Global merchandise trade volumes and values were showing modest signs of recovery since late 2019 when the global economy was hit by the measures taken to contain the COVID-19 pandemic. United Nations Conference on Trade and Development (UNCTAD) nowcasts for global trade values point to a fall of 3.0 per cent in the first quarter of 2020 with respect to the previous quarter.

"Most of the impact of these measures, however, will affect global trade in the second quarter of the year, with an estimated quarter-on-quarter decline of 26.9 per cent," says the report released by UNCTAD's Committee for the Coordination of Statistical Activities (CCSA).

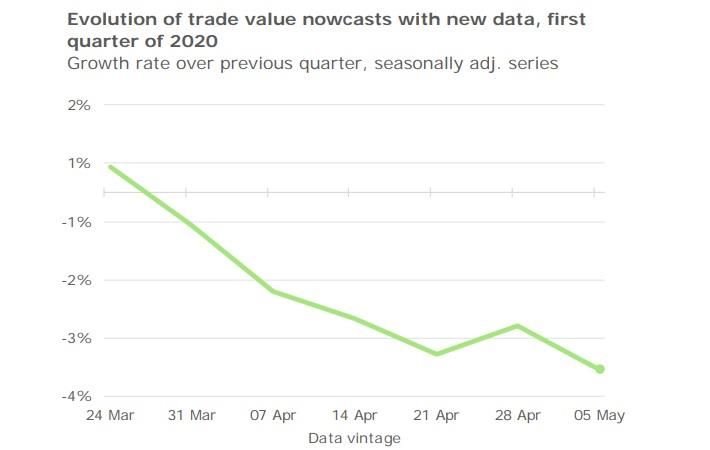

UNCTAD nowcasts incorporate a wide variety of data sources, capturing diverse determinants and indicators of trade. They are updated weekly to incorporate new data releases. The estimations in the report titled 'How COVID-19 is changing the world: a statistical perspective' are based on data available as of May 5, 2020.

The nowcasts for merchandise trade value for the first quarter of 2020 were revised downwards over almost all the last updates, reflecting increasingly deteriorating prospects with every release of new statistics. The drop in global trade nowcast for the first quarter is driven by marked decreases in related timely indicators.

Since December 2019, commodity prices have been falling at an accelerated rate. UNCTAD's Free Market Commodity Price Index (FMCPI) lost 1.2 per cent of its value in January, 8.5 per cent in February and 20.4 per cent in March. Fuels were the main driver behind this development, recording a price fall of 33.2 per cent in March, while minerals, ores and metals, food and agricultural raw materials saw prices decreasing by less than 4 per cent, the report said.

The fall of more than 20 per cent in one month is unique in the history of the FMCPI. From July to December 2008, after the outbreak of the global financial crisis, the maximum month-on-month decrease was 18.6 per cent. At that time, the descent lasted six months. The duration and overall strength of the current downward trend in commodity prices and global trade is yet uncertain.

ALCHEMPro News Desk (RKS)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!