India’s trade landscape has demonstrated notable shifts in recent periods, marked by a significant increase in exports to regions such as the European Union (EU) and North America. The growing focus on these lucrative markets highlights India's strategic emphasis on strengthening economic ties with developed regions. In contrast, trade with areas like the European Free Trade Association (EFTA) and the African continent has experienced a marked decline, reflecting potential challenges or shifts in demand. Meanwhile, Asian regions have shown moderate growth, and Oceania has witnessed substantial trade expansion, both in recent months and over the past six months.

As India seeks to balance its trade and address deficits, the textile sector has the potential to play a pivotal role in bridging these gaps. The effectiveness of this strategy will depend on a detailed examination of regional performance, the identification of promising markets for textile exports, and an assessment of the sector’s overall performance. By leveraging trade agreements and expanding market access, such as through the EFTA-India FTA and the India-EU FTA, India could enhance its export profile and mitigate trade imbalances.

A need to look beyond conventional

According to a report published by the Global Trade Research Initiative (GTRI), India’s trade deficit has widened with countries like Switzerland, Peru, the Netherlands, the United Arab Emirates (UAE), and Hong Kong. India imports non-oil merchandise from these countries which makes it imperative for the country to ensure that the exports from the export-led MSMEs and the other sectors increase.

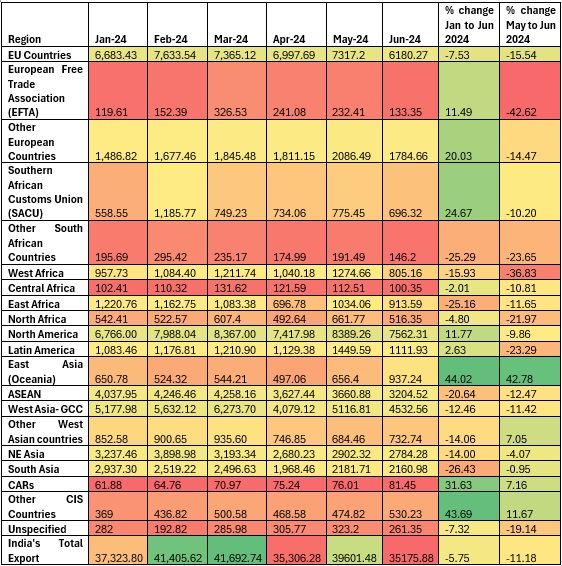

Table 1: Region-wise exports of India (in $ mn)

Source: Ministry of Commerce, Government of India

Based on the data, the following regions have shown significant growth or resilience, indicating their importance as key markets for India’s exports:

High Growth and Emerging Markets: East Asia (Oceania), CARs (Central Asian Republics), and other CIS Countries represent strong emerging markets with high growth. Among the Oceania countries, India only has an Economic Cooperation and Trade Agreement (ECTA) with Australia, whereas the agreement with New Zealand is still under negotiation. India can explore diversifying trade further with these countries. India’s textile trade with these countries is consistent and increasing market access to these countries can bolster trade diversification efforts of India.

Established Markets with Growth in North America and Other European Countries continue to be valuable markets with room for expansion. India needs to ensure the expansion is more to the side of the North American countries. Countries like Canada, Mexico, Dominican Republic are nations with huge potential to be export markets for India. The recent Joint Economic and Trade Committee set up bilaterally by India and the Dominican Republic can be an example of how India is trying to expand its market to different countries.

Regional Growth Opportunities: South African Customs Union (SACU) shows some volatility and represents a growing region that can be further leveraged. The union, which includes five countries—Botswana, Lesotho, South Africa, Namibia and Swaziland—imports apparel, cotton, man-made staple fibre and home textiles. As of 2023, India has a trade deficit with the SACU, and therefore, there is a need to increase market access to these countries via a Preferential Free Trade Agreement (PTA). The SACU accounts for only ~1 per cent of the country’s exports, however, with greater economic cooperation and market expansion agreements, India can attempt to increase its textile exports to this region. The region is promoting the textile and apparel industry as one of the strategic investment initiatives. Therefore, India can capitalise by enhancing its raw material exports like yarn and fabrics.

