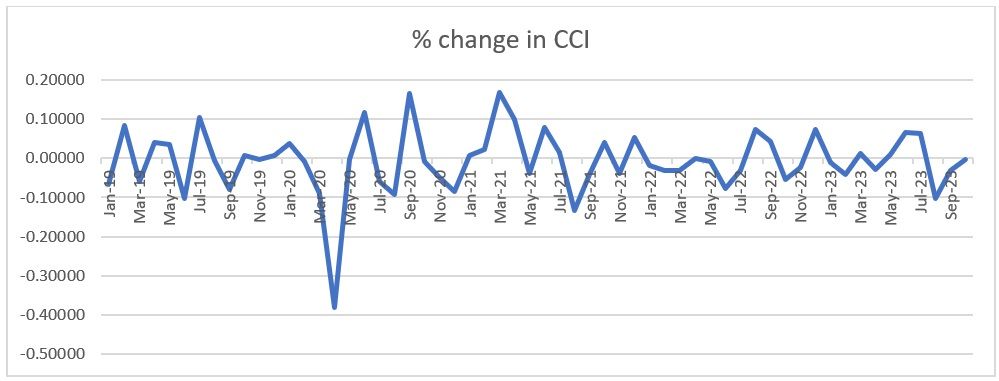

In October 2023, the United States witnessed a dip in consumer confidence, exacerbating fears of an impending recession. The Consumer Confidence Index (CCI), compiled by the Conference Board, declined to 102.6, a decrease from the revised figure of 104.3 in September. This downward trend has been attributed to a variety of domestic concerns, including rising prices across the board, increased gasoline costs, and soaring real estate values, all contributing to the October decline.

The fluctuating CCI mirrors the American public's wavering trust in the stability of the economy and the effectiveness of policies aimed at its stabilisation. Inflationary pressures continue to mount, as evidenced by the Consumer Price Index (CPI) climbing from 3 per cent to 3.3 per cent in October, further eroding consumer confidence.

The CCI is an indicator of the short-term economic outlook of consumers, influenced by factors such as labour market conditions, price levels, and external issues including geopolitical tensions. These factors not only impact purchasing power but also affect the resilience of supply chains, reflecting the broader uncertainties faced by the US economy.

Figure 1

Source: The Conference Board, US

The trade landscape of the US is set to face challenges due to a myriad of factors. Primarily, a decline in the CCI reflects waning consumer faith in the economy. This, coupled with inflationary pressures, leads to diminished demand for goods within the economy. The Present Situation Expectation Index (PSEI) further reveals a growing consumer pessimism, underscored by fears of income reductions amid looming recession concerns for 2024.

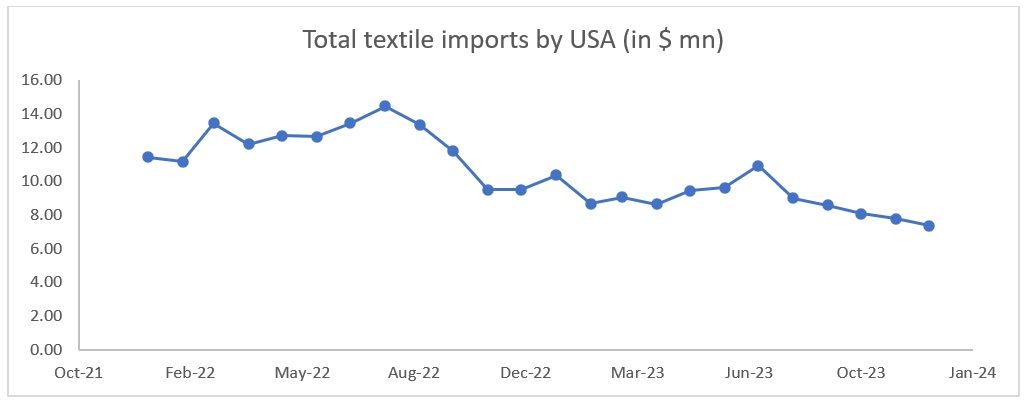

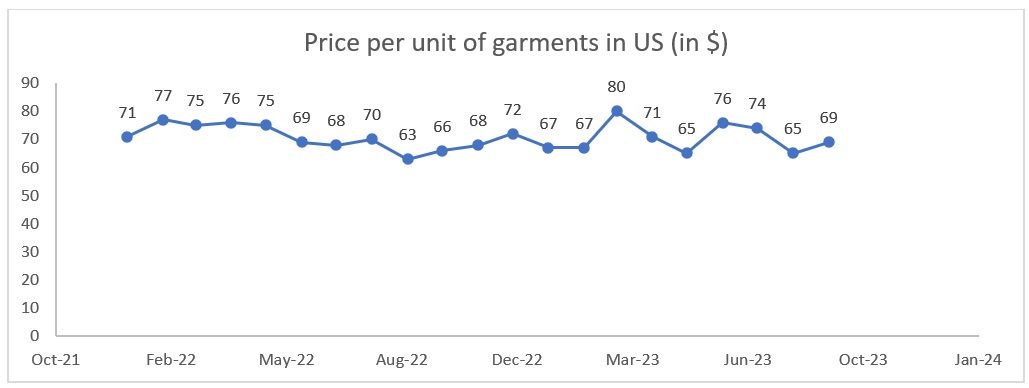

The CCI reflects consumers' reluctance to spend due to fears of reduced income. The rise in CPI further fuels this unwillingness to spend, as the per-unit price of apparel is higher due to increased duties compared to European counterparts. Higher prices lead to lower demand from consumers. On the supply side, retailers are equally hesitant, becoming increasingly cautious about consumer spending and, therefore, more reluctant to place orders. This caution is likely to result in reduced imports, as recent data indicates.

Internal factors such as the application of duties and the under-utilisation of free trade agreements (FTAs) are contributing to a reduction in trade. This may adversely affect the growth of merchandise trade relative to GDP, thereby impacting GDP itself. A low value of 0.3 indicates minimal responsiveness of trade to changes in GDP. Therefore, apart from the reduced CCI, rising inflation, low utilisation of FTAs, and external factors such as wars are fuelling an increase in the price of apparel in the US, consequently leading to a reduction in demand and, therefore, a fall in the imports of apparel.

Figure 2

Source: TexPro

Figure 3

Source: TexPro

According to US’ import data from January to July 2023, the most popular apparel imports were trousers and shorts, accounting for 24.47 per cent of total imports. Jerseys at 15.50 per cent and shirts at 11.26 per cent completed the top three categories, making up an overall 51.23 per cent. The remaining 48.77 per cent of imports comprised various apparel items, including T-shirts, dresses, innerwear, accessories, socks, babywear, jackets, blazers, coats, nightwear, skirts, swimwear, suits, sportswear, and ensembles. With this data in mind, it is hard to believe that only 13.5 per cent of total imports are imported via FTAs into the country.

Apart from the aforementioned reasons, the cause for the reduction in apparel imports is the duty on the same. The US charges 10-15 per cent duty on apparel imports, with few taking the benefits of any agreement or an FTA. Furthermore, the increase in duties on apparel imports is resulting in a rise in the per-unit cost of the apparel, which also affects the CPI. A recent study from the United States Fashion Industry Association pointed out the rising prices of apparel and the lack of utilisation of the FTAs to import the same, aiding an increase in inflation. Being a gross importer of apparel, the US needs to revamp the trade policy to ensure that the duties do not creep into CPI, adding further to inflation.

ALCHEMPro News Desk (MI WE)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!