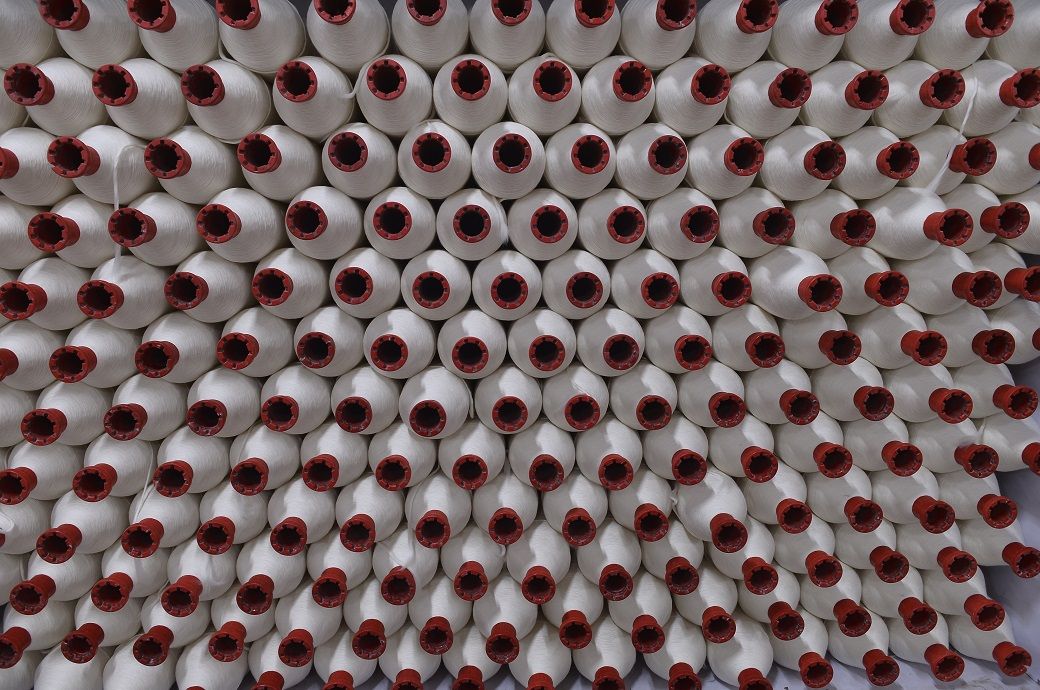

In Mumbai, prices for 60 count cotton yarn varieties declined due to weak demand and price reductions by spinning mills. Prices dropped by ₹2–3 per kg as mills cut their rates amid subdued demand. A trader from Mumbai told Fibre2Fashion, “Power looms and auto looms are facing an acute shortage of workers, which has reduced cotton yarn consumption over the past 2–3 weeks. Consumption may remain low until the first week of next month, when labourers are expected to return from their native places.”

In Mumbai, 60 carded yarn of warp and weft varieties were traded at ₹1,400-1,430 (approximately $16.58-16.93) and ₹1,340-1,390 per 5 kg (approximately $15.87-16.46) (excluding GST), respectively. Other prices include 60 combed warp at ₹319-323 (approximately $3.78-3.82) per kg, 80 carded weft at ₹1,400-1,460 (approximately $16.58-17.29) per 4.5 kg, 44/46 carded warp at ₹270-275 (approximately $3.20-3.26) per kg, 40/41 carded warp at ₹255-262 (approximately $3.02-3.10) per kg and 40/41 combed warp at ₹272-275 (approximately $3.22-3.26) per kg, according to trade sources.

The Tiruppur market also experienced weaker demand for cotton yarn, though prices remained largely unchanged in recent days. Tight payment conditions have hurt buying capacity in the region. Trade sources noted that payment issues are a bigger concern than labour shortages in Tiruppur. Weak export demand has further dampened market sentiment. Mills are shipping yarn to Bangladesh via sea routes but are exercising caution regarding payment before shipment. Bangladeshi importers are reportedly facing difficulties in processing payments through banks to Indian suppliers.

In Tiruppur, knitting cotton yarn prices were noted as 30 count combed cotton yarn at ₹257-265 (approximately $3.04-3.14) per kg (excluding GST), 34 count combed cotton yarn at ₹266-273 (approximately $3.15-3.23) per kg, 40 count combed cotton yarn at ₹278-291 (approximately $3.29-3.45) per kg, 30 count carded cotton yarn at ₹237-242 (approximately $2.81-2.87) per kg, 34 count carded cotton yarn at ₹242-247 (approximately $2.87-2.92) per kg and 40 count carded cotton yarn at ₹250-255 (approximately $2.96-3.02) per kg.

In Gujarat, cotton trade remained limited, with prices holding steady. Spinning mills are sourcing cotton from the Cotton Corporation of India (CCI), slowing private trade of the natural fibre. Trade sources said that private traders and ginners are reluctant to sell at current prices while CCI continues to meet the industry’s demand. They are expected to release their stocks only after CCI’s inventory begins to deplete and prices start to rise.

Cotton arrivals were estimated at 5,000–6,000 bales of 170 kg in Gujarat and 40,000–43,000 bales across the country. The benchmark Shankar-6 cotton was quoted at ₹54,000–54,500 (approximately $639.39–645.31) per candy of 356 kg, while southern mills were bidding ₹55,000–55,200 (approximately $651.23–653.60) per candy.

ALCHEMPro News Desk (KUL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!