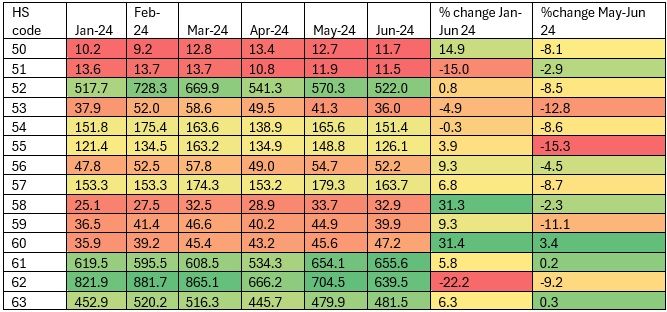

Table 2: Exports of India according to HS codes (in $ mn)

Source: Ministry of Commerce, Government of India

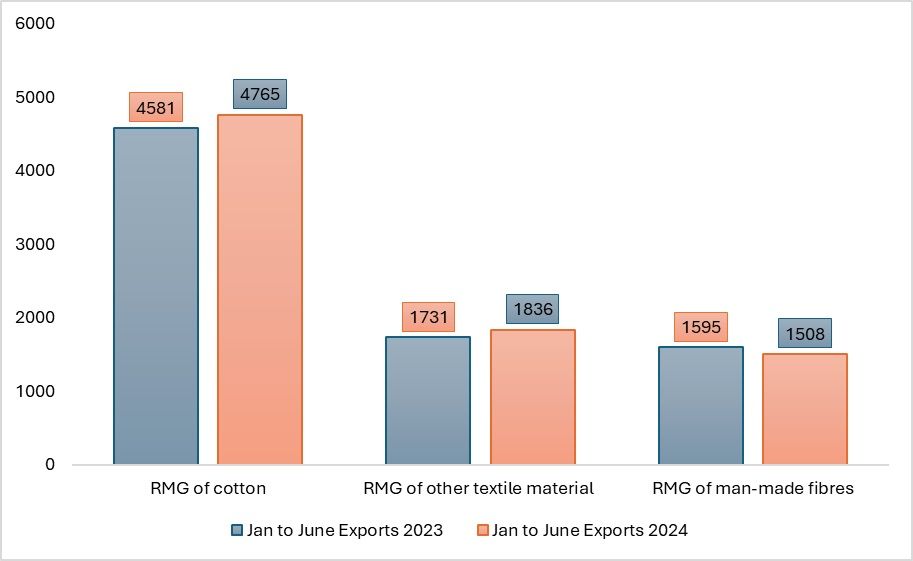

Analysing India’s textile exports reveals a notable growth trajectory in specific categories from January to June 2024. During this period, exports of apparel, home textiles, made ups, and cotton have significantly increased compared to other textile commodities. India continues to excel in exporting cotton ready-made garments (RMG), and overall textile exports from January to June show a consistent year-on-year rise, with the textile sector playing a key role in boosting India’s export performance during the period.

Despite this positive trend, there are areas with untapped potential. While India is thriving in the apparel, made-up textiles, and cotton sectors, it faces challenges in boosting exports of certain other categories. Specifically, the country is moderately performing in man-made filament, man-made staple fibres, and home textiles but lags in exporting knitted or crocheted fabrics, special textile fabrics, nonwoven yarns, silk, and woven fabrics.

Data from the Ministry of Commerce highlights that India’s major textile exports are primarily readymade garments, cotton, and home textiles. Other textile materials, such as man-made staple fibres, man-made filaments, and woven fabrics, do not feature among the top ten textile export commodities. An examination of product and country-specific export data underscores the dominance of readymade apparel, cotton, and made-ups. For instance, cotton is a leading export to Bangladesh, a major garment production hub, while woven fabrics are prominently exported to Sri Lanka.

To further bolster its textile export performance, India needs to enhance the promotion and export of all textile materials it produces. Expanding focus beyond its traditional strongholds to include underperforming categories could help the country diversify and grow its textile export portfolio.

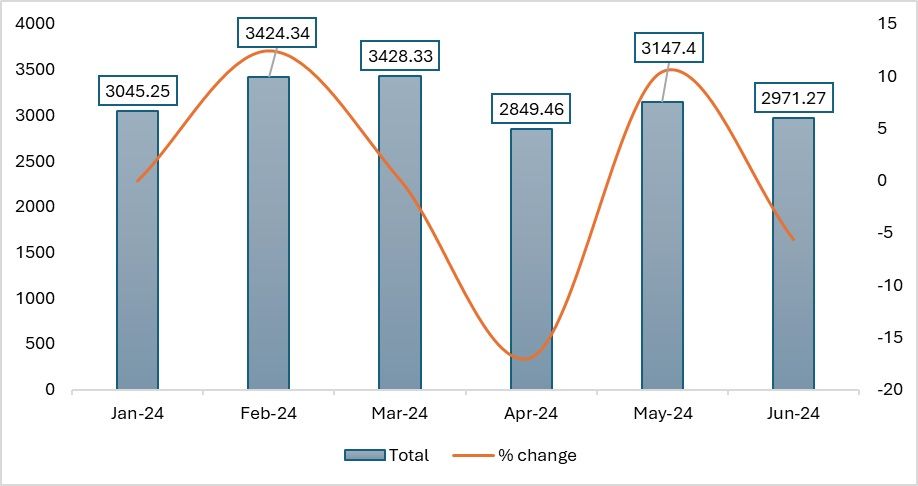

Exhibit 1: Textile exports of India (in $ mn)

