The exchange rate is one of the most significant aspects of today’s globalised world. With the integration of the world economy, global trade is increasing every year. According to the World Bank, global trade amounted to $30.4 trillion in 2023, having increased fivefold since 1995. This highlights the growing importance of exchange rates. Exchange rates are an integral part of the economy, as they have both direct and indirect influences on its functioning. A rise or fall in the exchange rate—that is, appreciation or depreciation of the currency—can affect not only the profitability of firms exporting goods to different nations but also impact inflation, employment, the pricing of commodities, and, most importantly, the balance of trade and the current account of a country. These two factors can either make or break an economy. Thus, it is crucial to analyse the impact of exchange rate fluctuations on the economy and trade.

What is exchange rate and who controls it?

Each country's central bank manages the exchange rate of its currency. It is the responsibility of central banks around the world to ensure that exchange rates are stable and not too volatile. A volatile currency—that is, if exchange rate changes are highly volatile and uncertain—can affect the value the country receives from exporting certain commodities, leading to a decline in the balance of trade. For countries that rely heavily on exports to fuel their economies, the role of central banks in controlling the exchange rate becomes crucial. Likewise, for those that rely on excessive imports, it is important to ensure that the currency remains cheaper relative to international currencies.

In export-reliant economies—such as China, the US, Japan, the Netherlands, Germany, Italy, and France—the central banks must ensure that the exchange rate of their currencies relative to their main markets also enhances the value of exports.

Another key reason to control the exchange rate is the onset of inflation. An increase in the money supply by a country's central bank results in further depreciation of the currency, thus boosting exports and helping countries maintain steady export earnings. Countries like China, the US, and Japan have higher liquidity and more money circulating in their economies, which makes their exports cheaper and relatively competitive. However, these countries also have to perform a delicate balancing act to ensure there is no demand-pull inflation domestically. There is a positive correlation between a country’s exchange rate movements and inflation: the higher the exchange rate, the greater the domestic inflation.

How does it affect the textile-producing and exporting nations?

The textile sector is one of the most sensitive sectors to nearly all economic variables. From inflation to changes in consumer income, the profitability of firms producing and exporting textiles is similarly affected. In a sector that relies heavily on discretionary demand, higher exchange rate volatility can result in constant shifts in the currency's competitiveness. This creates an interesting scenario when considering four major textile economies and comparing their real effective exchange rates (REER).

