The US economy has been grappling with higher interest rates since 2022, a strategy deployed by the Federal Reserve (FED) to combat rising inflation. After persistent hesitancy from the FED to cut rates due to inflationary pressures, interest rates have finally dropped. This marks a significant shift, as it's the first rate cut in nearly two years. The decision comes at a critical time when many consumers are burdened by debt and credit card repayments. While this action may provide some relief to the US economy, it must be carefully calibrated to prevent any potential shocks.

Success in reducing inflation to desirable levels

The primary objective of the US Fed in raising interest rates was to curb inflation, which surged following the COVID-19 pandemic and subsequent monetary injections. Supply chain disruptions, exacerbated by the Russia Ukraine war in the year 2022, followed by the rise in the gasoline prices; further contributed to inflationary pressures. These issues led to uncertainty in economic functioning and an overheated US economy. In response, the Fed progressively raised rates from 2022 to bring inflation under control.

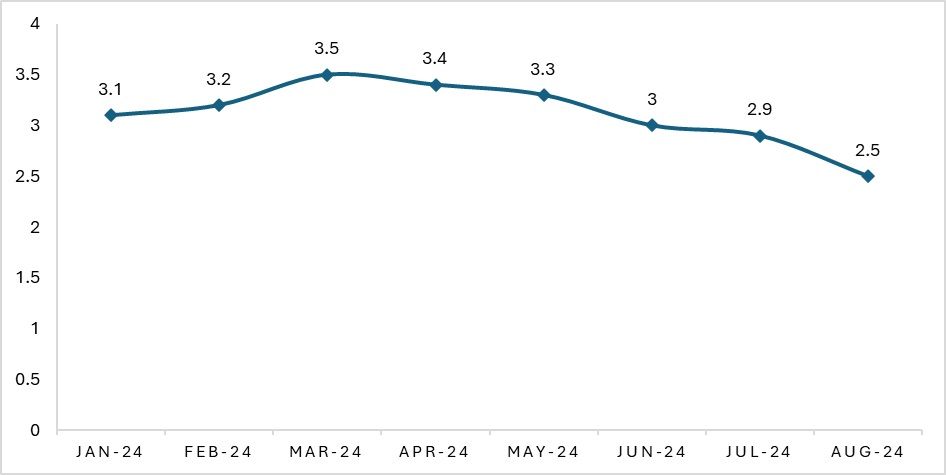

The increase in interest rates has affected textile businesses, prompting the government to reduce borrowing rates to facilitate expansion of the firms' operations. However, inflation is now as low as 2.5 per cent, closer to the US Federal Reserve's target of 2 per cent. The US, however, joined the effort later than other global central banks, such as those in the EU, Canada, New Zealand, and China. The current interest rates suggest that the Federal Reserve has achieved its target and is aiming to ensure that other factors in the economy are stabilising. The figures shown in the graph indicate that inflation is stabilising, suggesting the economy has cooled, making an interest rate cut imminent.

Exhibit 1: US inflation (in %)

Source: US Bureau of Labor Statistics

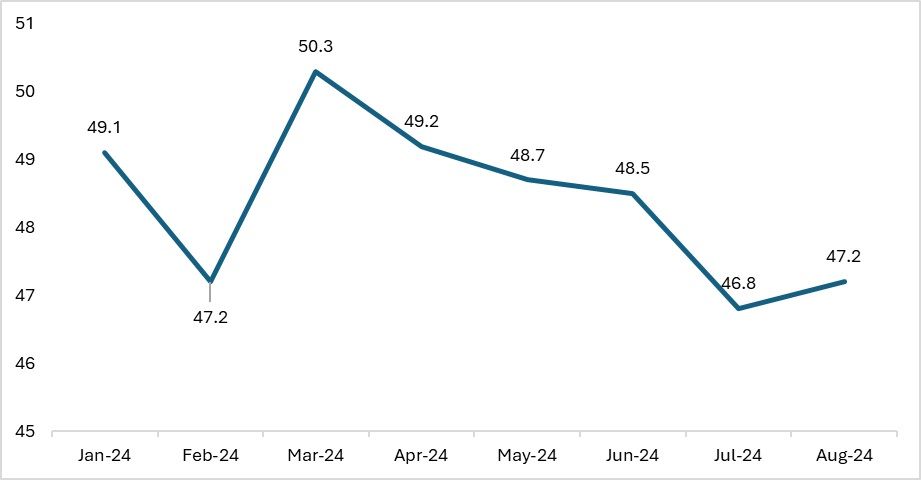

The Purchasing Managers Index (PMI), which often signals inflationary trends, also points to potential economic expansion with the recent interest rate drop. In August, the PMI increased by 0.8 per cent, reflecting higher demand and a possible recovery in the manufacturing sector. Although the PMI remains below 50, it has stayed above the critical 42-point threshold, which suggests the economy may expand further, albeit cautiously.

