The United States (US) and the European Union (EU) raised interest rates in 2022 and 2023 to combat inflation and cool the economy, which faced rising prices due to the pandemic, supply chain issues post-Russia-Ukraine war, and the Red Sea crisis, leading to a decline in consumer confidence. While inflation has recently shown signs of marginally slowing, there are expectations that the US Federal Reserve (Fed) may reduce interest rates soon. However, it is crucial to analyse the impact of this monetary tightening on textile-exporting economies in Asia.

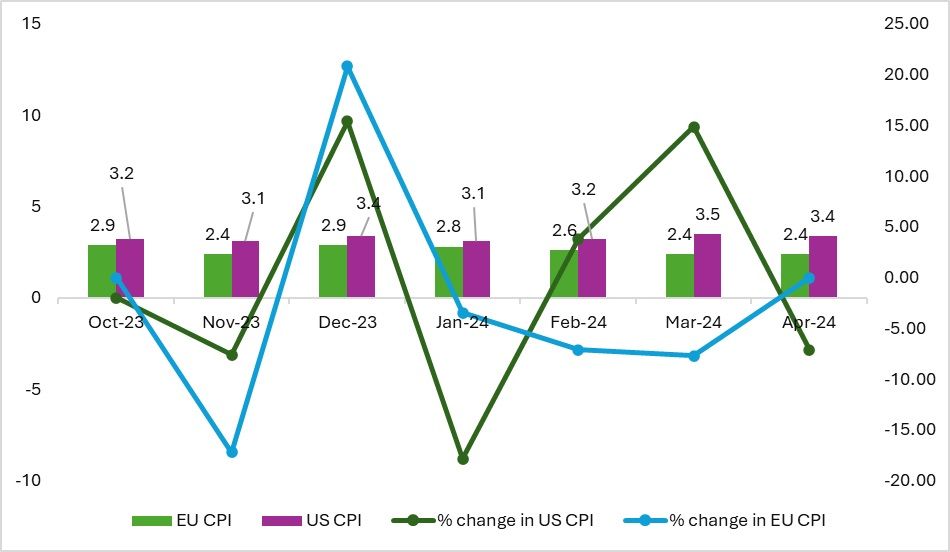

As inflation in the US and the EU started to show signs of cooling down, the US saw a nine per cent increase in the consumer price index (CPI) in March, followed by a constructive decline of two per cent in April. This has led to speculation that US interest rates may decrease, potentially reviving consumption and manufacturing in the country.

Figure 1: CPI in US & EU (in %)

Source: US Bureau of Labor Statistics, Eurostat and F2F analysis

Since 2022, the US Fed maintained higher interest rates, impacting commodity prices, increasing borrowing costs, and reducing demand in the economy. This has affected businesses in both the US and the EU. Although the CPI showed a constructive decline in April, central banks may still adopt a hawkish stance and continue to keep interest rates high.

According to the World Bank Global Commodity Report released in April 2024, tensions in the Middle East could prevent a decline in inflation and undermine hopes for economic stability, prompting central banks to maintain higher interest rates. Additionally, there are concerns that energy prices could soar if the conflict continues, further increasing inflation. Thus, whether central banks will reduce interest rates remains an open question.