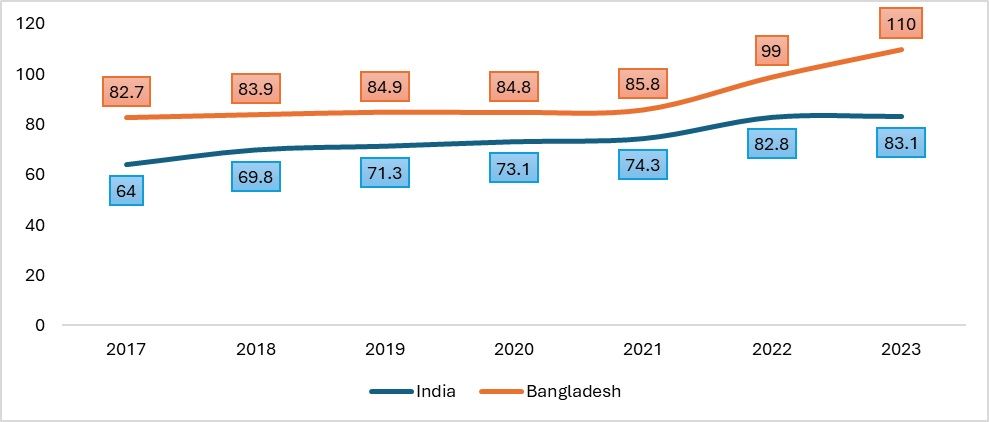

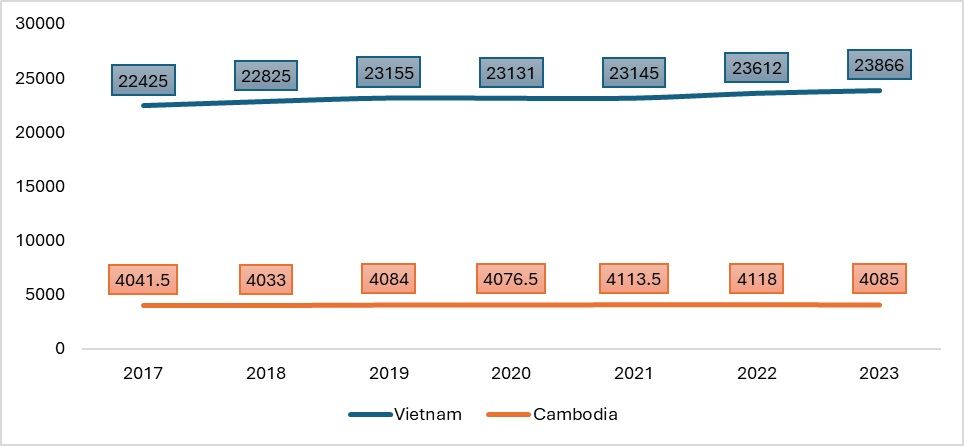

When examining major textile manufacturing economies such as Bangladesh, Vietnam, India, and Cambodia—which is emerging as a textile hub—there is a noticeable trend in how exchange rates have evolved. The real effective exchange rate is highly significant for these economies. It serves as an important indicator of export performance and determines the competitiveness of their exports. A rise in the real effective exchange rate indicates that a country's exports will be less competitive, whereas a fall in the rate signals an increase in export competitiveness.

Exhibit 1: REER of Bangladesh and India against the dollar

Source: International Monetary Fund (IMF)

The impact of the REER on the export competitiveness of an economy can be mitigated if there are other exogenous or external factors beyond the REER. Factors such as increasing FDI, technological developments, and, most importantly, the signing of Free Trade Agreements and participation in programmes that enable trade and remove trade barriers can reduce the immediate effects that exchange rates have on exports. When analysing how exports can be affected by the exchange rate, Vietnam, Cambodia, and Bangladesh stood out as potential outliers, where exports were increasing regardless of changes in the REER.

Exhibit 2: REER of Vietnam and Cambodia against the dollar

Source: International Monetary Fund (IMF)

As the real exchange rate increases, the export competitiveness of a nation’s economy decreases, and the country may start to import more as its currency becomes relatively cheaper.

Defying the trend

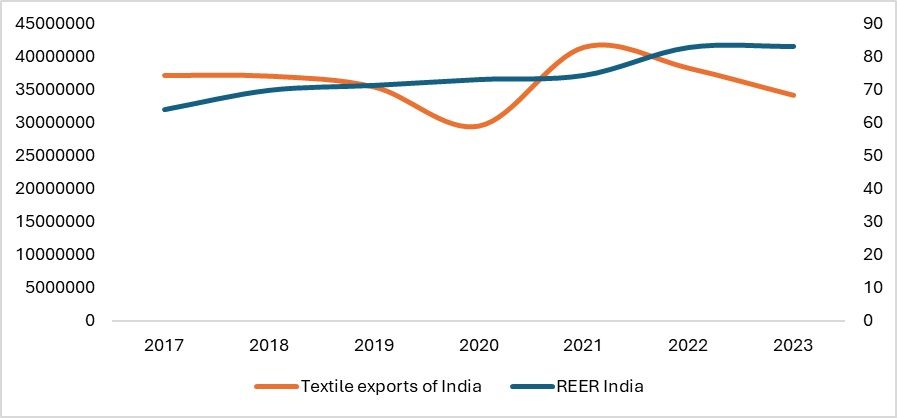

However, after analysing the relationship between REER and exports, one trend emerged: out of the four major textile-producing countries considered in the analysis, all except India defied the expected pattern of reduced competitiveness and falling exports.

Exhibit 3: REER and the textile exports of India (in $ bn)

Source: International Monetary Fund and ITC Trade map

The reason for the decline in India’s exports may be due to factors other than just the exchange rate. According to CRISIL, a one per cent depreciation in the currency leads to a less than proportional rise or fall in exports or imports, but global growth can boost trade by as much as 2.3 per cent. Indian exports have fallen because the currencies of other textile economies have depreciated further. Bangladesh’s currency, for example, has depreciated by more than 8 per cent. While the real exchange rates of countries like Cambodia and Bangladesh have fallen, increasing their competitiveness, India’s efforts do not seem sufficient to influence a rise in textile exports.

Moreover, India does not have sufficient agreements to address local currency issues, which could protect its trade earnings from unpredictable fluctuations in the dollar. An example is raw cotton exports, a stronghold of the Indian textile industry. India has only secured a local currency agreement with Bangladesh and not with other major export destinations like Vietnam, China, and Sri Lanka. Although there are countries willing to engage in local currency deals, India's speed of adaptation has been slower.

