The Asia-Pacific (APAC) region is recognised as the fastest-growing textile market globally, driven by rapid industrialisation in emerging economies like China and India. China continues to dominate the global textile market, leading in both production and exports. In the first quarter of 2023 alone, the region's garment exports totalled $13.69 billion, with China maintaining its strong position in global apparel exports. Bangladesh, Vietnam, and India are also critical players, leveraging their competitive manufacturing capabilities and cost advantages.

Southeast Asian countries such as Cambodia, Indonesia, and Vietnam have emerged as vital manufacturing hubs, attracting investments from international apparel brands seeking cost-effective production facilities due to their low labour costs and favourable government policies.

In the Middle East, the textile industry is experiencing substantial growth, driven by rising demand for luxury fashion items among affluent consumers in the region. Meanwhile, in Africa, countries like Ethiopia and Ghana show significant potential for textile sector expansion, supported by abundant raw materials such as cotton and supportive government policies.

The Americas have also seen steady growth in the textile market in recent years, with the United States playing a key role in this expansion. Technological advancements, such as smart textiles and digital printing, have significantly contributed to the industry's development. Additionally, the increasing popularity of e-commerce platforms in North America has boosted textile sales by offering consumers greater convenience and accessibility. Brazil and Peru are emerging as key players in textile production in South America, driven by rising global demand for eco-friendly and organic textile products.

In Europe, the textile market has been expanding at a moderate pace, largely due to shifting consumer preferences towards sustainable and high-quality products. European Union regulations promoting eco-friendly practices have spurred innovations, including the development of bio-textiles made from renewable resources or recycled materials.

This article offers an analytical perspective on the global apparel export landscape for 2023, focusing on leading apparel-exporting nations. It explores the factors influencing their export performance, providing valuable insights into market dynamics, competitive landscapes, and emerging trends. The analysis highlights export patterns, regional dynamics, and the Environmental, Social, and Governance (ESG) rankings of top exporting countries.

Table 1. Period-wise apparel growth trends and insights

Source: F2F Analysis

Top Apparel Exporting Countries in 2023

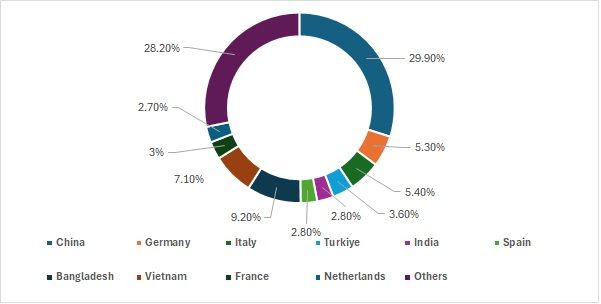

In 2023, Asia, particularly China, Bangladesh, India, Vietnam, and Türkiye, continues to lead the way in apparel exports. These nations not only possess robust manufacturing capabilities but also demonstrate a remarkable ability to innovate and adapt to evolving market demands. Alongside these Asian powerhouses, significant contributors from other regions, including the US, Germany, and Italy, have also emerged as key exporters, capitalising on their strengths in high-quality production and design.

This analysis delves into the export values of these key countries, providing a comprehensive overview of their performance in the global textile and apparel sector. It highlights how these top exporters are navigating the complexities of the current market, characterised by post-pandemic recovery, rising sustainability concerns, and the transformative impact of e-commerce and digital platforms, in addition to geopolitical challenges.

Understanding the dynamics of these leading apparel-exporting nations offers valuable insights into the industry’s recovery trajectory and strategic direction within an increasingly competitive global environment.

Exhibit 1: Share of top apparel and textile exporting countries in global exports for CY 2023 (in %)

Source: ITC Trade Map, Statista, F2F Analysis

Key insights from apparel export-import analysis

The global apparel export industry in 2023-24 is shaped by various factors, including regional dynamics, geopolitical events, and changing consumer demands. Countries such as China, Bangladesh, India, Vietnam, and Türkiye have emerged as leading exporters due to their strong manufacturing capabilities, competitive costs, and adaptability to market changes. The textile and apparel industry has demonstrated remarkable resilience, with export data indicating a robust recovery from the pandemic-related disruptions. Major exporters like China, Bangladesh, and Vietnam have regained momentum, reflecting their strategic adaptations and competitive advantages.

Regional Competitive Edge: Asian countries dominate the export landscape, leveraging cost efficiencies and manufacturing prowess. In contrast, European countries maintain a niche in high-quality, design-centric apparel, underscoring their unique market positioning.

Key challenges faced by leading apparel exporting nations

Geopolitical Instability: The Russia-Ukraine conflict and tensions in the Middle East disrupt trade routes and increase costs.

The Russia-Ukraine conflict has had a substantial impact on global trade. According to the World Trade Organization, the conflict has disrupted supply chains, particularly in Eastern Europe, leading to increased logistical costs and delays. This disruption has been exacerbated by sanctions and trade restrictions imposed on Russia, further complicating the movement of goods.

Raw material availability: The Russia-Ukraine war has also significantly impacted the availability of raw materials. Ukraine, a major exporter of raw materials like wool and certain synthetic fibres, has drastically reduced its export capacity. According to the International Trade Centre, wool exports from Ukraine decreased by 30 per cent in 2023 due to the ongoing conflict, affecting global supply chains.

Additionally, sanctions on Russia have limited the export of petrochemical products essential for synthetic fibre production, further straining the availability of raw materials. This has forced manufacturers to seek alternative sources, often at higher costs, affecting the overall cost structure of apparel production.

Tensions in the Middle East, including the Hamas-Israel conflict, have also affected trade routes. The Suez Canal, a critical artery for global maritime trade, has seen increased security risks and insurance premiums, impacting shipping costs and transit times. The Red Sea region, another vital trade corridor, faces similar challenges, increasing uncertainty for exporters.

Economic pressures

Inflation and rising costs: Global inflation has increased the cost of raw materials, labour, and transportation. Countries such as Bangladesh and Vietnam, which rely heavily on low-cost production, are facing squeezed profit margins and pressure to raise wages.

Lack of transparency and traceability

The textile industry's complexity has exacerbated issues related to transparency and traceability. The absence of effective tracking mechanisms has led to concerns about counterfeit products, unethical labour practices, and environmental damage.

Countries like India and Vietnam are pressured to enhance supply chain transparency to meet increasing consumer demands for ethical and sustainable products.

Divergence in ESG

The ESG rankings reveal a significant disparity among top apparel-exporting countries. This divergence emphasises the growing need for apparel-exporting countries to enhance their commitment to sustainability and ethical governance, as consumer expectations shift towards environmentally and socially responsible practices.

Countries with lower rankings, such as Bangladesh, India, and Cambodia, face considerable challenges in adopting comprehensive ESG frameworks.

Fibre2fashion News Desk (NS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!