The fear of the United States undergoing a possible recession is widespread, leading to a major stock market crash and a rush among people to buy safer assets like US Treasuries. However, the current signs of a recession in the nation, along with rising unemployment, persistent inflation, and a stringent Federal Reserve (Fed), have raised questions about how long the US can sustain higher interest rates.

The context

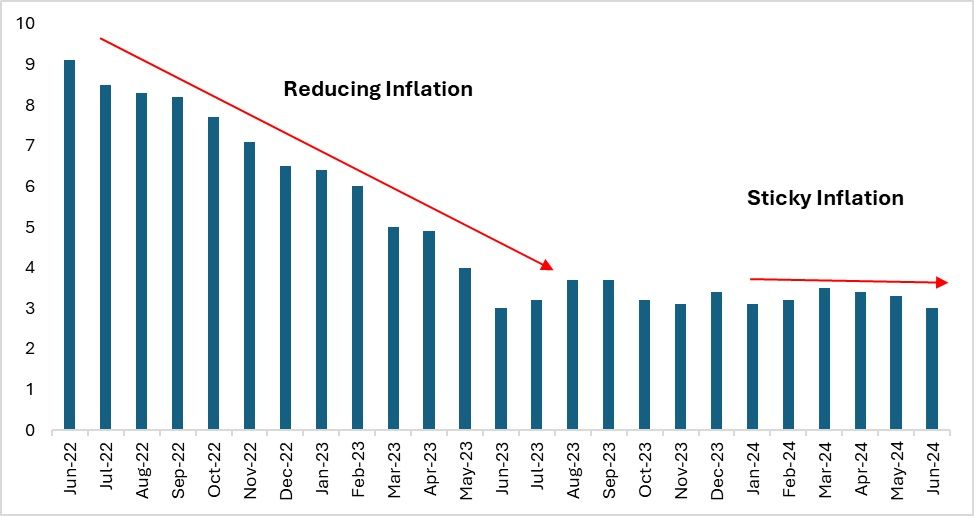

The question remains: while inflation in the country has significantly decreased since interest rates were raised to around 5 per cent in 2022, falling to 3 per cent in June 2023, how long can the US maintain these higher interest rates without adverse effects on the economy? Prolonged high interest rates could negatively impact the country's economic stability. The lag effect of these rates may cause the economy to buckle under the pressure. Higher interest rates typically lead to a reduction in consumer expenditure, a slowdown in the manufacturing sector, and eventually, a cycle of economic slowdown.

Figure 1: US inflation (in %)

Source: US Bureau of Labour Statistics

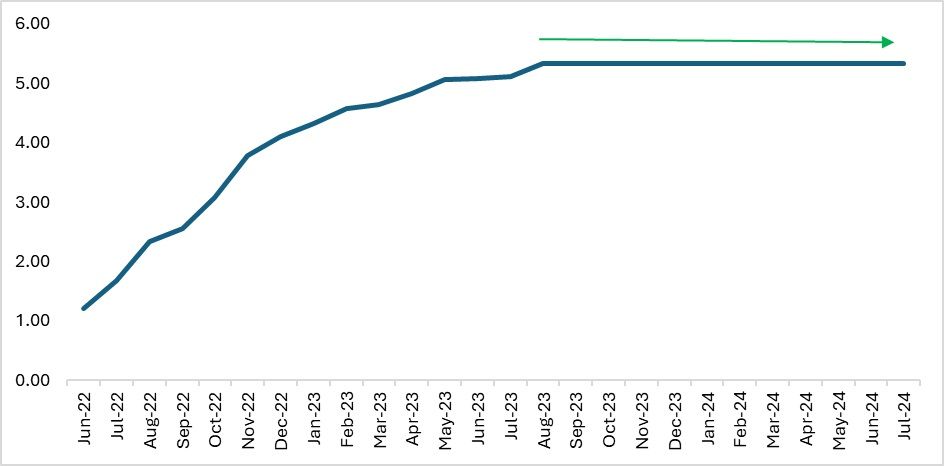

Inflation has finally reached 3 per cent after a prolonged period. However, considering the long-term costs to the US economy, the Fed must consider reducing interest rates before it is too late. Every policy decision has a lag effect, and it typically takes anywhere between 4 to 29 months for a monetary policy to fully take effect. While the FED’s decision to maintain higher interest rates may appear rational, given the current economic situation, there might be a need for the Fed to reassess their strategy. With interest rates remaining unchanged for almost a year, there must be a clear rationale behind this approach. However, as the US economy begins to show signs of contraction, it may be necessary to recalibrate the decision on whether to keep interest rates high or to lower them.