Another reason for the decline could be the high prevalence of small-scale industries in India, making the country’s exports more vulnerable to exchange rate volatility. With the REER also indicating the cost of production and productivity, the current trend suggests a need to improve value chain coordination and ensure that access to finance, technological know-how, and upgrades are available to all firms at an affordable cost.

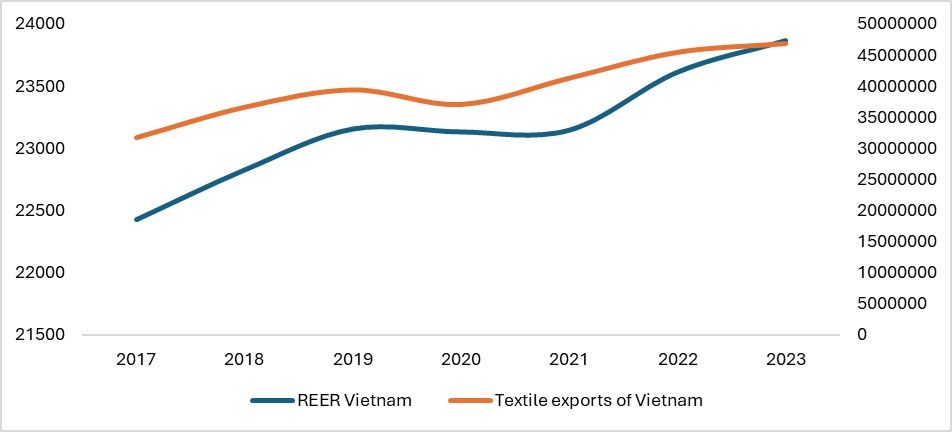

Exhibit 4: REER and the textile exports of Vietnam (in $ bn)

Source: International Monetary Fund and ITC Trade map

For Vietnam, the reason why exports are not being affected by changes in FDI is due to factors beyond just currency movements. Following the US-China trade war, the country has been receiving higher FDI. With the increasing role of geopolitics, the currency will have little or no impact. Almost all countries have benefitted from the US-China trade war—especially Vietnam, which has also become a manufacturing hub. Labelled as a currency manipulator by the US government due to the potential Chinese influence in its manufacturing sector, Vietnam’s exports remain unaffected by the consistent increase in the REER, due to the factors mentioned above.

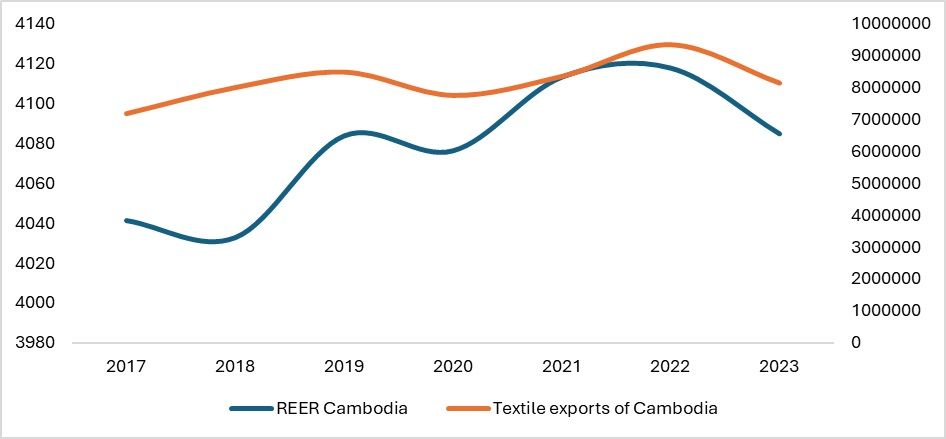

Exhibit 5: REER and the textile exports of Cambodia (in $ bn)