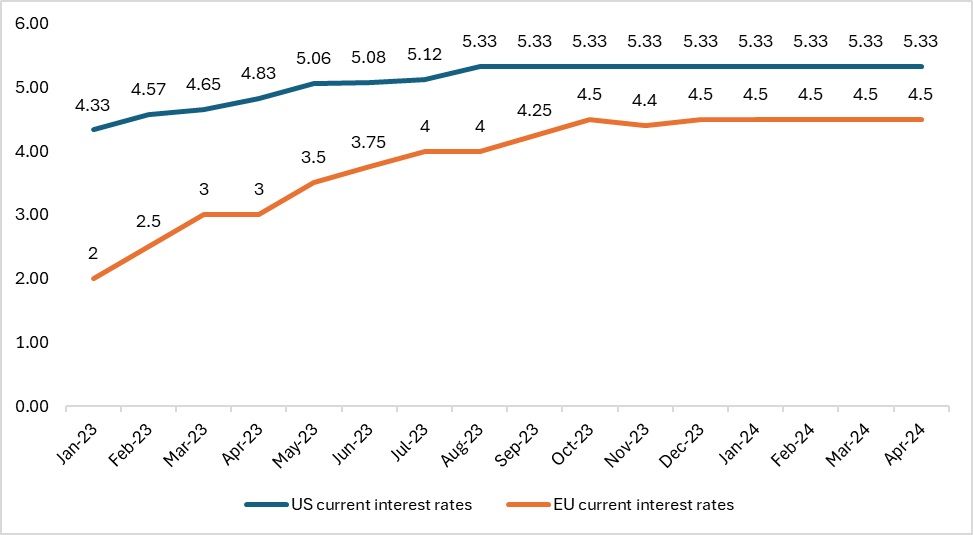

Interest rates

The US Fed had increased the interest rates to a target range of 5.25 to 5.5 per cent (current interest rate of 5.33 per cent) in July 2023 in a bid to bring the inflation down to the targeted level of 2 per cent and has maintained it at that ever since. The historically high interest rates dampened consumption and reduced the competitiveness of US industries, yet they have been unable to control the rise in inflation, leading to speculation that the country is entering a period of sticky inflation.

Figure 2: Current interest rates of US & EU (in %)

Source: US Federal Reserve, European Central Bank

The same was the case in the EU. The Russia-Ukraine war had led to the onset of a cost-of-living crisis in the nation as the price of natural gas increased leading to inflation in the country soaring. To control inflation, the European Central Bank periodically increased the interest rates from the low of around 0.5 per cent in August 2022 to a record 4.5 per cent in October 2023, leading to a drastic fall in the expenses of European households and a resultant decline in the orders from retailers. The hike in the interest rates by the ECB impacted not only the producers and the manufacturers in EU but also the manufacturers in the Asian continent who depend on these markets for their exports. Textile exporting nations like India and Vietnam for that matter can be taken as an example.

Impact on prices, consumption and textile economies

Higher interest rates in major textile consumer economies have impacted overall consumption and demand, affecting textile-exporting economies as well. With the fall in consumer confidence, discretionary expenses, including textile and apparel products, are expected to decline. Rising inflation and falling real income further reduce spending on discretionary items. This exacerbates the challenges faced by exporting countries, which are already dealing with rising costs due to wars and the Red Sea crisis.

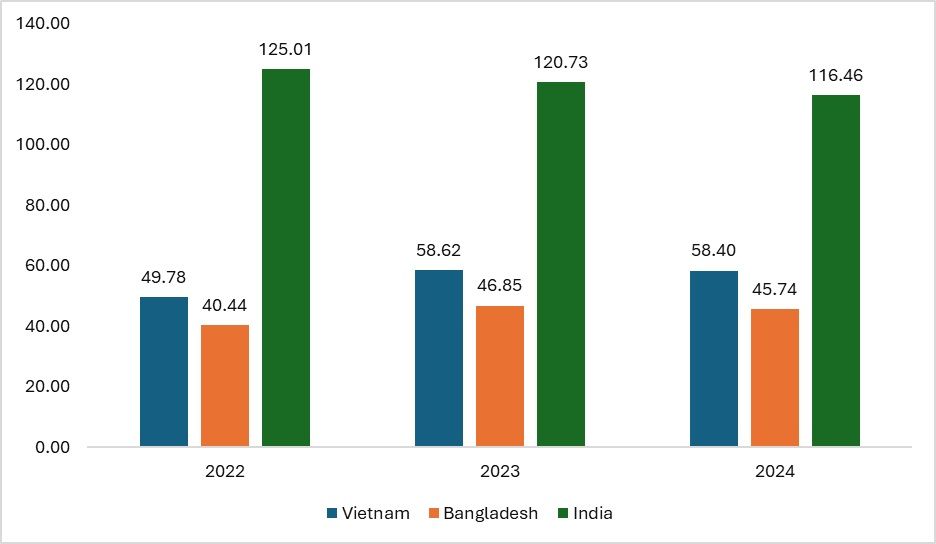

Figure 3: Unit value of apparel from Vietnam, Bangladesh and India (in $)

Source: TexPro

The fall in demand has led to an overall fall in the export of apparel to these nations. The unit price of the major apparel-exporting countries like Vietnam and Bangladesh increased in the year 2023 and that of India reduced in the same year compared to the prices in 2022. The reason for an increase in the unit prices of apparel for some nations is due to domestic issues like energy costs, and a rise in domestic inflation which led to an increase in the cost of raw materials in the home nations. Countries like Vietnam, Bangladesh, and Türkiye have already faced those problems, which worsened textile production and output, thereby increasing the unit price too. According to Fibre2Fashion’s market insight tool TexPro, the price of apparel exported from Bangladesh increased by around 15 per cent in 2023 as compared to unit prices in 2022 and for Vietnam it increased by 17 per cent in 2023 compared to the previous year with a marginal surge in the apparel exports.

