The November 2024 inflation figures for the US aligned closely with expectations, registering at 2.7 per cent, just marginally above the 2.6 per cent reported in October. While overall inflation remained steady, food prices rose by 2.4 per cent, marking a smaller increase compared to the broader inflation rate. This raises a critical question: Could this marginal rise disrupt the Federal Reserve’s (FED) progress in controlling inflation and potentially delay its anticipated rate cut schedule?

There are specific trends and observations relating to the US economy:

The trends and observations regarding the US economy warrant consideration:

(1). Stability in core inflation: The relatively small rise in inflation suggests the Federal Reserve’s measures are yielding results, though vigilance is required to prevent further upticks. (2). Divergence in sectoral inflation: The slower rise in food prices compared to overall inflation reflects uneven price movements across sectors, signalling potential shifts in consumer spending patterns and (3). Impact on rate cut expectations: Markets may recalibrate their expectations depending on how the Federal Reserve interprets these figures, particularly in the context of broader economic growth and employment trends.

The trends in inflation

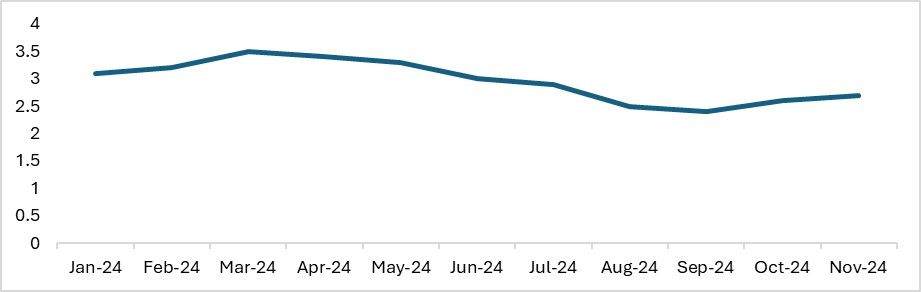

The rise in the prices of used cars, hotel rooms, groceries, and inflation fuelled the rise in inflation. The current increase of around 0.3 per cent is the highest growth since April 2024. Although the inflation has not reached the target of 2 per cent, the inflation is still at levels healthy for the US economy to sustain, thus the question of a rate cut reversal seems unlikely. However, the inflation in the US still stays sticky with the rates staying at the same range for more than 4 months; thus, indicating that the monetary policy decisions are experiencing longer lags in reducing inflation. However, the conditions in the US are way too different than those in Türkiye where the inflation is soaring high, triggering cycles of reduced consumption.

The US inflation rose by 3.4 per cent and now is in a trend as it was before June, where the inflation was rising and falling but was in the range of 3.1 to 3.5 per cent. However, the current rate is close yet far from the US FED target of 2 per cent.

Exhibit 1: US inflation (in %)

Source: US Bureau of Labour Statistics (BLS)

The US FED has cut rate by further 50 basis points (bps) (November and December together) after cutting the rates by 50 bps in September and further by 25 bps in October. With the current inflation increase in November, the main concern here will be how the retail sector is reacting to the increase in inflation. The retail sector will be marginally affected as inflation is increasing but the increase in wages has been stagnant and lower than the per cent change in the inflation in the country. However, with the inflation lowering, there will be higher real income with the consumers, thus giving them the freedom to spend more on discretionary goods like apparel. And that is reflected in the retail index as well.

Apparel retail and inflation

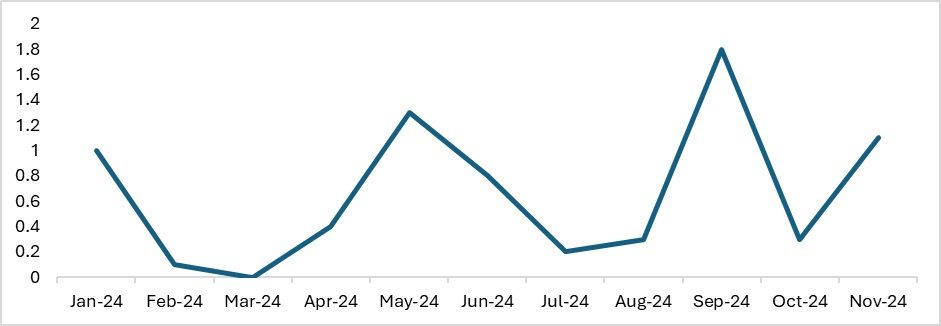

The apparel inflation is as of now moving in the opposite direction of the actual inflation. With the inflation cooling down, consumers are encouraged to buy more discretionary products thus leading to a demand push inflation. And with higher inflation, there is a cost-push inflation in the country for apparel.