Figure 2: US interest rates (in %)

Source: US FRED

High interest rates and unemployment

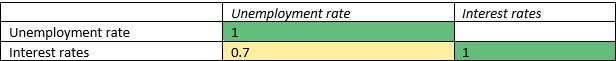

Higher interest rates affect not only businesses and manufacturing jobs but also impact consumers in terms of employment prospects. When interest rates are high, businesses are discouraged from borrowing, which in turn discourages expansion and reduces job creation. This has led to an increase in unemployment in the US economy. There is a positive correlation between interest rates and unemployment: the longer interest rates remain high; the more unemployment is likely to rise. A correlation coefficient greater than 0.5 indicates a strong correlation. Recently, the unemployment rate has increased from 4.1 per cent to 4.3 per cent, the highest level in three years. This increase has been attributed to the consistent maintenance of higher interest rates. If these rates are kept high for an extended period, layoffs may increase significantly.

Figure 3: Correlation matrix between inflation and unemployment in the US

Source: US Bureau of Labour Statistics, US FRED

With the US labour market showing signs of cooling and inflation reaching 3 per cent, closer to the central bank's target, consumer spending is now also beginning to slow. Increased consumer spending on discretionary items has been a key driving force for the US economy, keeping it resilient even amid ongoing global crises. However, there are now visible cracks in consumer spending patterns.

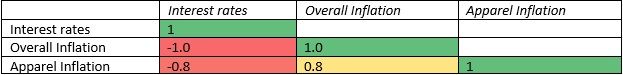

Interest rates have played a significant role so far, with inflation dropping from a high of 9 per cent in February to 3 per cent as of July 2022. Apparel inflation has also decreased to around 0.8 per cent, indicating easing prices in that sector and a potential increase in consumer spending. However, whether inflation will break through the 3 per cent barrier remains uncertain. This outcome largely depends on the Fed's decisions and how global situations, such as the conflicts in the Middle East and Russia, unfold. Fluctuations in oil prices could also impact the dollar, further influencing inflation dynamics.

Figure 4: Correlation between interest rates, inflation and apparel inflation in US

Source: US Bureau of Labour Statistics

US consumer spending tumbles

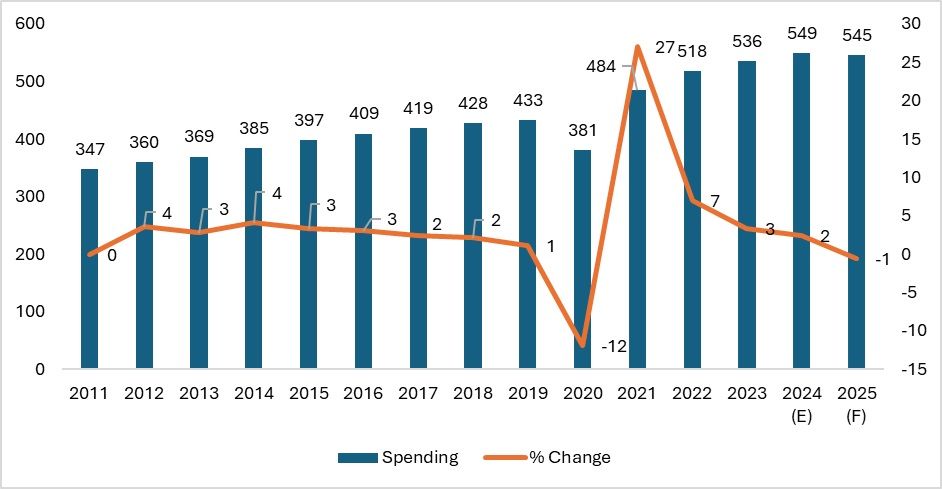

Although US consumer spending appears to be increasing when viewed on a graph, a closer examination reveals that this growth is actually diminishing on a yearly basis. The rate of growth in consumer spending is slowing down, with more and more consumers pulling back from discretionary expenses. In 2022, overall consumer spending increased by 7 per cent, but in 2023, the growth rate slowed to just 3 per cent. Estimates suggest that in 2024, consumer spending will see further diminished growth of only 2 per cent, with a potential decline expected in 2025 if current domestic and international conditions persist.

Figure 5: US consumer spending (in $ mn)

Source: US FRED

The Consumer Confidence Index in the US indicates a somewhat pessimistic outlook among consumers regarding the economy and inflation. While consumers are still spending, they are doing so cautiously, awaiting a decrease in interest rates. This cautious spending behaviour could lead to excess inventory in US retail stores, discouraging retailers from placing new orders. Such a scenario could create ripple effects throughout the manufacturing sector, potentially initiating a vicious cycle.