Exhibit 2: Purchasing Manager’s Index (PMI)

Source: Statista

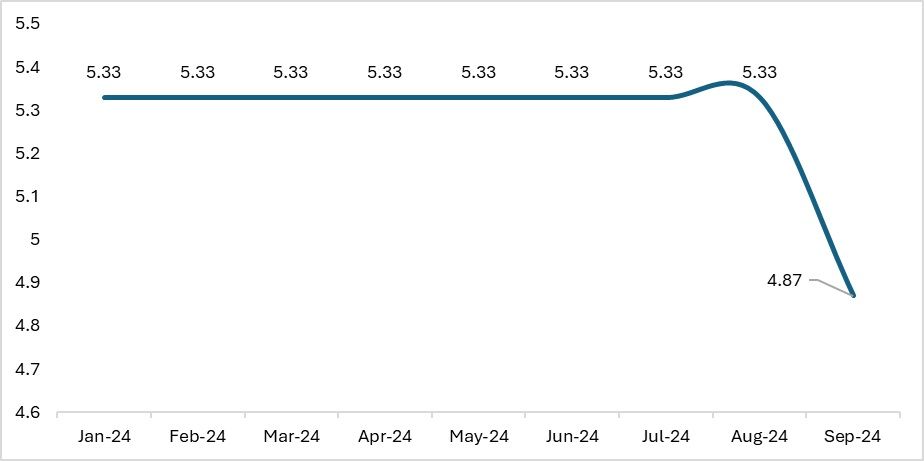

The recent lowering of interest rates by the Fed comes at a critical time, as the Fed seeks to balance controlling unemployment with managing inflation. Historically, interest rates have been reduced during significant crises, such as the global currency crisis, the dot-com bust, the real estate housing bubble, the 2008 financial crisis, and the COVID-19 pandemic. This raises questions about whether the current rate cuts indicate an impending economic downturn or reflect the Fed's success in managing inflation. While data shows that inflation has decreased, concerns persist regarding the potential impact on unemployment. The Fed's challenge now is to carefully navigate this balance to ensure a stable economic recovery.

Exhibit 3: Interest rates in the US (in %)

Source: US FRED

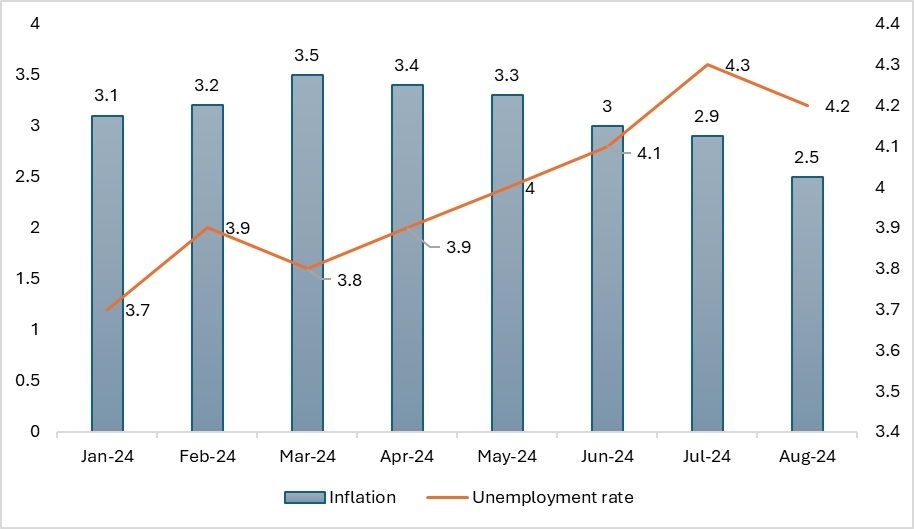

Inflation and unemployment dynamics

Inflation and unemployment traditionally share an inverse relationship: as inflation rises, unemployment tends to fall, and vice versa. With inflation now at more manageable levels, attention is shifting to the potential impact on unemployment. In 2023, the US labour market was notably tight, marked by high vacancy rates and low worker availability. This led to increased wages, which can further contribute to inflationary pressures. The Fed will need to carefully monitor wage growth to avoid reigniting inflation while maintaining healthy employment levels.

