chinese imports, it could further strain the profitability of Chinese manufacturers and deepen the economic challenges posed by devaluation and inflation. The full implications will only become clear as the US policies take shape and their impact on global trade unfolds.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!