Women are facing a significant price disparity when purchasing commodities, with costs being 15 to 20 per cent higher compared to similar products for men. A comprehensive study conducted by the United States International Trade Commission (USITC) highlights this issue, showing that women’s clothing is priced 13 per cent higher on average than men's clothing. This phenomenon, commonly known as 'pink tax', refers to the additional cost added to goods and services specifically marketed towards women.

Differential tariff on apparel

The pink tax already applies to essential personal care items, such as sanitary napkins. The import duty on women's final products is significantly higher, consequently raising the average price of these commodities. This is the case in nearly all countries worldwide, with exceptions like Australia, Japan, Europe, and Canada, where pink taxation is not applied. As one of the major importers of apparel, the US' imposition of such differential rates on apparel raises a lot of eyebrows.

US and the application of pink taxation

A recent report from the Progressive Policy Institute highlighted a notable disparity in the pricing of women's apparel in the US. As of 2017, there was a 1 to 4 per cent difference in the average taxes across four major categories for both genders. Although this gap has narrowed due to an increase in import tariffs on men's apparel, a difference still exists. Furthermore, specific non-ad-valorem taxes, which are higher for women's apparel imports, continue to place an additional financial burden on consumers.

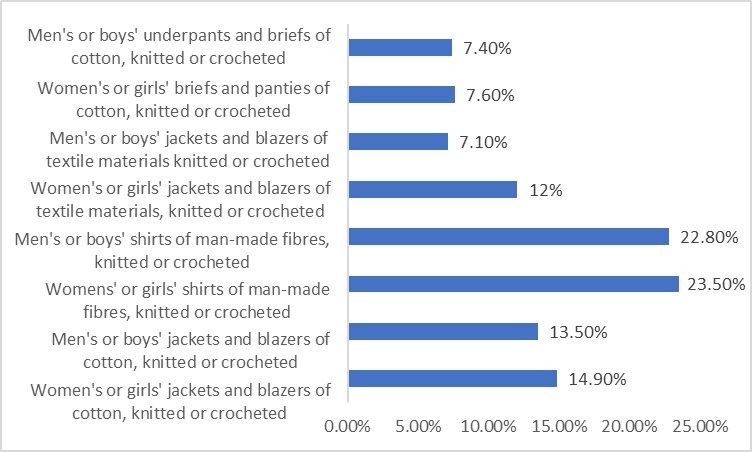

Figure 1: Import tariffs on apparel for men and women in the US

Source: USITC

Wage gap

An average woman earns less compared to a man, so an additional tax exacerbates the financial pressure on women. Wage disparity is also significant in many countries. For instance, in India, male workers earn 24 per cent more than their female counterparts, as reported by Deloitte's Women @ Work 2023 report. In the US, the pay gap is approximately 14 per cent. According to the Pew Research Centre, women earn only 84 cents for every dollar earned by men. The International Labour Organization (ILO) reports that globally, men earn 20 per cent more than women.

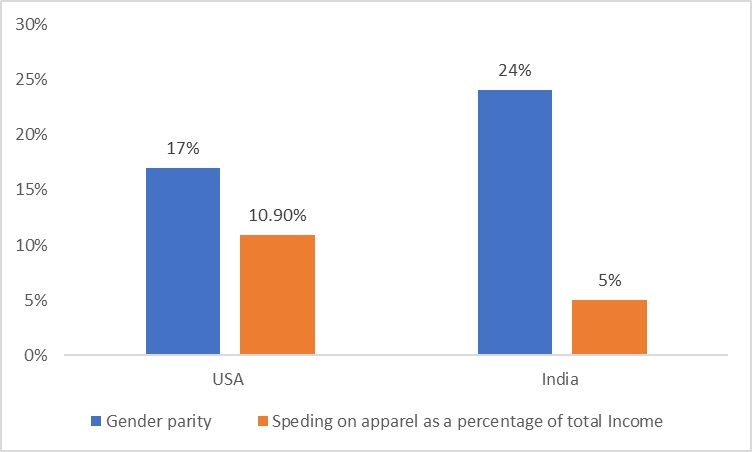

Figure 2: Gender parity and spending on apparel in India and US

Source: PEW Research and International Labour Organisation (ILO)