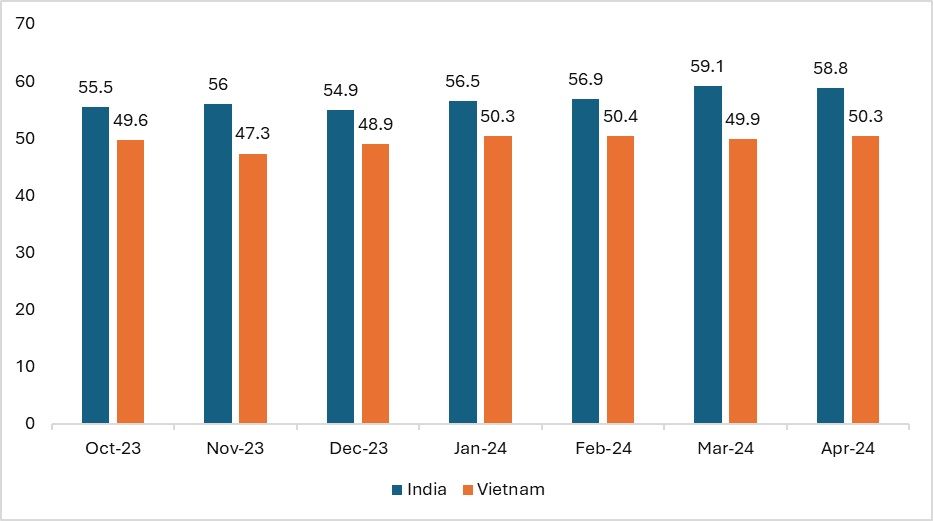

Figure 4: Purchasing Managers’ Index (PMI) of India and Vietnam

Source: CEIC Data

The lack of orders will affect the Purchasing Managers’ Index (PMI), which is influenced by consumer orders, material prices, income, and employment in the economies. With central banks in the US and the EU increasing interest rates, orders from retailers have reduced, leading to a decline in manufacturing in the supplying nations. Examining the PMI of India and Vietnam, it can be observed that while India did not experience a significant fall in the PMI, Vietnam's PMI fluctuated between periods of contraction and expansion. Nations experiencing consistent periods of contraction and expansion face competitive pressure and subdued demand from their export markets.

Interest rates and their impact on exports

The higher interest rates maintained by the US Fed and the European Central Bank have significantly affected consumer spending. The Red Sea crisis in late 2023, which led to higher shipping costs, compounded this issue. As a result, there has been a massive reduction in overall spending, leading to a decrease in orders.

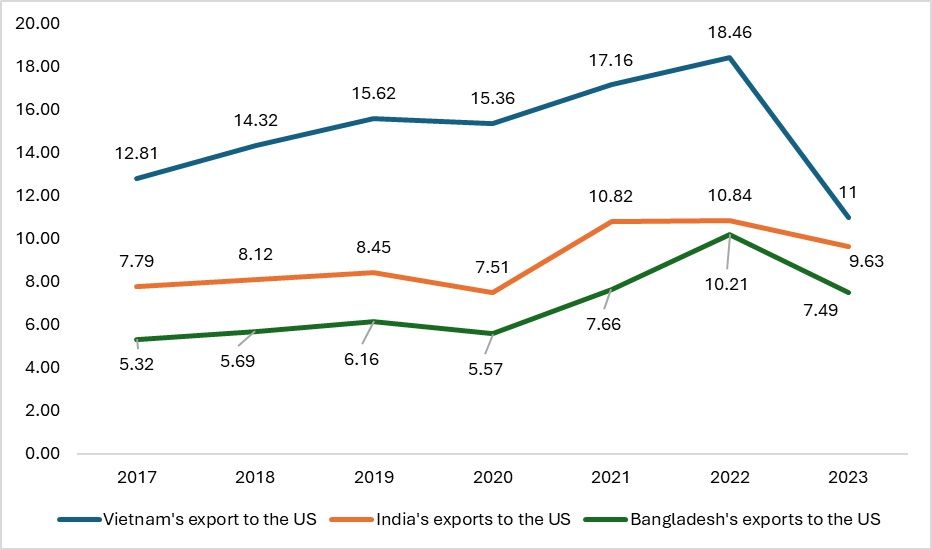

A correlation analysis revealed that exports to the US and the EU tend to decrease as interest rates in these regions rise. The data supported this trend, with some exceptions. In 2023, textile exports from India and Vietnam were particularly affected. Vietnam's exports to the US dropped by a staggering 40 per cent, while India's exports decreased by approximately 11 per cent. Bangladesh also saw a reduction of around 26 per cent in its exports to the US, not only due to the policy decision but also because of internal issues such as workers' protests and fuel pricing problems.

Therefore, the current reduction in textile exports from these nations is a result of both the increased policy rates in consumer countries and the economic crisis, which further exacerbated the decline in exports.