Source: DGCI&S dashboard

In the report published by GTRI, India’s trade deficit is increasing with countries like Peru, Switzerland, Hong Kong, and the UAE. Expect for the UAE, India does not import crude oil from these nations. Thus, going by the trade figures and the recently improving contribution of textile exports in the overall export profile of the nation, India also should develop a comparative advantage to manufacture and export more textile goods. India should increase the production of man-made fibres which are in higher demand.

Exhibit 2: Exports of RMG of different materials by India (from January to June) (in $ mn)

Source: DGCI&S dashboard

According to data published by the Ministry of Commerce, India currently enjoys a positive trade surplus in textiles with its top four trading partners with whom it otherwise faces a trade deficit. This indicates a strong position in textile exports relative to these nations. Moving forward, India must modernise its textile operations and leverage market access initiatives to expand exports further.

However, there are potential challenges to be mindful of. Geopolitical tensions and the associated rise in freight costs could hinder export growth. These factors might impact the overall cost structure and competitiveness of Indian textiles on the global stage. Therefore, while India capitalises on its current strengths in textile exports, it must also navigate these external challenges carefully to sustain and enhance its growth trajectory.

Region-wise potential for textile exports

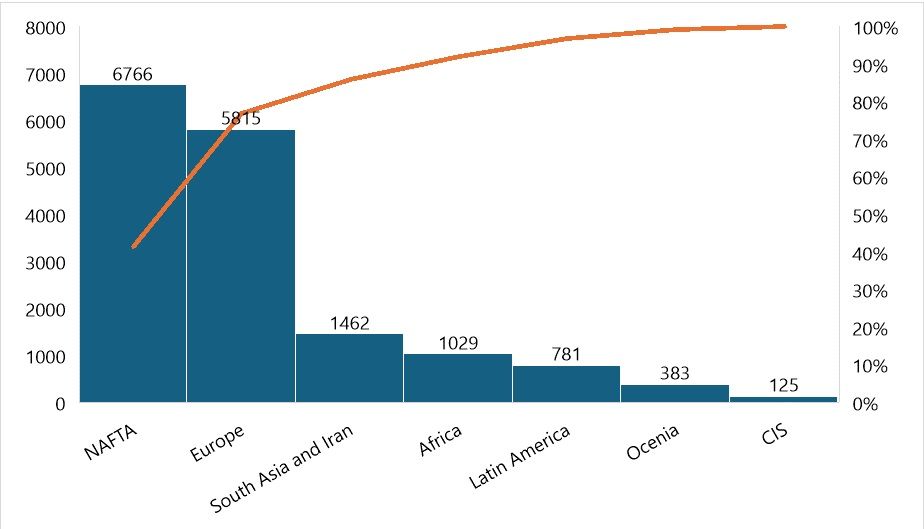

Although India has an increasing deficit with almost all the nations that it trades with, the country also has more potential to trade with some regions. To reduce the increasing trade deficit, the country should expand its trade with the regions that it has not explored so far. Especially, if focused on textiles, there is a lot of potential for the country to export a higher quantity of textiles to these regions, especially to the African nations. As far as regions like NAFTA and the Commonwealth of Independent States (CIS) are concerned, India is already negotiating an agreement with them. The Free trade Agreement with Canada is not likely to resume soon. However, the negotiations for an FTA with the Eurasian Economic Union have reached their final stages. Therefore, in the long term, India can take a step to reduce the deficit. However, the same is not without significant challenges. With the current FTAs and PTAs focusing more on labour rights and fair wages, India may have to first work also on the policies and make significant structural changes in the sector to successfully crack FTAs.

