Economic Outlook

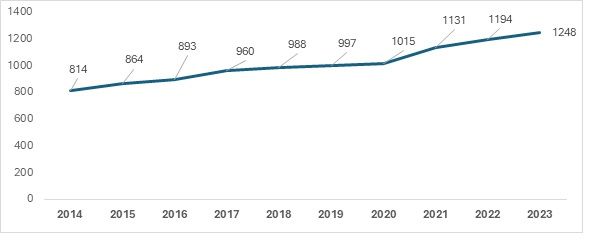

Exhibit 1: Turkiye’s GDP over the years (in $ bn)

Source: TCMB (Central Bank of Turkiye)

The Gross Domestic Product (GDP) has been increasing in real prices over the years. The agricultural sector’s contribution is 6.5 per cent of Turkiye's GDP, while manufacturing remains the primary industrial activity, accounting for 22 per cent of GDP. Within manufacturing, the automobile and textile industries dominate, making significant contributions to the economy. Turkiye currently ranks as the 5th largest textile exporter globally. Its integration into the Turkiye-EU Customs Union provides access to private investments from the European Union. Given the evolving situation in Bangladesh—a major textile exporter to the EU under the GSP scheme—Turkiye should explore leveraging these investments to strengthen its textile sector and enhance its competitive edge in the EU market.

Exchange rate review

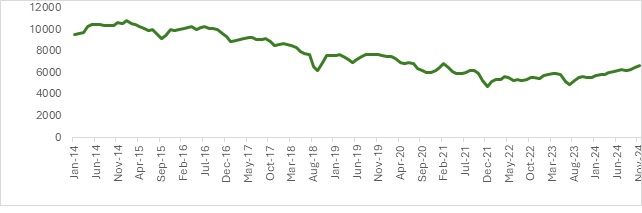

Exhibit 2: Turkiye’s foreign exchange rate against foreign currencies over the years in Turkish lira

Source: TCMB

Exchange rates play a crucial role in deciding the export competitiveness of any product in the international market. The above data shows the CPI-based Real Effective Exchange Rate (REER) against a basket of currencies that are deemed important to Turkiye for bilateral trade. A lower REER would indicate that Turkiye’s exports would be more cost-effective for its major importing markets.

Textiles and apparel are particularly price-sensitive due to the high level of competition in the global market and the relatively low switching costs for consumers. As a result, consumers are more likely to choose products based on price, leading manufacturers to focus on cost-efficiency and economies of scale. Turkiye has seen a progressively declining exchange rate, making its textiles cheaper and more competitive in the international market. However, current trends for the European Union show that European consumers now prefer higher quality goods regardless of the prices.

Turkiye competes with other European Union countries such as Italy and Germany, which provide superior quality compared to Turkiye. The lower exchange rates do not mean that Turkiye’s textiles would find a better position in the EU market, its biggest trade partner. However, Turkiye could find better prospects in Kazakhstan and Iraq, featuring in the top 15 consumers of Turkish textiles, where consumers might be more price-sensitive for textiles.

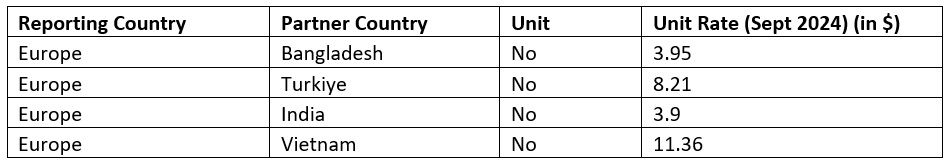

Table 1: Unit rates for textile imports as reported by Europe

Source: TexPro, F2F Analysis

The above data depicts Turkiye’s and its textile competitors' unit rates of apparel for September 2024 to Europe. Europe is likely to import from Bangladesh and India given the latest data. Bangladesh emerges as a bigger winner due to the GSP scheme in place, which allows it to export to the EU (comprising the majority of Europe). Here, Turkiye only ranks slightly better than Vietnam, with the unit rate being 8.21. Turkiye’s recent trends have also shown a slight increase in the real effective exchange rates starting from January 2024. Unit rates for Turkiye in the current month of December are likely to be higher, given that the REER for the month stood at 6730 in November, a record high in CY 2024.

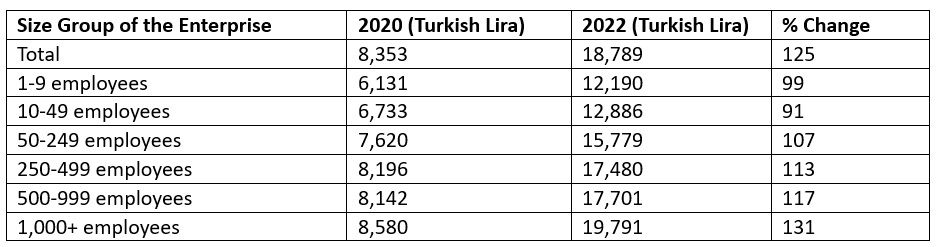

Table 2: Enterprises and their monthly average costs on labour (in Turkish lira) at current prices