Figure 5: Vietnam, India and Bangladesh’s exports to the US (in $ bn)

Source: ITC Trade map

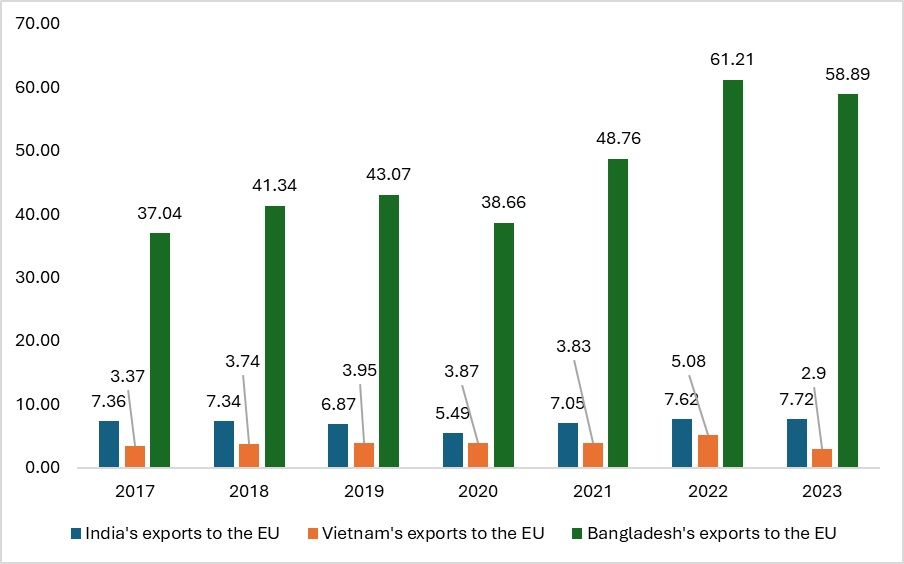

The situation, however, is reversed when it comes to exports to the EU. India's exports to the EU increased by around 1.3 per cent, in contrast to Vietnam's sharp decline of approximately 42 per cent and Bangladesh's drop of about 3 per cent. Despite an overall fall in India's textile exports, exports to the EU have risen.

The EU experienced a cost-of-living crisis in 2023 and faced fears of a recession throughout the year, yet consumer spending remained robust in major countries. This resilience in spending helped India’s textile exports increase marginally. According to a McKinsey report, many European consumers continued to spend on discretionary goods, which kept India's textile exports steady.

In contrast, Vietnam's exports to the EU suffered due to domestic issues such as electricity supply problems, geopolitical issues, war, and inflation-related challenges. These factors worsened the country's textile production, further dampening exports.

Bangladesh's exports to the EU were also affected, but the decline was less severe. One contributing factor could be the lower unit cost of Bangladeshi textiles and apparel, which benefit from the Generalised System of Preferences (GSP), allowing easier access to the EU market.

Figure 6: India, Vietnam and Bangladesh’s exports to the EU (in $ bn)

Source: ITC Trade map

As a result of these factors, the global share of textile exports from these countries has either remained the same or decreased. This trend is evident in the individual countries' performance as well. India’s share in the total textile imports of the US increased marginally to 8.8 per cent in 2023 from 8.6 per cent in 2022; whereas Vietnam’s share in the total textile imports of the US reduced marginally to 13.5 per cent in 2023 from 13.9 per cent in 2022.

The uncertain policy environment, coupled with high interest rates maintained by the US and EU central banks, has significantly impacted the textile industries in Asia. Reduced demand and additional uncertainties due to geopolitical tensions and wars have further exacerbated the challenges for producers, who were already struggling with the increasing uncertainty.

Although the increase in the interest rates has not affected the Asian economies on a macro level, the manufacturing of textiles and garments has been affected on a larger scale than expected due to the higher reliance of the countries on the US and EU markets for their textile exports.

Road Ahead:

With consumer nations like the EU and the US implementing policies to combat inflation and economic distress, textile-producing nations are affected as orders decrease. The current situation, combined with wars and geopolitical issues, has plunged textile-exporting nations into uncertainty, leading to higher costs, lower demand, and reduced manufacturing. Although this is a short-term impact, a prolonged period of high interest rates will affect these countries' economies, not only in terms of manufacturing and exports but also in terms of investments.

Higher interest rates in the US and the EU attract Foreign Portfolio Investors (FPI) to these regions, resulting in a withdrawal of investments from Asian countries. Therefore, with falling inflation in the EU and the US, it is expected that the planned rate reduction schedule will be followed. However, with ongoing wars and the surrounding uncertainty, the future remains unclear.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!