Exhibit 4: Relation between inflation and unemployment in US (in %)

Source: US Bureau of Labor Statistics

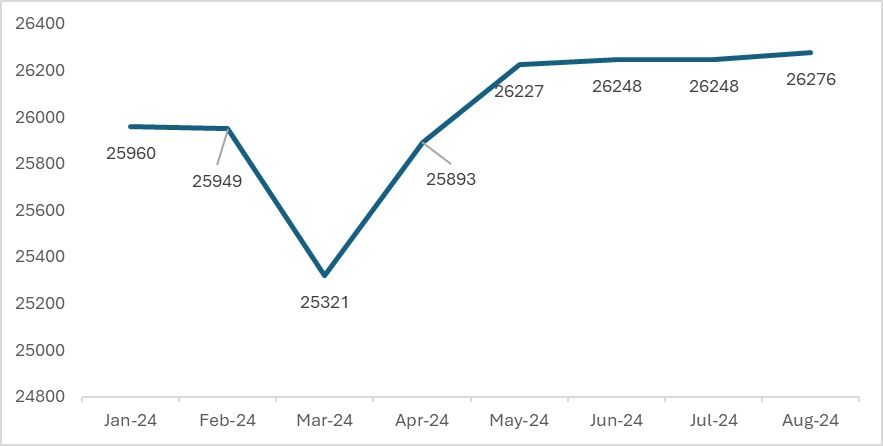

However, with the fall in inflation, there is now a potential rise in consumers' discretionary expenses. Retail spending remained strong even when interest rates were high, and with the recent unexpected drop-in rates, total outstanding dues may also decrease. According to recent statistics released by Forbes, the average credit card debt is 10 per cent higher than before; therefore, the current action by the Federal Reserve will provide some relief for consumers. This is also likely to lead to an increase in consumer retail spending. Although spending increased only marginally, it displayed a stable trend from May 2024 to August 2024.

Impact of falling interest rates on consumer spending in apparel and home textiles

The recent drop in interest rates is set to influence consumer spending patterns, particularly in the apparel sector. When interest rates rose, consumers quickly reduced their spending on clothing. However, with rates now projected to decrease further through 2025, spending on apparel and footwear is expected to rebound.

This shift is already evident in retail sales, which saw a sharp 2 per cent decline in March but recovered by the same margin from April to June. Factors such as lower unemployment and falling gasoline prices have also contributed to this recovery, allowing consumers to redirect their spending towards discretionary items.

As consumer confidence improves, reflecting a stronger belief in the US economy and policy decisions, increased spending is anticipated in the coming months, particularly from October onwards. This could lead to improved sales and revenue for US apparel retailers, who were previously affected by higher interest rates and reduced consumer spending.

Exhibit 5: Apparel sales in US (in $ mn)

Source: US Census Bureau

However, retailers will face challenges. The higher prices of apparel, driven by increased costs throughout the supply chain during the period of high interest rates, may need to be reassessed. With falling rates and rising demand on the horizon, retailers must decide whether to maintain current pricing or lower it to attract more consumers. Additionally, categories like home textiles could experience a surge in sales as consumers look to refresh their living spaces, buoyed by the improved economic outlook. Overall, while apparel is likely to benefit from renewed consumer spending, home textiles could emerge as another key area of growth.

Road ahead: Balancing inflation, unemployment and consumer confidence

The Fed’s primary goal of reducing inflation is nearly achieved, with inflation now down to 2.5 per cent. While the risk of recession seems to have lessened, concerns about unemployment remain a key focus for the Fed, especially as interest rates continue to fall. Although forecasts suggest ongoing economic growth, there are still potential risks that could reignite inflation, such as geopolitical tensions, the possibility of a trade war, and the outcomes of upcoming elections, all of which will influence US trade policy. Any shifts in policy could affect inflation and consumer preferences, potentially impacting the retail sector.

Currently, the economy is benefitting from the notable drop in interest rates. However, basic economic principles suggest it will take time for these lower rates to translate into increased sales and consumer spending. With rising consumer sentiment as a positive sign, there is hope that the elections will also support US economic growth without disrupting interest rates or the momentum in retail spending.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!