Source: International Monetary Fund and ITC Trade map

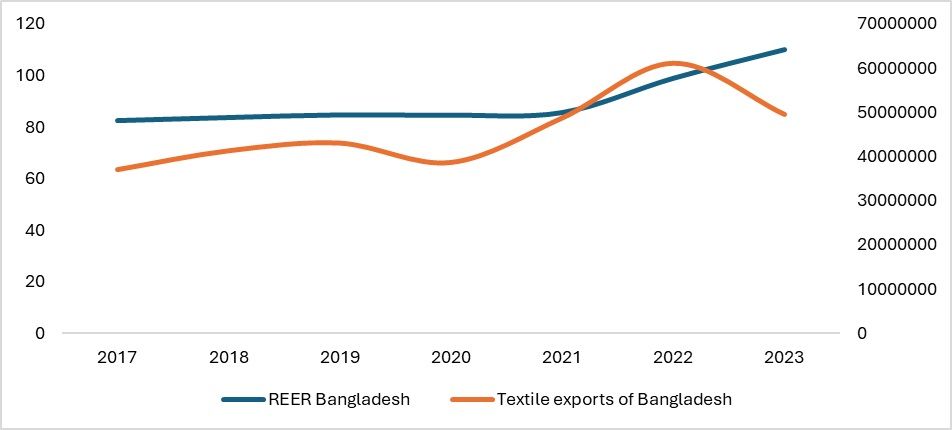

Following Vietnam, Cambodia and Bangladesh also exhibit the same pattern, where exports are not significantly affected by fluctuations in the REER. Numerous research papers have highlighted the reduced impact of the REER on export competitiveness and export volume. The growing influence of geopolitics, alongside the countries benefitting from the ‘China plus one’ strategy, as well as increased FDI and technological development, contribute to this trend.

Cambodia, in particular, has benefitted not only from its inclusion in the Generalised System of Preferences but also from the Trade and Investment Framework Agreement (TIFA) with the US since 2006, which has boosted exports. Cambodia exports around 67 per cent of its total goods to the EU and 30 per cent to the US.

Bangladesh, on the other hand, may not be as affected due to its regional currency agreements with India and, more recently, China—its main suppliers of textile raw materials. These agreements mitigate the impact of currency fluctuations on imports of intermediate textile products. However, in 2023, Bangladesh did follow the theoretical trend of reduced trade as the REER increased. This was largely due to factors such as labour protests, fuel shortages, and a depleted FOREX reserve, which severely affected exports.

Exhibit 6: REER of Bangladesh and the textile exports (in $ bn)

Source: International Monetary Fund and ITC Trade map

Impact of devaluation and inflation

Countries like Vietnam and China deliberately devalue their local currencies to make their exports cheaper for importing nations. However, such measures can also affect local sourcing by leading to cost-push inflation, which increases the prices of raw materials within the local economy.

Dollar domination and the changing landscape

To date, the US dollar has dominated global transactions. Whether in terms of merchandise trade or foreign reserves held, the dollar remains the top reserve currency as of 2024. In 2024, the dollar accounted for 89 per cent of total international exchange transactions, as indicated by SWIFT data. As of April 2024, 59 per cent of global transactions were made using US dollars, making the greenback the most important currency in the world.

However, one of the key reasons why exchange rate fluctuations may have less impact on a nation’s exports is the trend towards de-dollarisation in trade and currencies. BRICS nations, for example—representing 42 per cent of the world’s population and a significant share of global GDP—are taking the lead in trading using local currencies. This can help countries reduce the impact of exchange rate volatility on trade, particularly in export-oriented sectors like textiles, which often rely on imported raw materials for production.

India has already begun framing policies and signing agreements aimed at improving trade balances and reducing the impact of dollar volatility on exchange rates. China, meanwhile, has taken further steps in this regard: by 2023, the renminbi accounted for around 6 per cent of all trade settlements. According to SWIFT reports, the RMB is increasingly being used by other countries to settle their trade with China. However, the road to de-dollarisation remains challenging. Countries must ensure easy convertibility and reduce foreign assets to maintain overall financial stability.

Road ahead

Currently, many countries are increasingly focused on securing their export markets from geopolitical events. Countries like India, for example, are signing agreements that offer either duty-free access or a reduction in duties. This has, at first glance, reduced the impact that currency exchange volatility can have on the textile trade and exports. Nations like Vietnam and Bangladesh are examples where trade has not been affected, regardless of whether the REER has increased or decreased. However, rising exchange rate volatility may still impact inflation within these countries and cause imports to become more expensive.

With the growing number of trade agreements and local currency arrangements, the concern over currency fluctuations has diminished. Many garment-producing nations, such as Vietnam and Bangladesh, import fabrics and cotton from China. Bangladesh, in particular, is planning to deal in local currency with China. As globalisation expands and more countries opt to conduct trade in local currencies, the impact of currency volatility is expected to decrease over time. Many countries are becoming aware of the effects of a fluctuating dollar on their currency and on the cost of importing essential goods. Consequently, as more countries adapt to local currency transactions, the influence of a fluctuating dollar is likely to lessen in the coming years.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!