Pay gap and the Tariff gap:

The limited purchasing power of women, linked to lower wages, is further impacted by increased tariffs, leading to higher prices for commodities. In the United States, as imports surge amidst ongoing economic uncertainty and the effects of conflicts, the implementation of a disparate tax system emerges as a significant concern. Figure 2 demonstrates the wage disparity between men and women, correlating it with expenditure on apparel as a percentage of total income. On average, citizens allocate nearly 11 per cent of their budget to apparel, while the gender pay gap stands at 17 per cent. In contrast, in India, where the pay gap is a more substantial 24 per cent, expenditure on apparel is relatively lower at 5 per cent. Despite these differences in spending patterns and wage disparities, both countries show an increasing consumer demand, highlighting the need for policies to mitigate the effects of ‘pink taxation’. While the issue of higher tariffs on women-targeted products is recognised, the specific rationale for these elevated tariffs remain unclear.

Fundamentally, it boils down to basic economic principles. An elevated tax not only translates to an increased financial burden on consumers but also results in diminished purchasing power. The stark reality of women being consistently underpaid and compelled to allocate a greater portion of their income towards essentials such as apparel has been underscored in numerous research papers and annual progress reports. However, despite this awareness, a concrete explanation for the higher tariffs imposed on products targeted at women is yet to be elucidated.

The policy

With this unique case of gender-based differential tariff imposition on apparel in the US, several states have implemented laws to ensure a reduction in discrimination. In June 2023, California introduced a law prohibiting businesses from increasing the prices of the same goods for different genders. This makes it the second state, after New York, to implement laws to stop pink taxation. Although some states have introduced such laws, there has been no federal policy to address this issue. A bill was proposed in 2021, but it has not yet passed in Congress.

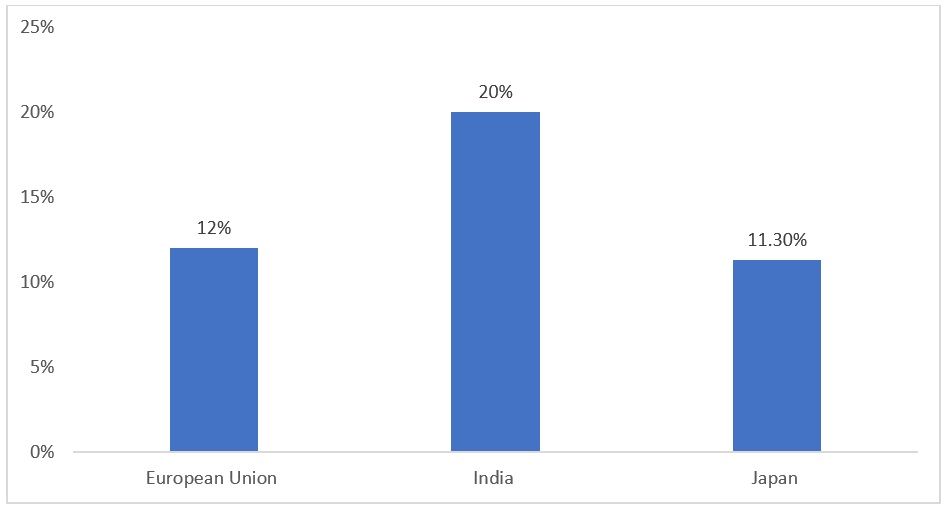

Figure 3: Import tariff on apparel in different regions:

Source: World Trade Organisation database (WTO)

Global scenario and the road ahead:

Globally, only four countries do not apply a pink tax: Australia, Japan, Europe, and Canada. According to data from the World Bank, Europe has a more linear tax structure, with a 12 per cent tariff on all apparel. Similarly, Japan's tariff ranges from 7 to 10 per cent, depending on the style of the apparel. India, on the other hand, applies a standard rate of 20 per cent to all categories of the aforementioned apparel imports, thus eliminating the possibility of pricing according to gender.

Although the discriminatory tariff might not affect consumption in the short term, as studies released by the USITC show, the current tariff structure could lead to economic inequality between genders, potentially affecting retail sales in the long run. Therefore, a uniform, gender-neutral tax might be the solution.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!