Bangladesh, renowned as the second largest exporter of readymade garments (RMG) globally, trailing only behind China, is currently grappling with significant challenges in its textile sector. The sector is currently battling the dual pressures of rising gas prices and inflation. Worker protests over conditions and pay are adding to the industry's woes. The industry is also suffering from a natural gas shortage, exacerbating production challenges.

The country's garment industry, pivotal to its economic growth, attracts major brands like H&M, Levis, GAP, and Zara, thanks to its cost-effective labour. This has made textiles a cornerstone of Bangladesh's economic success. As per the Export Promotion Bureau, garments constitute 83 per cent of Bangladesh's total exports as of 2022.

From April onwards, there's been a noticeable decline in exports, attributed to weakened global demand. This downturn is partly due to higher interest rates in advanced economies, aimed at curbing inflation, which in turn affects the demand for Bangladeshi exports.

Recent protests and resulting property damage are further complicating matters, potentially diminishing Bangladesh's reputation as a reliable export hub. This could have significant implications, given the substantial foreign direct investment (FDI) the country receives for its RMG sector.

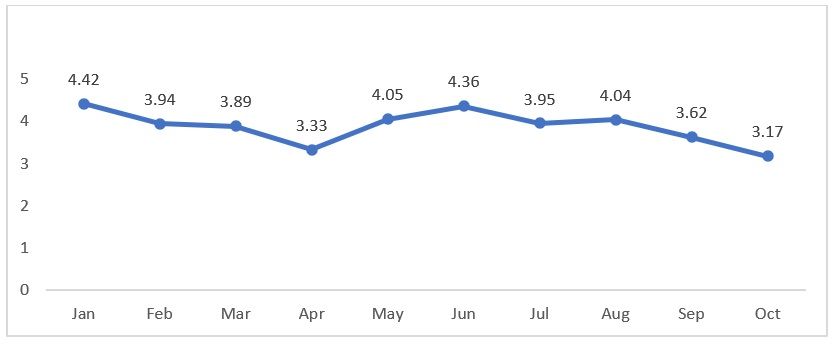

Figure 1: Bangladesh’s RMG exports in 2023

Source: Export Promotion Bureau

RMG exports from Bangladesh have been declining since June, as per the Export Promotion Bureau (EPB). In the latest figures, exports fell to a low of $3.17 billion, a 15 per cent decrease from the previous month. This represents a substantial 37 per cent drop compared to the same month last year. These factors are contributing to 2023 being a challenging year for Bangladesh's apparel exports. Moreover, the recent labour strike highlights social, economic, and political shortcomings in Bangladesh, which, if not addressed promptly, could significantly impact the textile industry.

Workers and Wage Economics

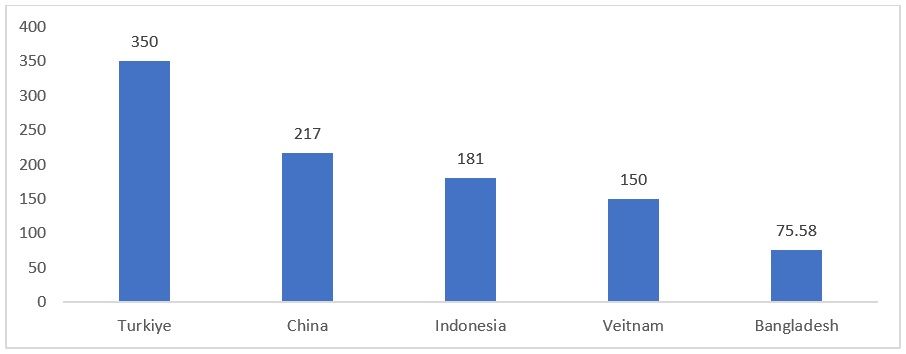

It is alarming to observe the substantial contrast in the monthly wages of the world's two leading garment exporters. China, holding the top spot, compensates its workers with a salary of $217, while Bangladesh, trailing significantly, pays a meagre $75.75 per month. Despite differing production methods between the two countries, the wage gap is striking, reaching a staggering 188 per cent. Bangladesh offers the lowest wages among all RMG producers, highlighting a significant disparity in compensation within the global garment industry. According to a World Bank report, Bangladesh could take over the market as other markets seek to diversify their production bases, reducing reliance on China. However, Bangladesh could only benefit if it solves the current issue along with the gas shortage; otherwise, other countries may overtake it as the second-largest apparel producer.