Exhibit 2: The inflation in apparel (in %)

Source: US Bureau of Labour Statistics (BLS)

The US apparel inflation has undergone significant changes with fluctuating inflation. Both cost-push and demand-pull inflation are observed. With the Trump Administration scheduled to take office on January 20, 2025, more encouragement to local manufacturing is expected, which would have a mixed impact on the US apparel retail industry, which also relies on imported materials to produce and source apparel.

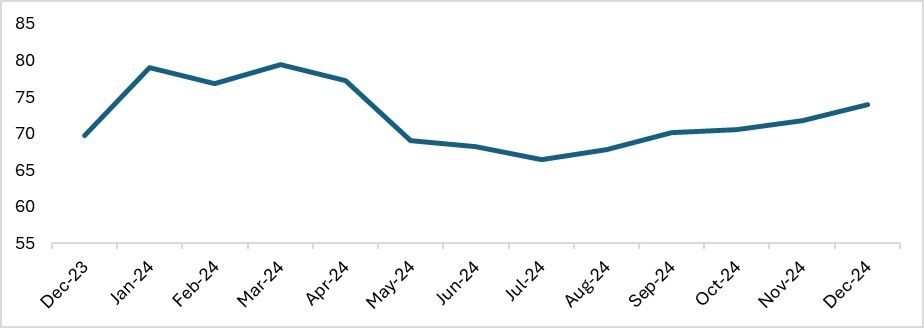

Exhibit 3: Consumer Confidence Index

Source: University of Michigan Survey of Consumers

The increase in apparel prices will be decided based on whether consumer confidence has increased or is a mere increase in the input costs. In the US, however, inflation is now falling, which is a positive result of the policies of the FED. The positive rise in apparel inflation with the fall in total inflation indicates a possible price rise led by higher consumer demand. The Consumer Confidence Index has increased in November and is projected to increase in December. With the consumer confidence index increasing consistently there are more hopes of consumer spending staying robust and inflation will less likely impact the FED decision to reduce the interest rates. If the consumer confidence stays upbeat and the inflation continues its gradual fall; the current rate of sticky inflation will not affect the US economy or the decision of the FED.

The state of the US retail

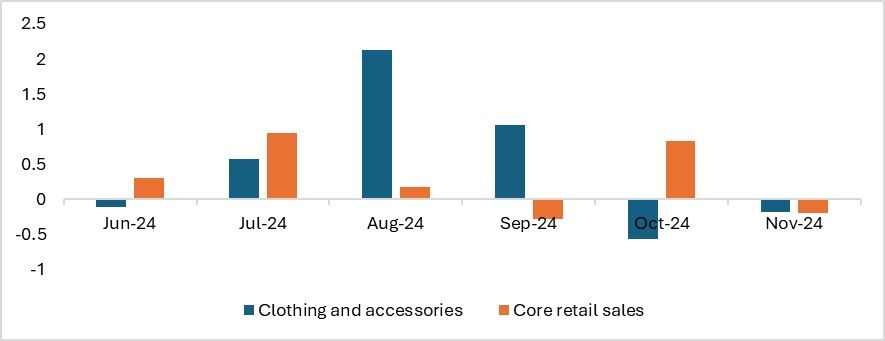

The US retail data which was released in the month of October showed a minor fall in the retail sector in the sales of clothing and accessories in the US. In the month of October, retail sales fell by 0.58 per cent, and recovered, where retail sales fell by -0.18 per cent. With inflation falling and higher purchasing power in the hands of US consumers, there are higher chances that consumers will demand more apparel.

With the winter season in focus, there will be a higher demand for jackets and other winter wear which can also drive sales. With Christmas being celebrated during the month, there are higher chances that the clothing retail will jump for December. The same trend was observed last year when the offline and online retail sales of clothing and apparel increased by 8 per cent to $276 billion. Therefore, retail sales are expected to pick up during the holiday season.

Exhibit 4: The retail sales index (in %)

Source: National Retail Foundation (NRF)

There are expectations for retail sales to increase during the holiday season. According to the National Retail Foundation (NRF), the holiday season sales will increase by 3 per cent. This can further boost inflation in apparel. With the predicted consumer confidence index for the month of December increasing, there can be a possibility of retail inflation increasing as well.

Way ahead

Currently, the US inflation has increased, but it is not threatening the economy in a way that it forces the FED to change its course of change in the interest rates. If the FED sticks to its decision and reduces the interest rate, then the retail sales of the country may also increase. The US retail sector has been struggling with lower sales realisation and increased costs for the last two years, from which it is now recovering.

The inflation in the country is reducing although it is following patterns of sticky wages and slower wage growth. This does not mean that the US economy is struggling. In fact, the country is experiencing a phase where the higher interest rates and the following phase of the reduction in the interest rates are playing a role in influencing various aspects of the economy, including retail sales. Stronger consumer sentiment is also reflecting the confidence of US consumers in the US economy and the policies of the FED. Thus, the current inflation will not be worrisome for US consumers, policymakers as well as stakeholders in the textile-apparel industry.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!