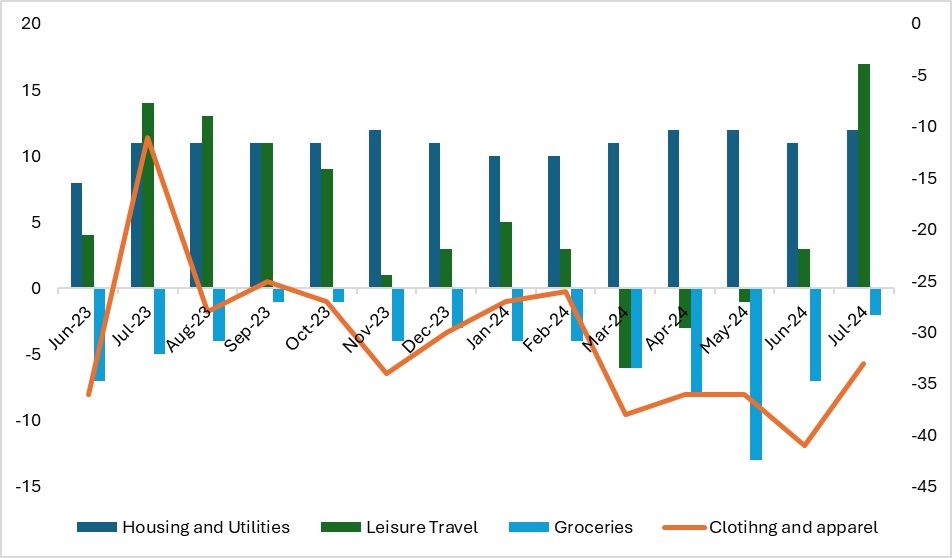

The recent Deloitte Consumer Spending Intent edition from July 2024 highlights these trends. While some categories, like household utilities and leisure travel, continue to show persistent growth, retail sales for apparel are experiencing significant fluctuations. Consumers are increasingly reluctant to spend on discretionary items such as clothing, concerts, and other non-essential goods, which could worsen as 2023 progresses.

However, in July, there was a slight recovery in consumer spending, particularly in discretionary categories like clothing, apparel, and leisure travel, which remained upbeat. The only consistent spending has been on groceries and household utilities. If interest rates remain unchanged, the risk of a reversal in consumer spending growth increases, potentially leading to an eventual decline in overall consumer spending.

Figure 6: Deloitte’s Consumer Spending Intent (% change)

Source: Deloitte

Manufacturing woes

The challenges extend beyond the consumer side to the production sector as well. The U.S. economy is showing signs of contraction, with the Purchasing Managers' Index (PMI) falling to an eight-month low. The manufacturing sector, which accounts for 10 per cent of the U.S. economy, is experiencing a downturn. A contracting PMI often signals underlying issues within the economy. Despite an increase in supplier deliveries, there has been a reduction in new orders, pointing towards an economic slowdown.

A contraction in the manufacturing sector also suggests a decrease in demand, with US manufacturers reluctant to increase production due to surplus inventory. Higher interest rates further exacerbate this reluctance, as slowing demand, declining profitability, and a negative outlook for the US economy and inflation contribute to the ongoing contraction in the PMI. This situation curtails manufacturers' willingness to expand their capacities, which, in turn, leads to fewer job creations.

In addition to the manufacturing sector, the tech sector has also seen significant layoffs. With the backbone of the US economy contracting and the services sector facing job cuts, consumer spending and demand may further contract in the coming months. Therefore, a decisive action is needed to prevent the economy's resilience from breaking and faltering.

Road ahead

The classic signs of a recession are typically interpreted through indicators such as falling manufacturing output, a reduction in the country's GDP, declining retail sales, and tumbling real incomes. If these conditions persist for two consecutive quarters, it is generally considered a confirmed sign of a recession. Consumer spending is expected to experience diminishing growth and potentially fall by 2025. However, with contracting manufacturing and reduced job creation, coupled with increased layoffs in the US economy, there is growing speculation that the country may slip into a recession if interest rates are not reduced in a timely manner. Prolonged high interest rates could produce effects opposite to those intended, exacerbating economic difficulties.

The US Fed faces a critical decision regarding the lowering of interest rates. Prolonged high rates have already led the manufacturing sector to postpone expansion plans, resulting in a lack of new job creation. Additionally, extended high interest rates can dampen consumer spending, reducing demand and potentially triggering a cycle of undesirable economic contraction. While the Federal Reserve has indicated a potential rate cut by September, there are concerns that this move might come too late to effectively stabilise the US economy.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!