Figure 2: Wages per month in different garment-producing nations

Source: Centre for Policy Dialogue

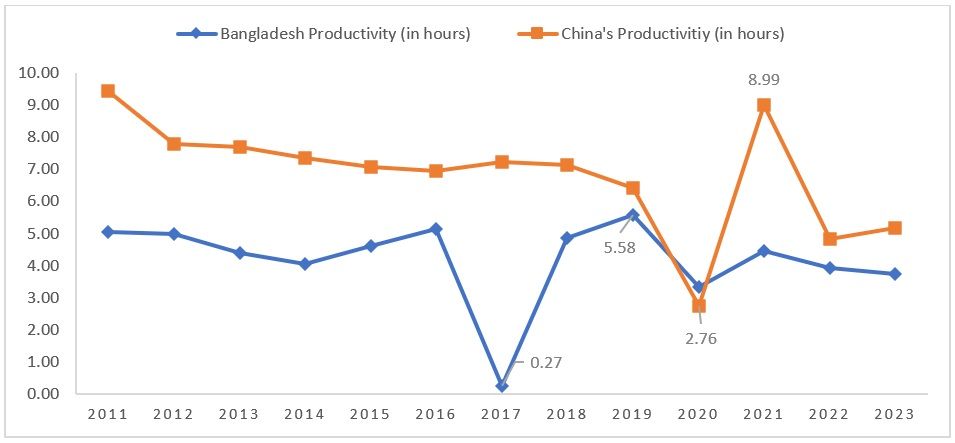

The current situation in Bangladesh highlights the issue of subsistence wages and their impact on labour productivity, which could potentially reduce the sector's output and lead to a decline in exports. Amidst ongoing policy debates about the relationship between minimum wages and productivity, a study by Kellogg University revealed that labour productivity rises with an increase in minimum wages. This finding is particularly relevant to Bangladesh's current challenge. A suitable hike in the minimum wage would not only positively affect production but also enhance the country's ability to capitalise on markets accessible through Free Trade Agreements or other preferential arrangements.

Figure 3: Labour Productivity in Bangladesh and China (in hours)

Source: CEIC Database

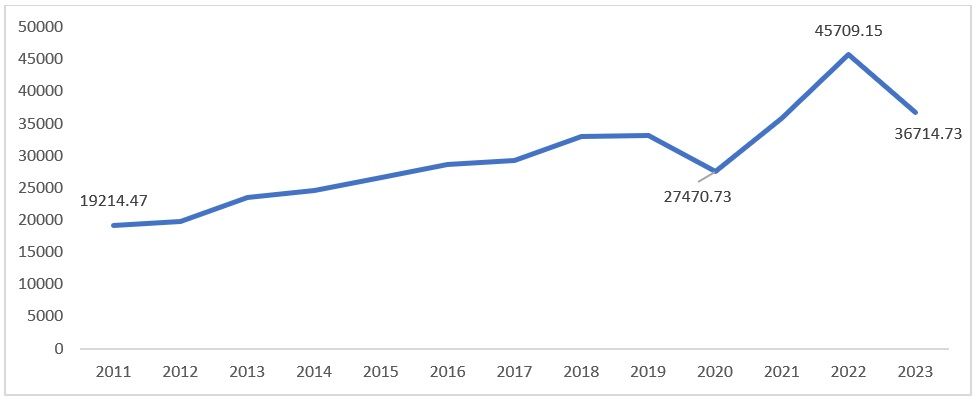

Figure 4: Bangladesh’s RMG exports from 2011-2023

Source: Bangladesh Garment Manufacturers and Exporters Association

As protests intensify in the country and factories shut down, production is set to grind to a halt. This will impact not only Bangladesh but also its major markets such as the United States of America, Europe, and Asian countries. Additionally, countries like Benin and those in Africa, which supply raw cotton for apparel production, will be affected. According to Fibre2Fashion’s market insight tool TexPro, exports are estimated to decrease to $36,714.73 million. The ongoing issue, marked by closed factories and halted production, will strain supply if it continues for an extended period.

Competitive Advantage or Fortunes Reversing?

The refusal to pay labour adequate wages raises questions: Was this advantage artificially created through lower wages, and if so, at what cost? The country has already breached labour laws concerning workplace provisions and wages. There is a fear that the country should not become the next Xinjiang, prompting the textile industry to impose a ban.

With the country set to lose its status as a least developed country (LDC) in 2026, granted under the Generalised System of Preferences, it must ensure higher operational efficiency, increased mechanisation, and address the issue of fair wages. After 2026, changes will occur not only in tariff structures but also in more qualitative aspects like workplace regulations, labour rights and wages, and sustainability in production and sourcing. Failure in any of these areas could diminish competitiveness, either through imposed tariffs or bans for non-compliance with basic laws. Thus, the current protests are a wake-up call for the country to address these long-ignored issues before it exits its protective bubble.

ALCHEMPro News Desk (MI WE)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!