Exhibit 3: Region-wise balance of trade of India in textiles (in $ mn)

Source: DGCI&S dashboard

NAFTA, which includes the US, Canada, and Mexico, is the top destination with a higher trade surplus for India. This region has a strong demand for various Indian textiles, including cotton garments, home textiles, and man-made fibres. India has more potential by expanding further into e-commerce which is more common in the region to buy apparel. The US is the largest market, particularly for cotton textiles, readymade garments, and home furnishings. There is potential to expand further by targeting niche markets and higher value-added segments, such as organic and sustainable textiles. Europe, including major markets like the UK, Germany, France, and Italy, shows a high trade surplus in textiles due to its significant imports of Indian apparel, yarns, and fabrics. Its emphasis on sustainable and eco-friendly textiles aligns well with India’s growing capacity in organic cotton and sustainable textile production.

Along with this, the India-EU FTA would help the country to enhance the country’s exports. With this, India may also get fair access to the EU market. Market penetration can be enhanced by focusing on high-quality, branded apparel and textiles that meet EU standards. South Asian region, which includes countries like Bangladesh, Sri Lanka, and Iran, is equivalently important for the country. Bangladesh imports significant quantities of yarn and fabric from India for its garment manufacturing industry. India can further strengthen its position by increasing exports of value-added fabrics and specialised yarns to Bangladesh and Sri Lanka. Iran also offers potential, particularly in synthetic fibres, provided the geopolitical conditions are favourable. However, there are higher chances of the country facing sanctions.

African countries import raw materials such as yarn and fabric for their growing textile and garment manufacturing sectors, particularly East African countries like Ethiopia and Kenya. Additionally, these countries are emerging as textile hubs due to investment from global companies, making it a strategic opportunity for India to supply raw materials, fabrics, and finished goods.

Latin American countries, particularly Brazil, Colombia, and Chile, import Indian textiles, but the market size is comparatively smaller. There is scope to increase market share by exploring Free Trade Agreements (FTAs) that reduce tariffs, improve logistics connectivity, and promote Indian textiles at regional trade fairs. In Oceania, the country has a presence in Australia via the ECTA, however, it needs to increase its market presence in other Oceania countries.

India’s Current Surpluses and Future Challenges

From January to June 2024, India’s textile exports have shown a year-on-year increase compared to the same period in 2023. However, a monthly comparison reveals a decline in exports, highlighting some inconsistencies in the growth trend. The data indicates that India’s textile export sector is heavily concentrated on cotton, ready-made garments (RMG) made from cotton, and home textiles, with other textile materials receiving relatively less attention. Despite significant domestic consumption of textile raw materials, there is a notable underperformance in the export of specialised fabrics, woven fabrics, and man-made filaments.

India’s textile exports are currently skewed, with a substantial portion directed towards Bangladesh, which receives most India's cotton yarn. This concentration has led to challenges for yarn manufacturers who face diminishing demand, adversely affecting overall textile export volumes.

To address the trade deficit, India can leverage its textile sector more effectively, particularly in countries where textiles are among the top imports. Expanding exports to these nations could help bridge the trade gap. Additionally, India should look beyond the Asian region and explore opportunities in other textile-producing areas, such as NAFTA countries, Africa (e.g., Kenya, South Africa), and Turkiye, which is a key player in the EU textile market.

Diversification and increased market access are critical for enhancing textile exports. India is currently negotiating trade agreements with several countries, including the UAE, New Zealand, Peru, Oman, SACU, the European Union, and the United Kingdom. These agreements reflect a strategic focus on Western markets, indicating India’s intent to diversify its export destinations.

The current geopolitical landscape presents a strategic opportunity for India to address existing challenges and implement necessary structural changes to boost textile exports. Although the short-term benefit of Bangladesh’s current crisis offers an advantage, India should prioritise fast-tracking the FTA with the EU. This could provide a significant boost as Bangladesh is set to graduate from the Generalised System of Preferences (GSP) by 2026, potentially leaving a larger share of the EU market available for India.

India’s textile industry possesses considerable untapped potential. To capitalise on this, the sector must shift its focus from merely being an employment-generating industry to becoming a major revenue generator. Embracing sustainability standards and adapting to new policies—such as those being implemented by the EU and the US, which emphasise labour practices, fair production, and renewable energy use—will be crucial for future growth.

In conclusion, while the textile sector currently accounts for 12 per cent of total exports and 13 per cent of the manufacturing sector, the existing concentration and lopsided export patterns suggest a pressing need for diversification. Expanding focus to include markets in Oceania, SACU, EFTA, and Eurasian countries, alongside traditional markets in Europe and the US, will be vital for achieving balanced and sustainable growth in India’s textile exports.

ALCHEMPro News Desk (KL)

Receive daily prices and market insights straight to your inbox. Subscribe to AlchemPro Weekly!