Source: TCMB, F2F Analysis

The data for enterprises covered by collective agreements reveals a clear upward trend in monthly average labour costs from 2020 to 2022 across all size categories. For all enterprises combined, the average monthly labour cost increased significantly from 8,353 Turkish lira (TL) in 2020 to 18,789 TL in 2022. Smaller enterprises with 1-9 employees saw their labour costs rise from 6,131 TL in 2020 to 12,190 TL in 2022. Similarly, businesses with 10-49 employees experienced an increase from 6,733 TL to 12,886 TL during the same period. For medium-sized enterprises with 50-249 employees, the cost rose from 7,620 TL to 15,779 TL, while larger enterprises with 250-499 employees saw their labour costs go from 8,196 TL to 17,480 TL. The higher the employment size of the company, the higher has been the rise in the labour cost. The highest rise of 131 per cent has been noticed, in the case of 1000+ employees. The impact of the labour cost is impacting the textiles industry as well.

Textile export performance

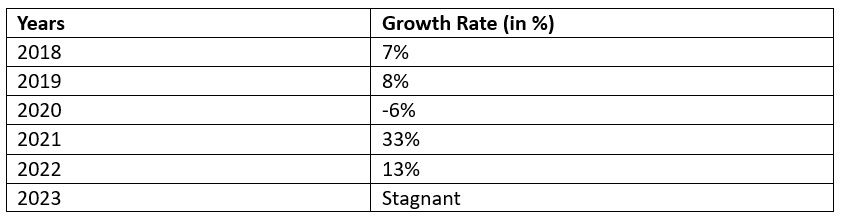

Table 3: Turkiye’s textile exports over the years (in %)

Source: ITC Trade map, F2F Analysis

The above table highlights Turkiye's textile export performance over the years. After moderate growth of 7 per cent in 2018 and 8 per cent in 2019, the industry faced a sharp decline of -6 per cent in 2020, largely due to the global disruptions caused by the COVID-19 pandemic. However, the sector rebounded strongly in 2021 with an impressive growth rate of 33 per cent, driven by a surge in global demand as markets reopened. In 2022, growth slowed to 13 per cent, indicating stabilisation. By 2023, the industry witnessed stagnation, signalling potential challenges such as intensified global competition, economic uncertainty, and shifting trade dynamics, which require strategic interventions to reignite growth.

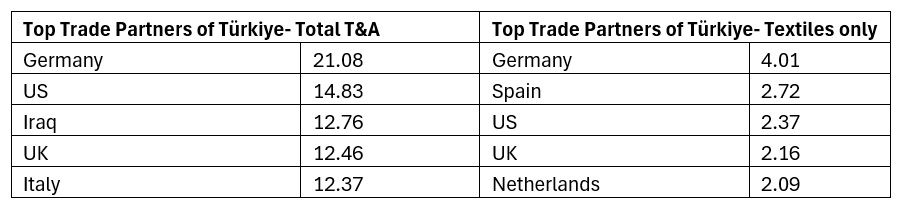

Table 4: Turkiye’s top exporting countries (in $ bn)

Source: ITC Trade Map, F2F Analysis

The table illustrates Turkiye's key trading partners in textile and apparel. Germany emerges as Turkiye’s top trading partner in both categories, supported by their longstanding socio-economic ties. Notably, Turkiye focuses on exporting textiles to neighbouring countries and EU member states, leveraging tariff benefits. However, these advantages have not been fully capitalised in Italy, primarily due to Italy's strong domestic textile industry. Iraq presents a unique case, while Iran does not list Turkiye among its major textile importers. To strengthen its position, Turkiye's textile industry should explore opportunities to expand its presence in both Italy and Iraq, building on existing trade relations.

Way forward

To solidify its position in the global textile market, Turkiye should capitalise on its strategic location, skilled workforce, and advantageous trade agreements, particularly with the EU Customs Union. Despite challenges such as rising labour costs and intensifying competition from countries like Bangladesh and Vietnam, Turkiye retains a significant edge through its ability to deliver high-quality textiles with shorter lead times and reduced transportation costs to European and Middle Eastern markets.

The textile industry must prioritise attracting new investments, especially from the EU, to capitalise on declining export growth in competitors like Bangladesh. Diversifying into high-value-added textiles, embracing technological innovation, and implementing sustainable practices will be essential for maintaining Turkiye’s status as a leading exporter. A step in this direction is the 'Turkish Textile Industry Sustainability Action Plan', announced in July 2021 by the Istanbul Textile and Raw Materials Exporters' Association (ITHIB) under the leadership of the Turkish Exporters' Assembly (TIM). This initiative provides a framework for aligning the industry with global sustainability standards, further strengthening Turkiye’s position as Europe’s top textile supplier.

Expanding market penetration in Italy and Iraq—leveraging existing trade relationships—and negotiating improved terms with key EU partners could also drive export growth. Besides, the government incentives and targeted support for the textile sector could help offset rising labour costs, improve competitiveness, and bolster Turkiye’s global standing in the textile trade.

ALCHEMPro News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!